Factoring Finance Example

Factor 3y 2 12y.

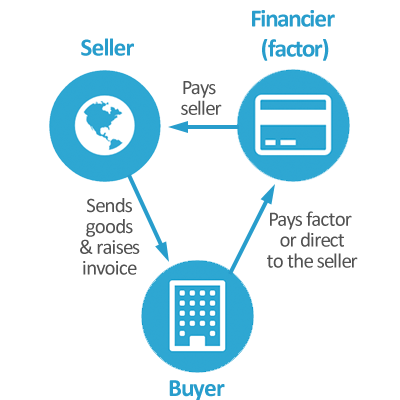

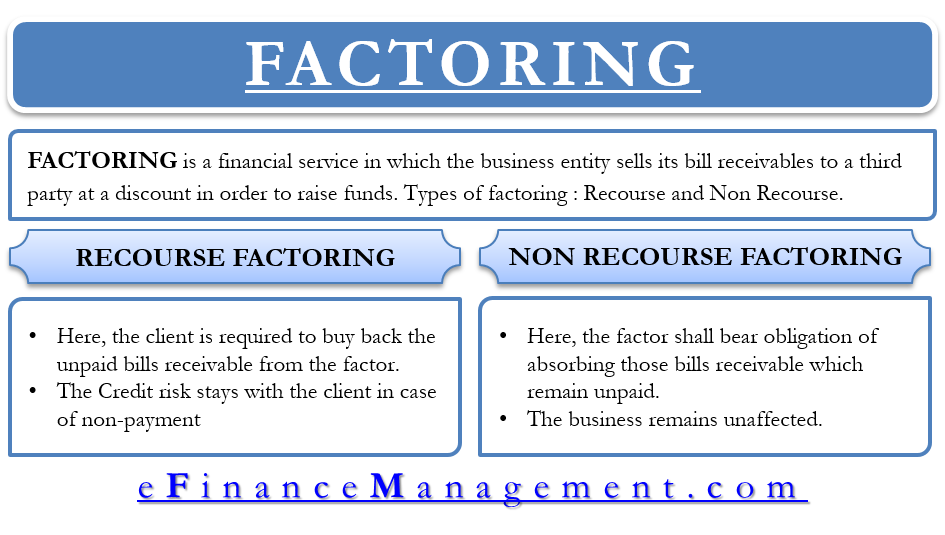

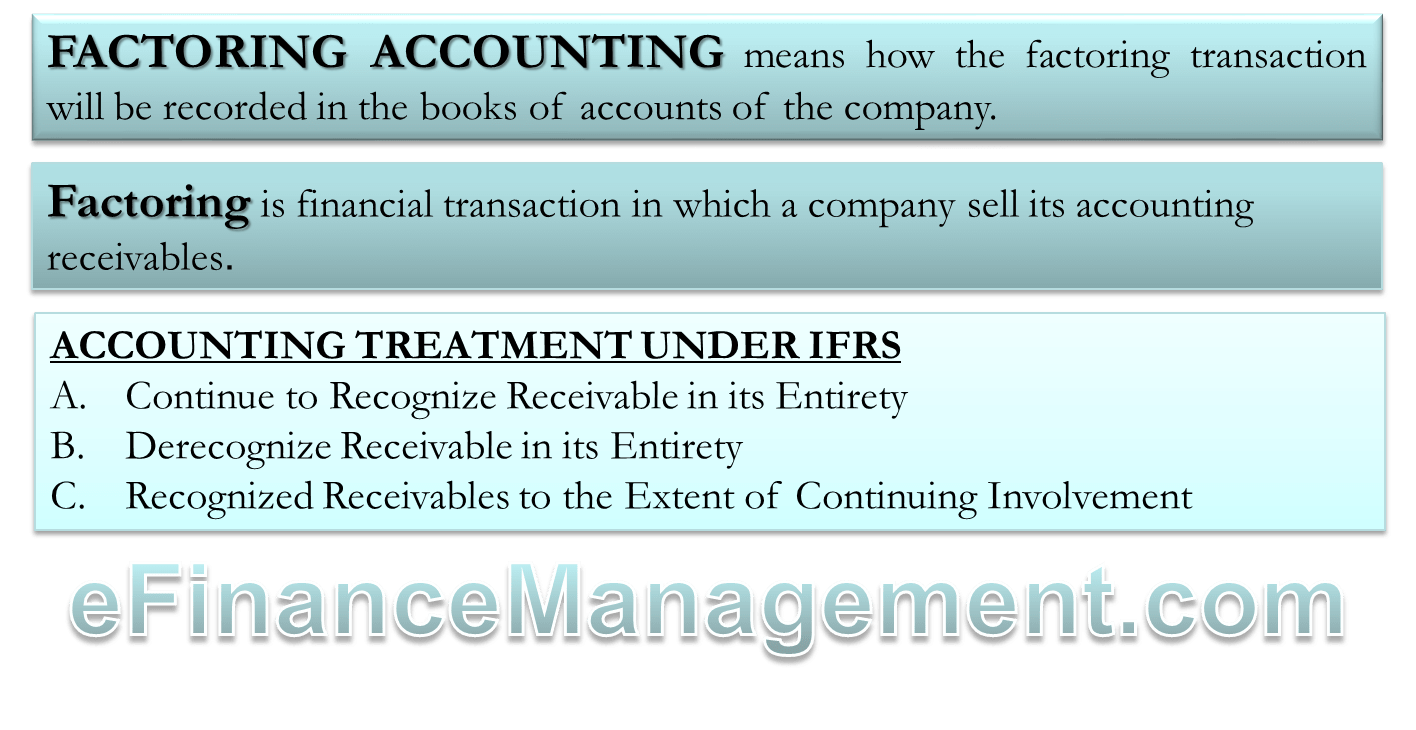

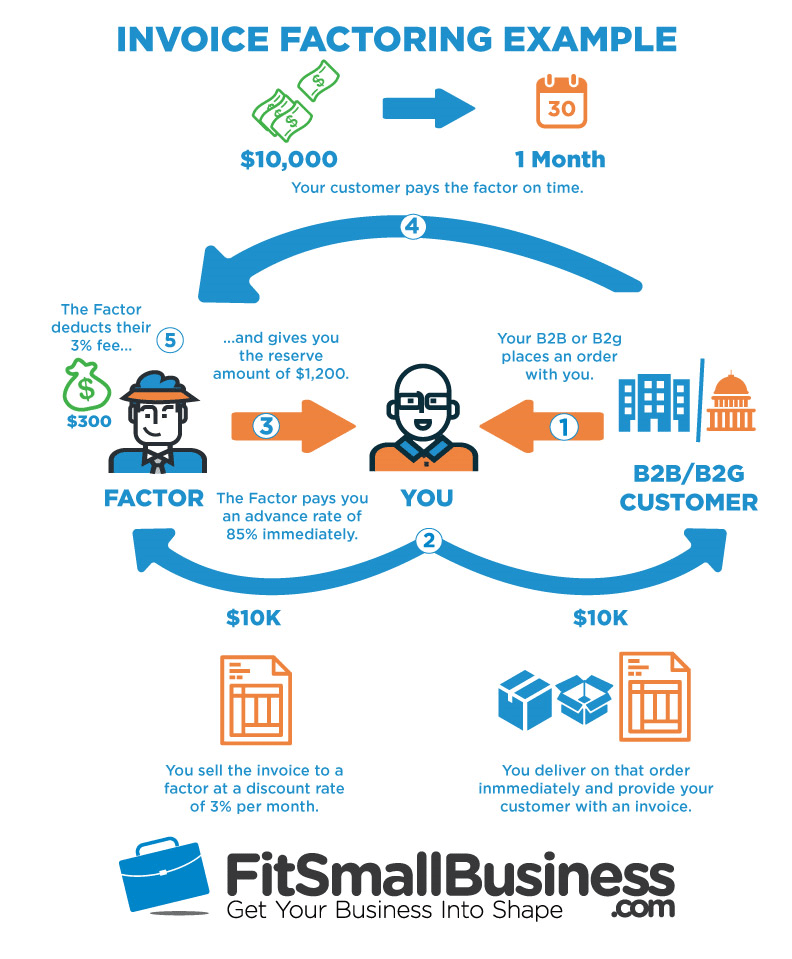

Factoring finance example. In this purchase accounts receivable are discounted in order to allow the buyer to make a profit upon the settlement of the debt. They are often used to finance small transportation carriers that work with reputable brokers shippers. Factor at discounted prices. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount.

But to do the job properly we need the highest common factor including any variables. Understanding how accounts receivable factoring works. For example a factor may want the company to pay additional money in the event one of the company s customers defaults on a. 3y 2 12y 3 y 2 4y.

Firstly 3 and 12 have a common factor of 3. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. So we could have. Factorising is the process of finding a number s factors.

