Fha Loans First Time Home Buyers Only

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)

Out of every five us buyers one chooses fha loan.

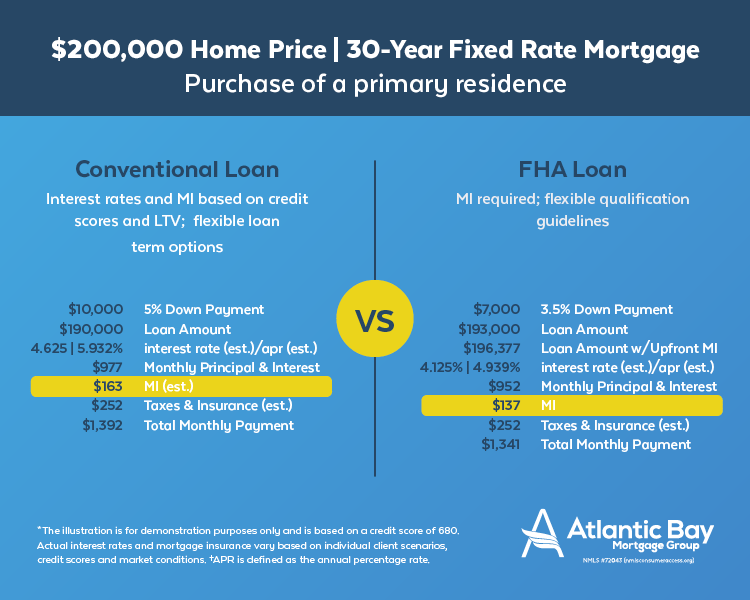

Fha loans first time home buyers only. Fha loans are a good option for first time homebuyers who may not have saved enough for a large down payment. This applies to former homeowners as well as first time buyers. The 203 b home loan is also the only loan in which 100 percent of the closing costs can be a gift from a relative non profit or government agency. In this scenario fha loan remains the best choice.

Fha loans typically have more relaxed qualification requirements than conventional mortgages. As a matter of fact it is the widely used residential loan program in the us. Lendingtree fha loans aren t only for first time homebuyers but there are some things you ll need to keep in mind. The fha home loan program is not limited to first time home buyers only.

It s a popular financing tool among first time homebuyers who have yet to build larger savings. An fha loan is a mortgage that s insured by the federal housing administration. Check out these tips for getting your fha loan. Many borrowers with limited funds and low credit scores take advantage of fha loans.

Fha loans aren t only for first time homebuyers but there are some things you ll need to keep in mind. Are fha loans only for first time homebuyers. But this is not true. They commonly come in 15 year and 30 year terms as well as 20 year fixed rate loans.

First time and repeat home buyers can qualify for fha loans as long as they meet the basic eligibility requirements. In part fha loan is popular because it requires just 3 5 down payment. First time as well as repeat buyers like to get a home with low or no down payment at all. But although first time home buyers make up a large percentage of home loans insured by the fha other borrowers are certainly not restricted from this government program.

It s a common misconception that fha loans are only for first time home buyers. In fact anyone who meets the minimum guidelines set forth by hud could qualify for the program. This makes fha loans. They allow borrowers to finance homes with down payments as low as 3 5 and are especially popular with first time homebuyers.

Those criteria include a down payment of 3 5 a manageable level of debt and a credit score of 500 or higher. Contrary to popular belief fha loans aren t only for first time home buyers. This loan often works well for first time home buyers because it allows individuals to finance up to 96 5 percent of their home loan which helps to keep down payments and closing costs at a minimum. Fha home loans and principal residency the one significant requirement of the federal housing administration is that fha home loans are reserved for primary residences.

/home-sellers-paying-closing-cost-credits-4134262_FINAL-b881d78ab2234285b358324624cc0e16.png)