Getting Liability Insurance For Small Business

General liability insurance protects the insured in the event he or she is sued for claims that come within the coverage of the insurance policy.

Getting liability insurance for small business. Nationwide can help with defense costs regardless of fault as well as protection for judgments court costs and more. How much should small businesses pay for liability insurance. Employers liability cover is to protect you against legal costs if an employee is injured gets ill or their property gets damaged as a result of your business. Learn how these coverages protect small businesses and how much you ll want to consider for your unique risk.

Every business needs a general insurance policy to be protected from common liabilities. General liability insurance is a fundamental business policy because it covers events that may happen to any business owner like injuries and property damage you cause people who aren t your employees. That s why it s best for small business owners to work with licensed insurance carriers like the hartford. Learn more about the types of small business insurance coverage that companies typically choose to purchase from the hartford.

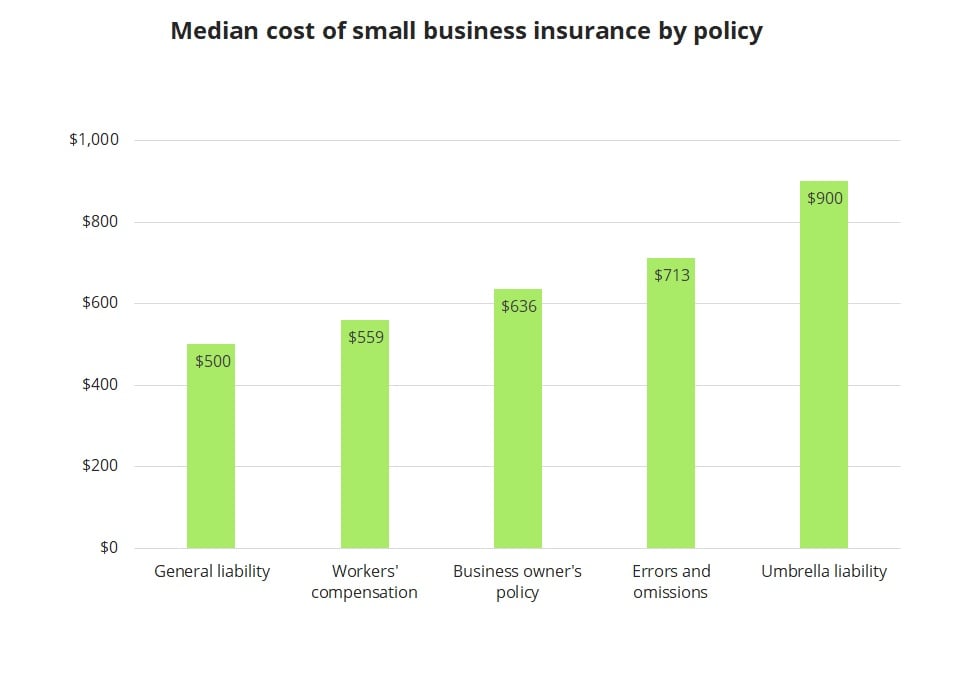

However insurance requirements vary from state to state for different types of businesses. General liability insurance costs vs average claim costs. Why get small business liability insurance from the hartford. For small businesses with annual revenues of less than 5 million use the following table as a liability insurance guide.

Business insurance for small businesses is a must. General liability insurance is often combined with property insurance in a business owners policy bop but it s also available to many contractors as a stand alone coverage through the progressive advantage business program. Business insurance protects you from the unexpected costs of running a business. Liability insurance can help cover medical expenses attorney fees and damages you are legally responsible for.

Get a free online quote for small business insurance today. It s legally required if your business employs others. Aside from public liability insurance you can also find other types of cover for your business. As a contractor or small business owner geico can help you get the coverage your business needs.

Who needs general liability insurance. Costs vary depending on your risk but most small businesses pay between 400 and 1 300 per year for coverage. General liability gl insurance typically provides insurance coverage to small businesses for among other things third party bodily injuries medical payments and advertising injuries.