Employer Tax Credit For Health Insurance

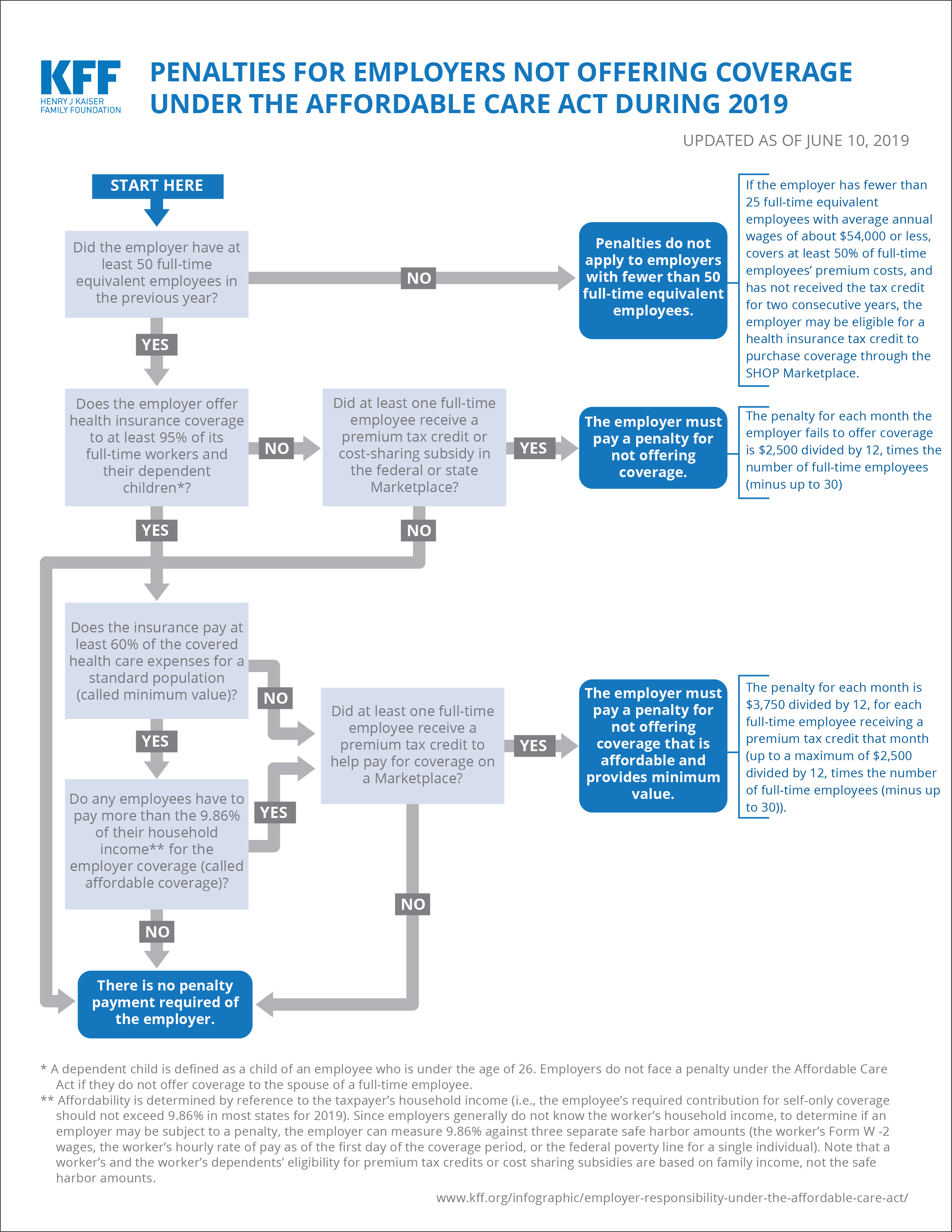

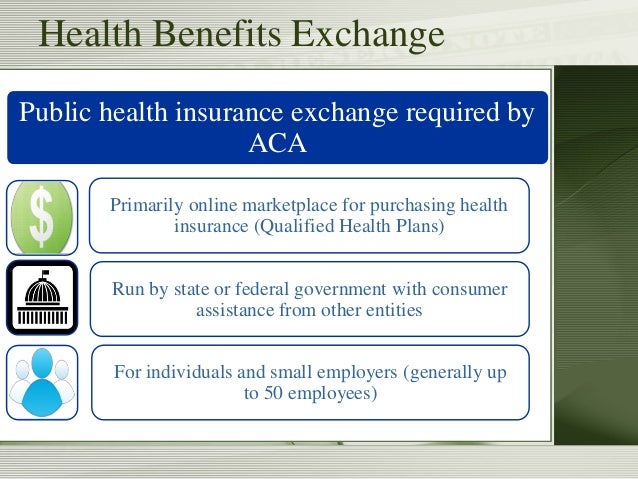

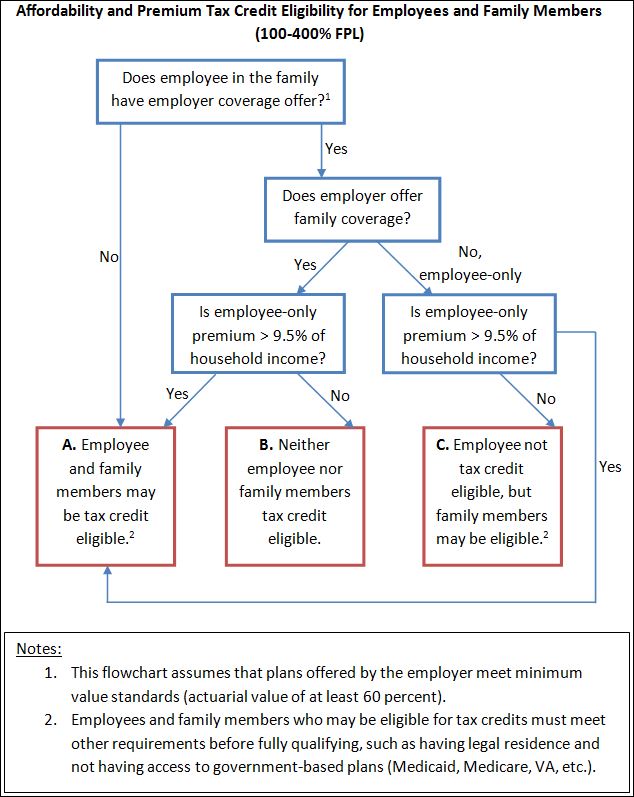

You may qualify for the small business health care tax credit that could be worth up to 50 of the costs you pay for your employees premiums 35 for non profit employers.

Employer tax credit for health insurance. You can make a claim during the year or after the year has ended. Your small business must meet the following requirements to qualify for the health insurance tax credit. 111 148 to help small businesses and small sec. Click the manage your tax link in paye services.

You pay average annual wages below 52 000 this number is subject to change with inflation. The premium tax credit also known as ptc is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the health insurance marketplace. You must use form 8941 credit for small employer health insurance premiums to calculate the credit. The small employer health insurance tax credit under sec.

501 c tax exempt organizations afford the cost of providing health insurance coverage for their employees. 45r was enacted by the patient protection and affordable care act ppaca p l. Making a claim during the year. Claiming the health care tax credit.

Small employer tax credit requirements. Use myaccount to claim the credit s if your employer pays medical insurance relief for you or your family. Select claim tax credits select medical insurance relief under the category health. To get this credit you must meet certain requirements and file a tax return with form 8962 premium tax credit.

/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png)