Eo Insurance Quotes

Errors and omissions insurance e o.

Eo insurance quotes. Protect your business from costly mistakes. Errors and omissions insurance quotes. The information you provide will be shared with our business partners so that they can return a quote. If you cancel your e o policy your business becomes vulnerable to client lawsuits.

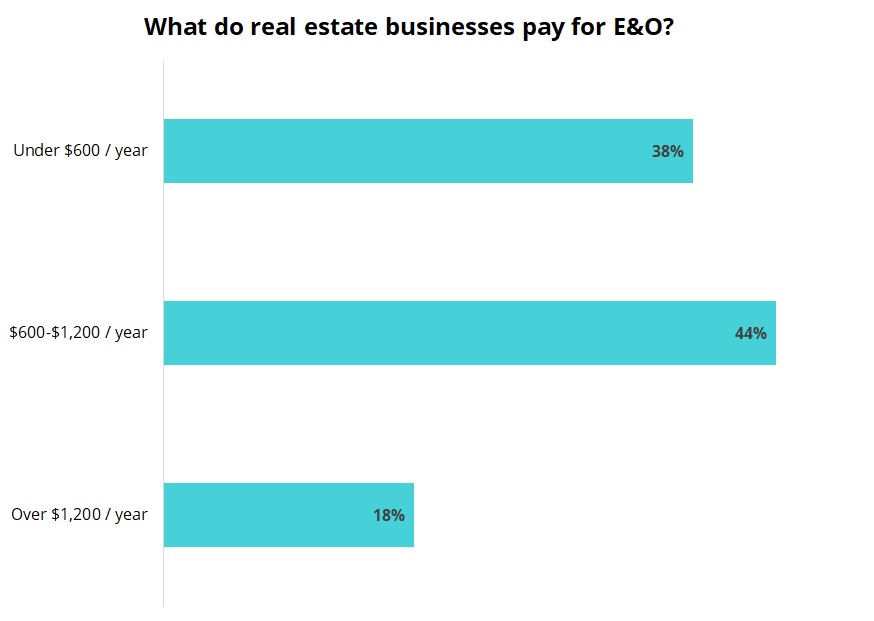

How much does errors and omissions insurance cost. E o insurance is a kind of specialized liability protection against losses not covered by traditional liability insurance. We can help you secure business insurance in all states except hawaii. Errors omissions insurance also called e o eo and professional liability insurance helps protect your company or professional practice from risks not typically covered by your general commercial liability policy e o is a businessperson s version of the malpractice insurance taken out by medical practitioners and lawyers.

