Home Mortgage Loan Definition

A mortgage is a debt instrument secured by the collateral of specified real estate property that the borrower is obliged to pay back with a predetermined set of payments.

Home mortgage loan definition. This refers to the sale of a home for less than what the homeowner owes on their mortgage. Mortgages and home loans learn everything you need to secure the best home mortgage or refinance your existing mortgage. Facilitate a short sale. Mortgage loan basics basic concepts and legal regulation.

A home mortgage will have either a fixed or floating interest rate and. A home loan is typically paid back over a term of 10 15 or 30 years. Mortgages are also. If the home is refinanced the refinanced mortgage maintains the first mortgage position.

Installment loan advanced against real property secured under a mortgage agreement. What is a home loan. Learn about fixed rate mortgages how they work and if one is right for you. Foreclose on your property.

For most people purchasing a home is. What is a mortgage insurance premium. For fha loans the mortgage insurance premium remains throughout the life. We ll cover the different types of mortgages and prepare you for your mortgage transaction.

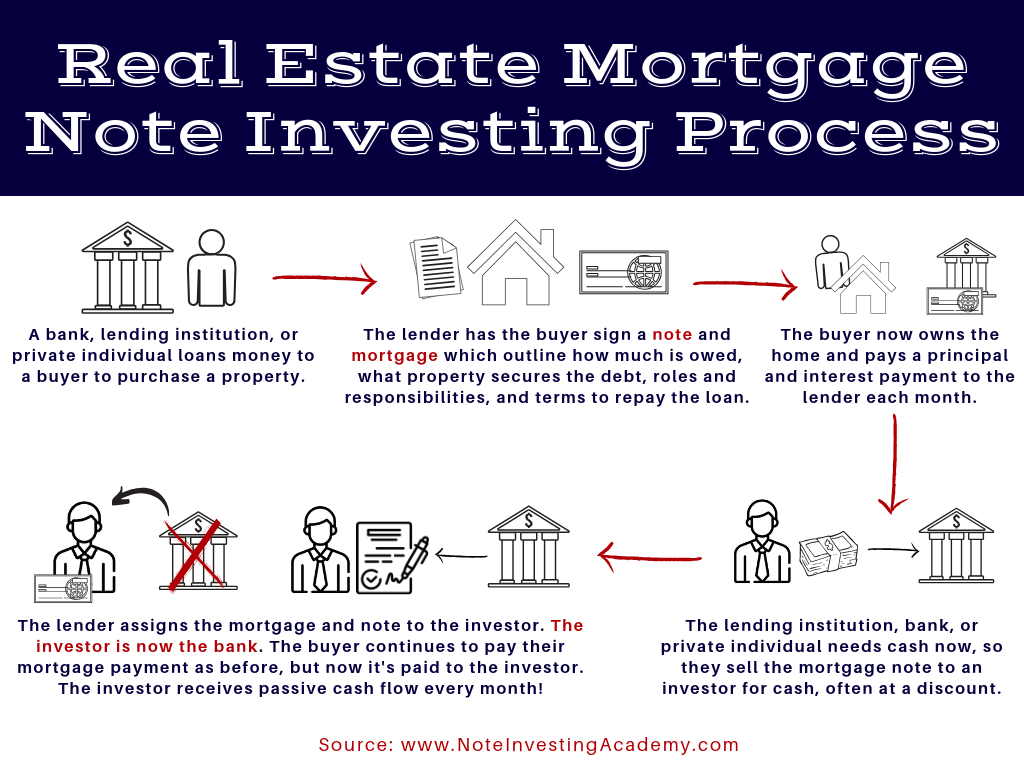

A mortgage modification is a less palatable alternative to a foreclosure which occurs when a bank repossesses a home evicts the homeowner and sells the home of a borrower who cannot repay their loan. A home loan or mortgage is a contract between a borrower and a lender that allows someone to borrow money to buy a house apartment condo or other livable property. A first mortgage is the primary or initial loan obtained on a piece of real estate. According to anglo american property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

Definition of mortgage loan. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but because most. In order to secure a home loan lenders require the home to be put up as security and the most common. A mortgage insurance premium mip is an insurance plan implemented in fha loans regardless of the down payment amount you put down on the loan.

A home mortgage is a loan given by a bank mortgage company or other financial institution for the purchase of a residence.

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)

:max_bytes(150000):strip_icc()/ScreenShot2019-01-15at3.35.40PM-5c3e475ec9e77c00019b7191.png)

/what-is-a-conventional-loan-1798441_FINAL-cd12be4836c94eb6ae68117635d2dc19.png)