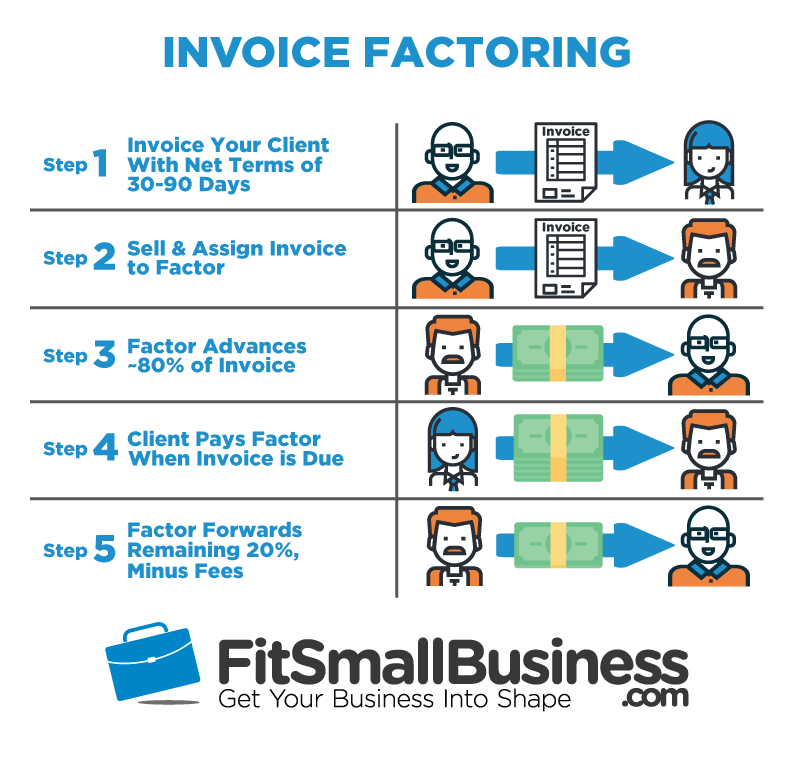

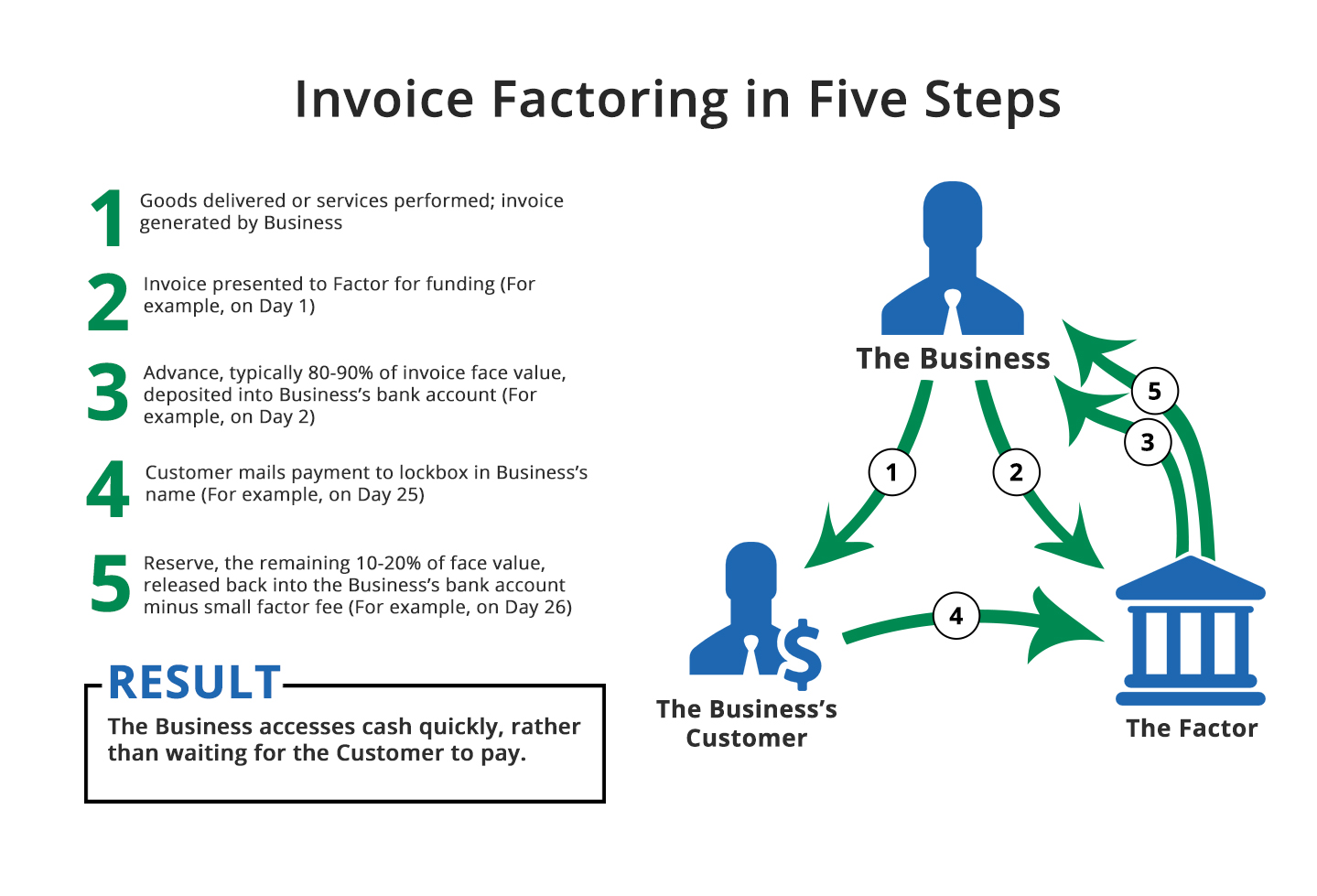

In algebra factoring uk. Accounts receivable factoring is also known as invoice factoring or accounts receivable financing. The factor collects payment on the receivables from the company s. Factoring implies a financial arrangement between the factor and client in which the firm client gets advances in return for receivables from a financial institution factor it is a financing technique in which there is an outright selling of trade debts by a firm to a third party i e.

The factoring agreement can vary between financial institutions. In the previous example we saw that 2y and 6 had a common factor of 2. For example in the equation 2 x 3 6 the numbers two and three are factors. Factoring receivables factoring or debtor financing is when a company buys a debt or invoice from another company factoring is also seen as a form of invoice discounting in many markets and is very similar but just within a different context.

Through invoice factoring a company sells its accounts. Team technology has the following definition of the term. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. This article focuses on the meaning of the term in the world of business and finance.

The first example shows a two installment transaction. Invoice financing is a form of short term borrowing that is extended by a lender to its business customers based on unpaid invoices. These transactions are the most common in the factoring industry and apply to most companies.