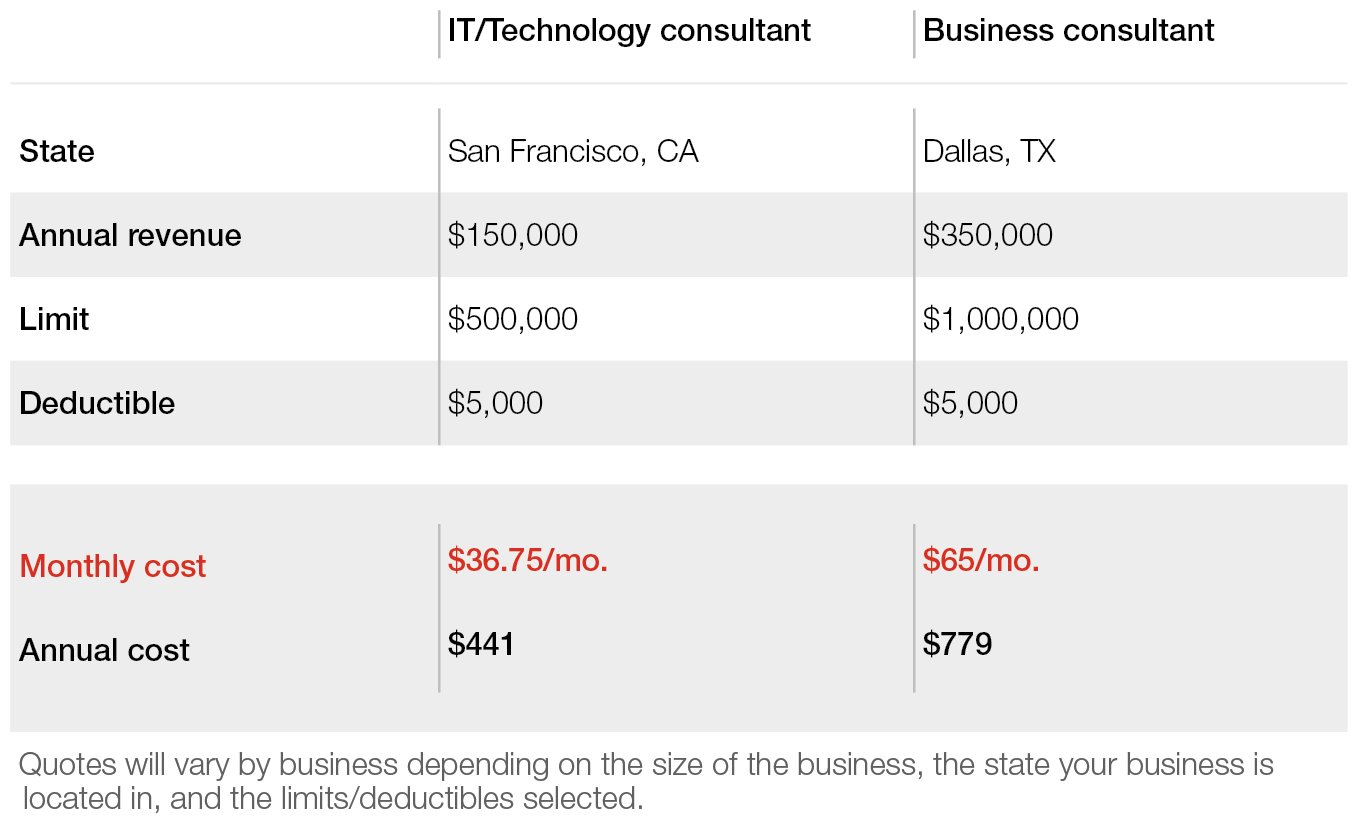

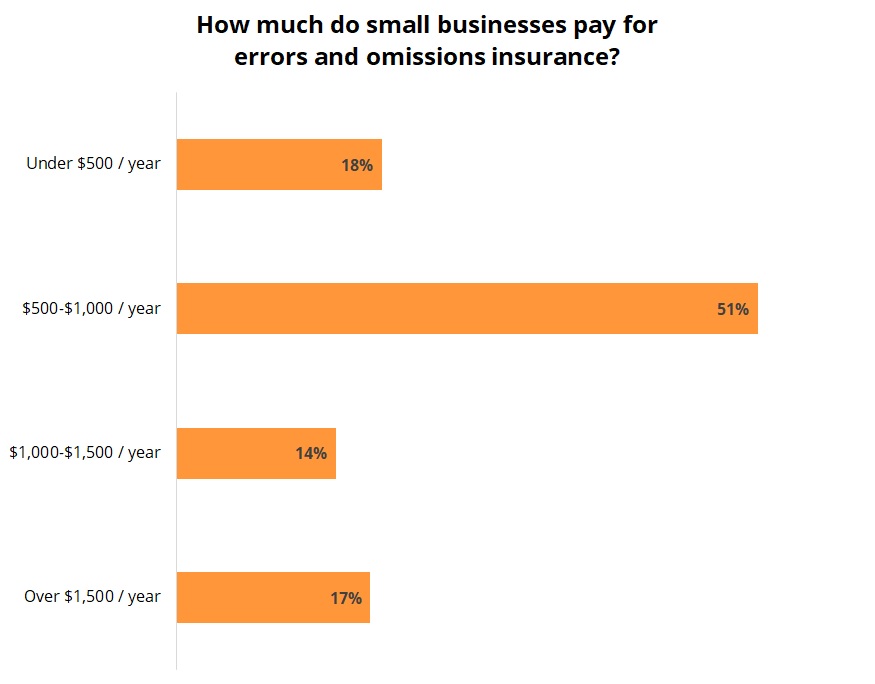

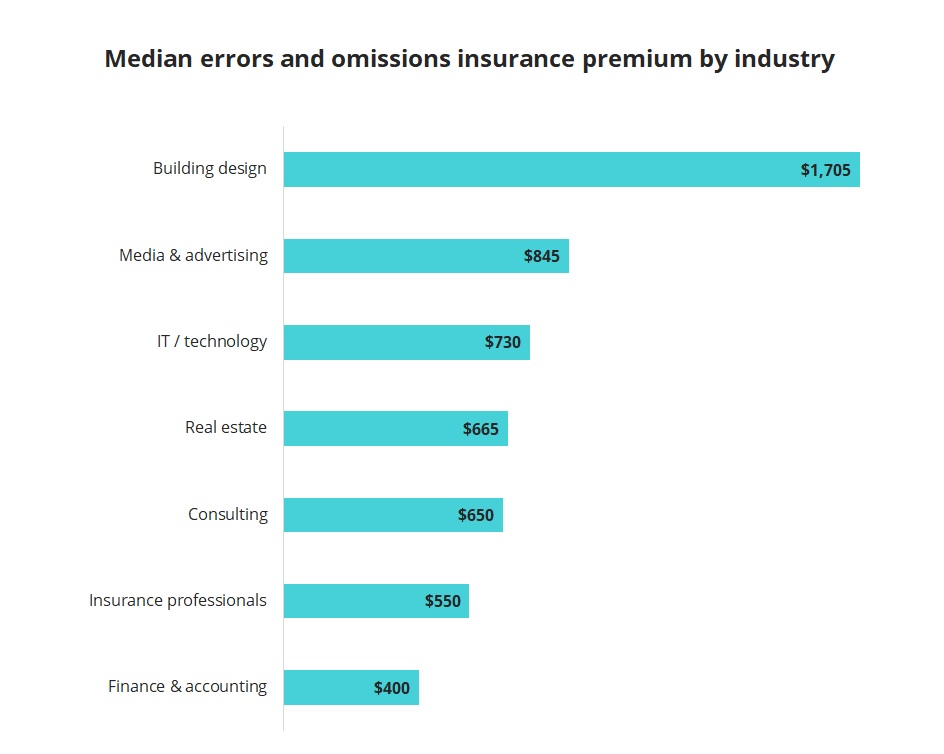

The errors and omissions insurance cost can vary for different types of businesses. Get a customized errors and omissions insurance quote. Professional liability insurance coverages are written through non affiliated insurance companies and are secured through the geico insurance agency inc. Generally any business which offers advice or provides a service needs an errors and omissions policy.

Protect your business from lawsuit costs and apply online for a free e o insurance cost quote from the hartford to help protect your small business today. Errors and omissions insurance e o often referred to as professional liability insurance protects your business in the event you re found legally liable for faulty advice or negligence related to a professional service. While e o insurance covers potential fallout from a professional mistake it does not provide complete protection. Errors and omissions insurance is a type of professional liability insurance.

It protects you and your business from claims if a client sues for negligent acts errors or omissions committed during business activities that result in a financial loss. Claims adjusters life insurance agents and other insurance professionals should also consider. This insurance covers the negligence errors or omissions of a business and pays the financial damages awarded in lawsuits filed by a third party typically a client. Errors and omissions insurance e o is a type of professional liability insurance that protects companies and their workers or individuals against claims.

A typical e o policy is claims made meaning the insurance company pays claims only if they re filed when the policy is active and the incident must have occurred after a retroactive date that clearly defines the day coverage began. Who needs e o insurance.