Factoring Loan

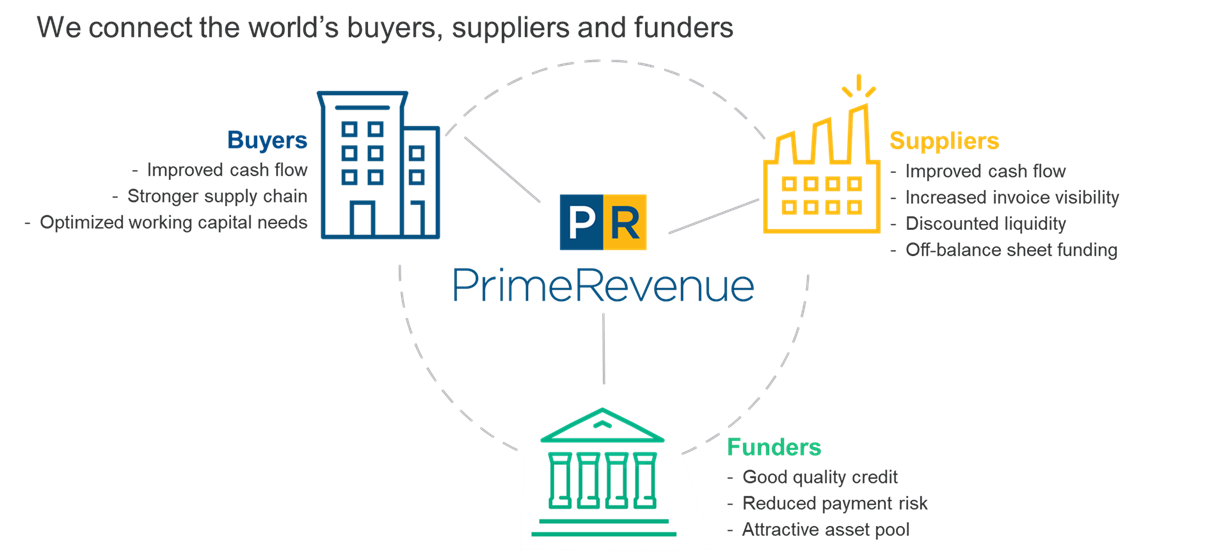

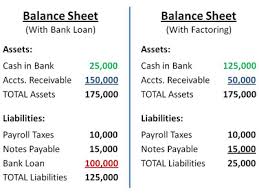

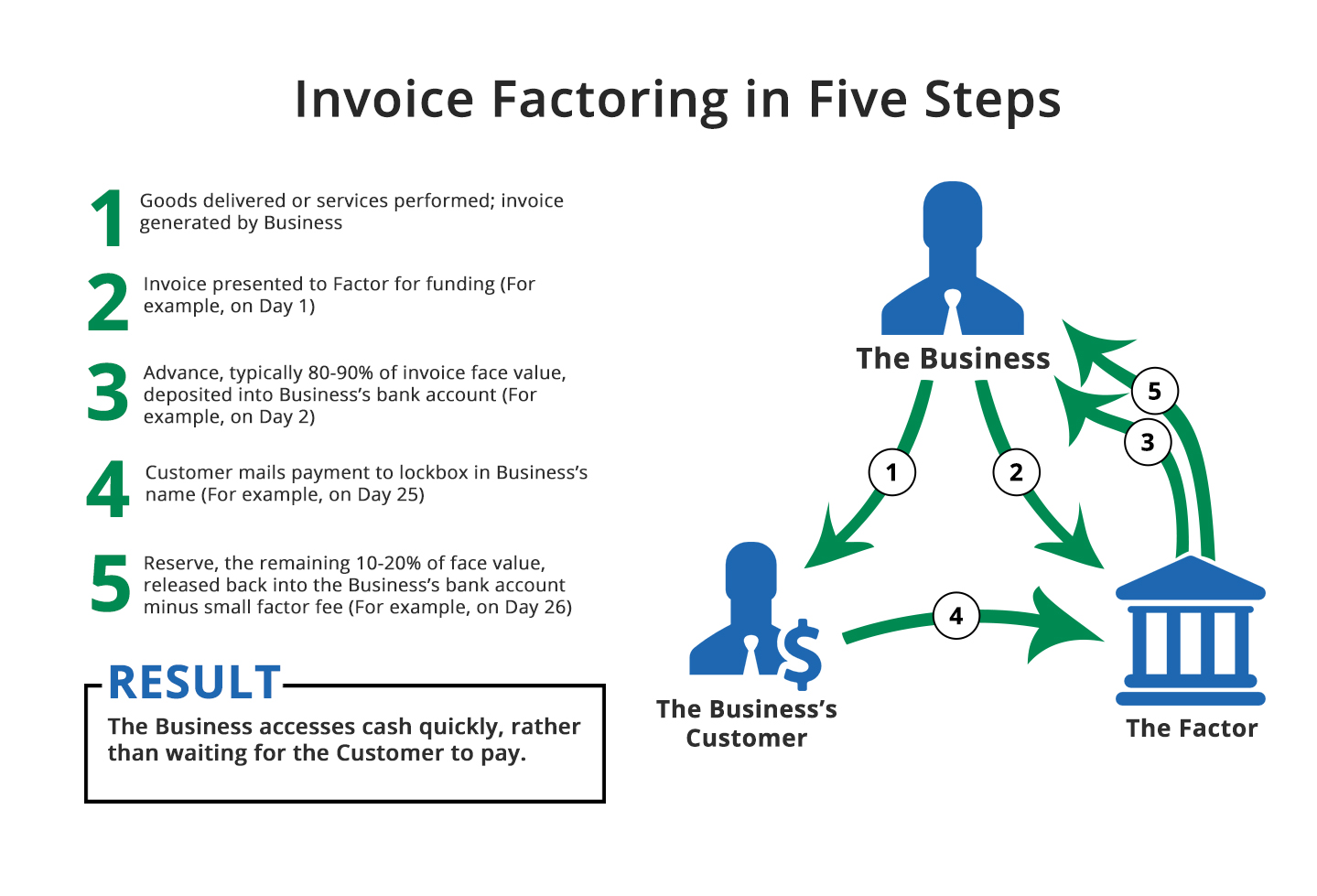

Factoring is not considered a loan as the parties neither issue nor acquire debt as part of the transaction.

Factoring loan. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. Like other types of working capital loans accounts receivable factoring is available for businesses with subpar credit and rocky cash flow. The funds provided to the company in exchange for the accounts receivable are also not. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

When a company receives a factoring loan it may be able to obtain 100 of the value immediately. Although accounts receivable financing offers a number of diverse advantages it also can carry a. It is the purchase of future receivables. Technically factoring is not a loan.

