Factoring Of Receivables

A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

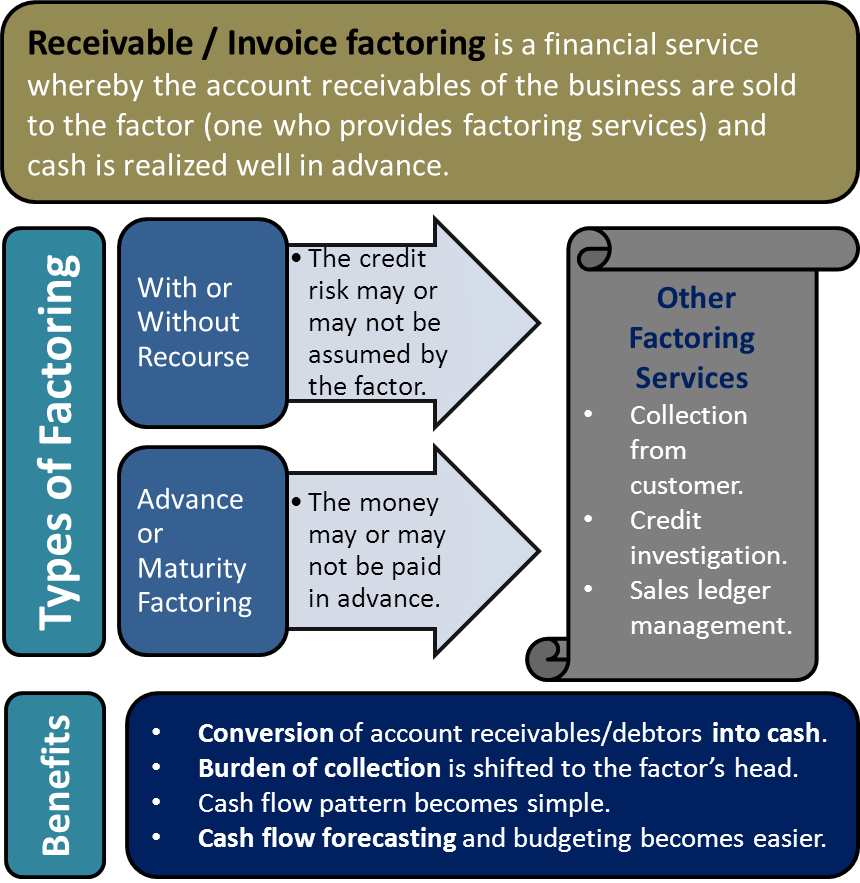

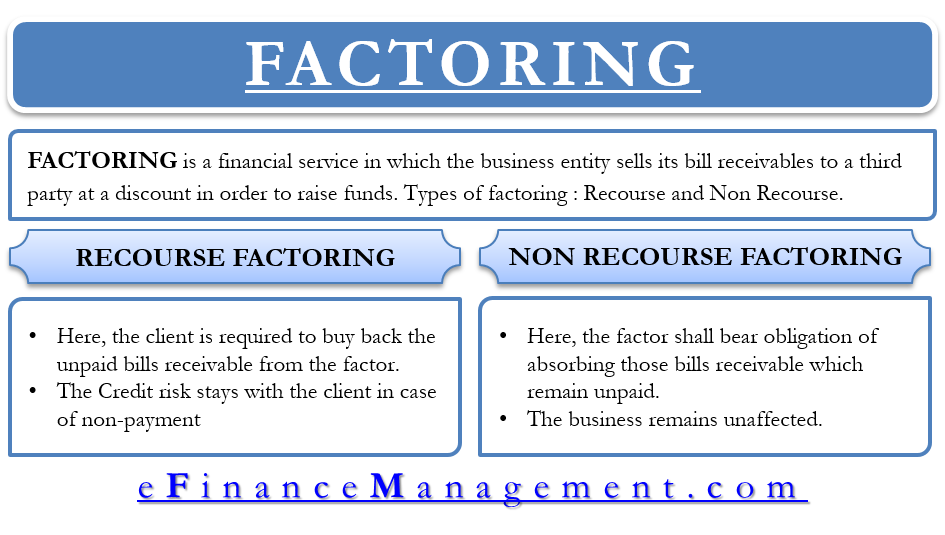

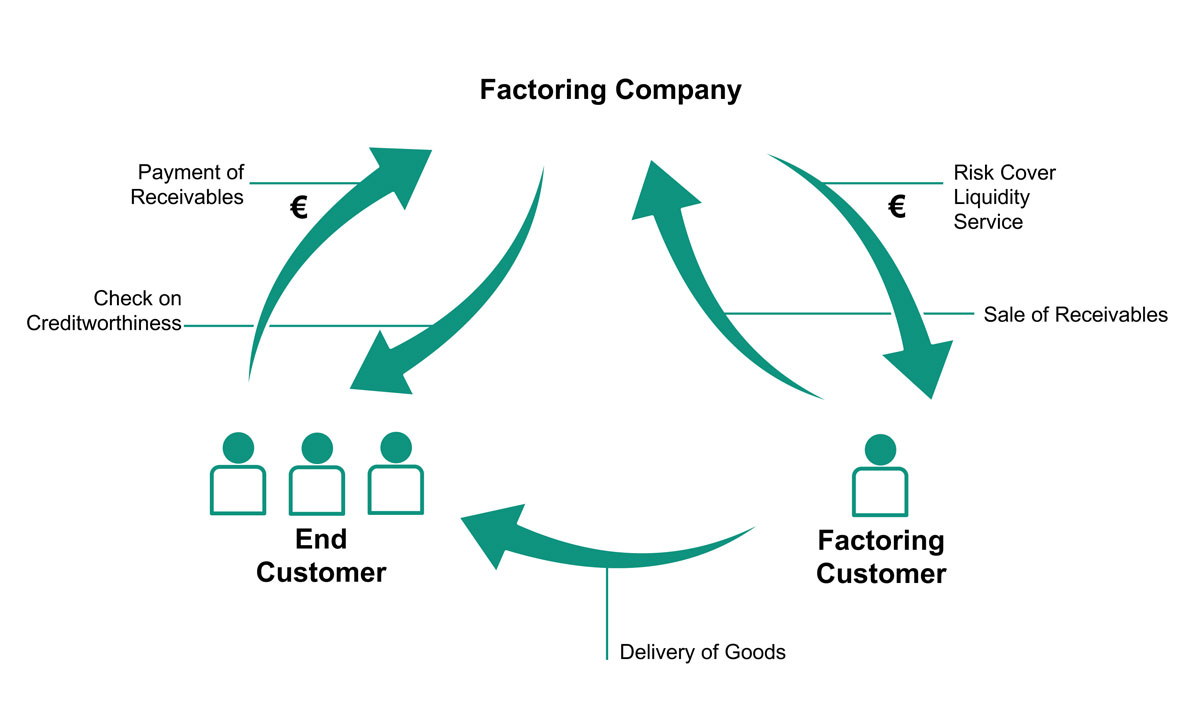

Factoring of receivables. The factor takes all responsibility for analyzing the creditworthiness of the customer collection of payment on the due date and also and credit loss arising on account of nonpayment by the customer credit risk is transferred from the business to the accounts receivables factoring companies. When the factor is bearing all the risk of bad debts in the case of non recourse factoring a higher rate is charged to compensate for the risk. Factoring helps a business convert its receivables immediately into cash instead of waiting for due dates of payment by customers. When they collect the invoice the lender pays the remaining 20.

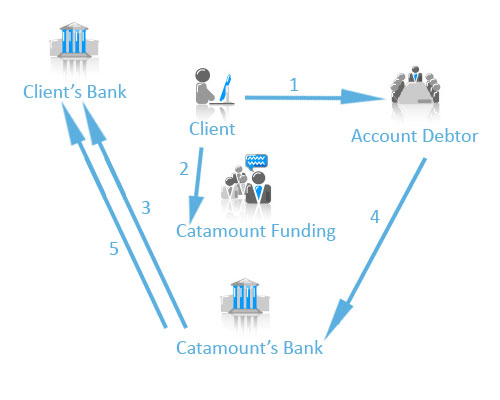

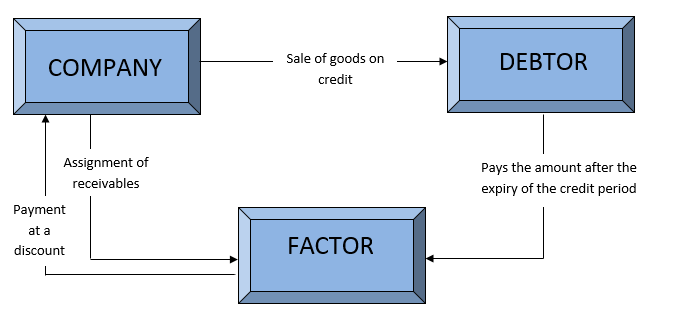

The financing company which buys the receivables is called a factor. Providing cash liquidity without taking on debt. Thus the transferor has no further involvement with customer payments. Factoring of accounts receivable means selling of invoices to a third party called factor usually a factoring company or a bank.

Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. Since the invoices have been factored factor is entitled to collect receivables. It is sold to a finance company also known as the factor at a discounted price for cash. Factoring is the selling of accounts receivables to a third party to raise cash.

A company will receive an initial advance usually around 80 of the amount of an invoice when the invoice is purchased by the lender. When a business sells products and services to a customer on account the goods are delivered and the sales invoice is created but the customer does not have to pay until the invoice due date. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. Under a factoring arrangement the customer is notified that it should now remit payments to the factor.

With recourse factoring the company selling its receivables still has some liability to the factoring company if some of the receivables prove uncollectable. Factoring receivables is the sale of accounts receivable for working capital purposes. Fueling business growth when new opportunities arise. Factoring is also known as accounts receivable factoring or account receivable financing.

Accounts receivables financing factoring is perfect for business owners who typically handle a lot of invoices need funds quickly and are waiting for payment from their customers. Factoring involves the sale of receivables to a finance company which is called the factor. Factoring is the sale of accounts receivable of a company to a financing company at discount.