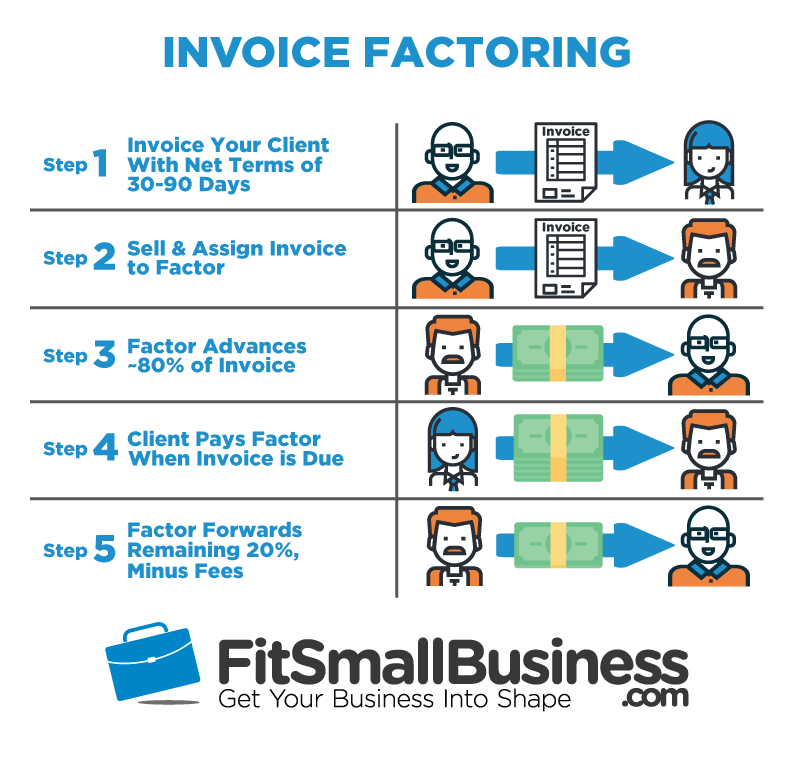

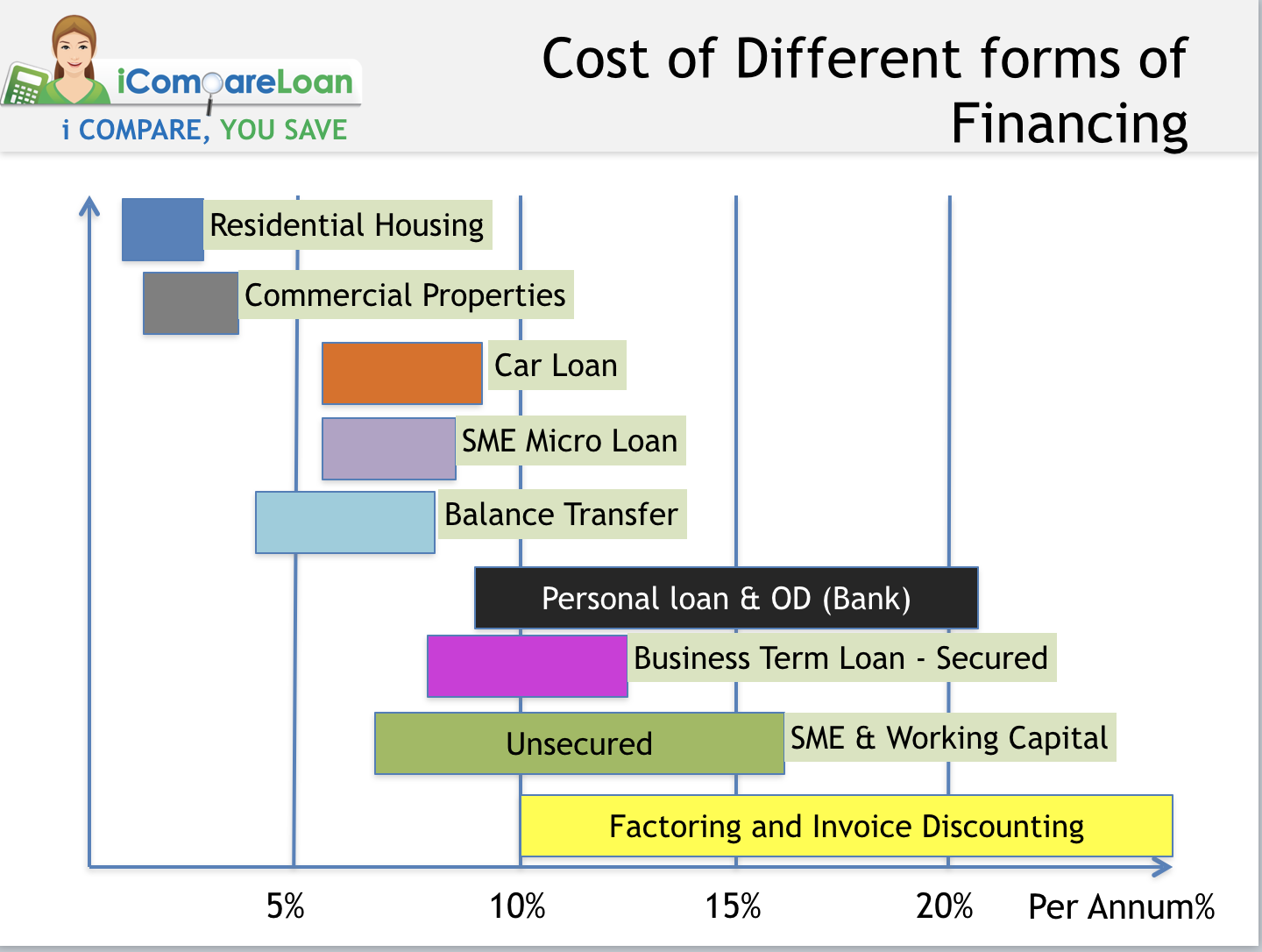

Accounts receivable factoring is also known as invoice factoring or accounts receivable financing. As long as your customer has paid its bills in the past you probably won t have trouble getting approved. Essentially the factor is purchasing the right to collect on an invoice when it s paid minus a discount of 2 to 6. Factoring may provide the cash you need to fund growth or to take advantage of early payment discounts suppliers offer.

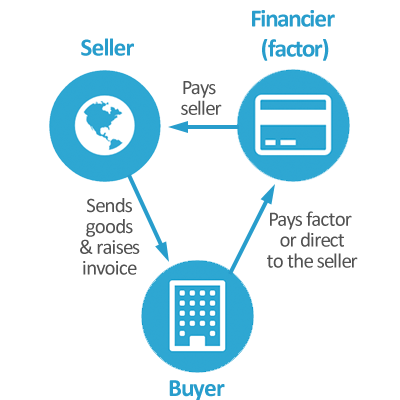

Factoring is a short term solution. Most companies factor for two years or less. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. They loan you an amount of money which you re expected to pay back over a specific amount of time in addition to a generally high amount of interest.

The factor will pay around 75 of the invoice up front followed by the remainder once they ve collected on the invoice. Factoring is a financial transaction in which a company sells its receivables to a financial company called a factor. Is factoring a loan. A factoring loan also known as factoring receivables is a type of funding method in which a business owner uses unpaid customer invoices as collateral under the agreement that he or she will pay back the loan.

The factor collects payment on the receivables from the company s. Factoring invoices is a debt free form of financing. A third party known as a factor purchases a company s invoice s or purchase order s at a discount giving a business owner access to a percentage of that invoice or purchase order now instead of when the invoice or p o.