Does Transferring Credit Card Balances Hurt Your Credit

A balance transfer card is one way to pay off debt faster because during the introductory rate period you will pay little to no interest.

Does transferring credit card balances hurt your credit. Ideally your credit card balances should be below 30 of the credit limit. However any decrease in your scores would likely be temporary and over time this could be a positive change. A new credit card can also help your scores in the long run by increasing your available credit and adding another account to your credit profile. But there s one thing to keep in mind before you move your debt to a new balance transfer card.

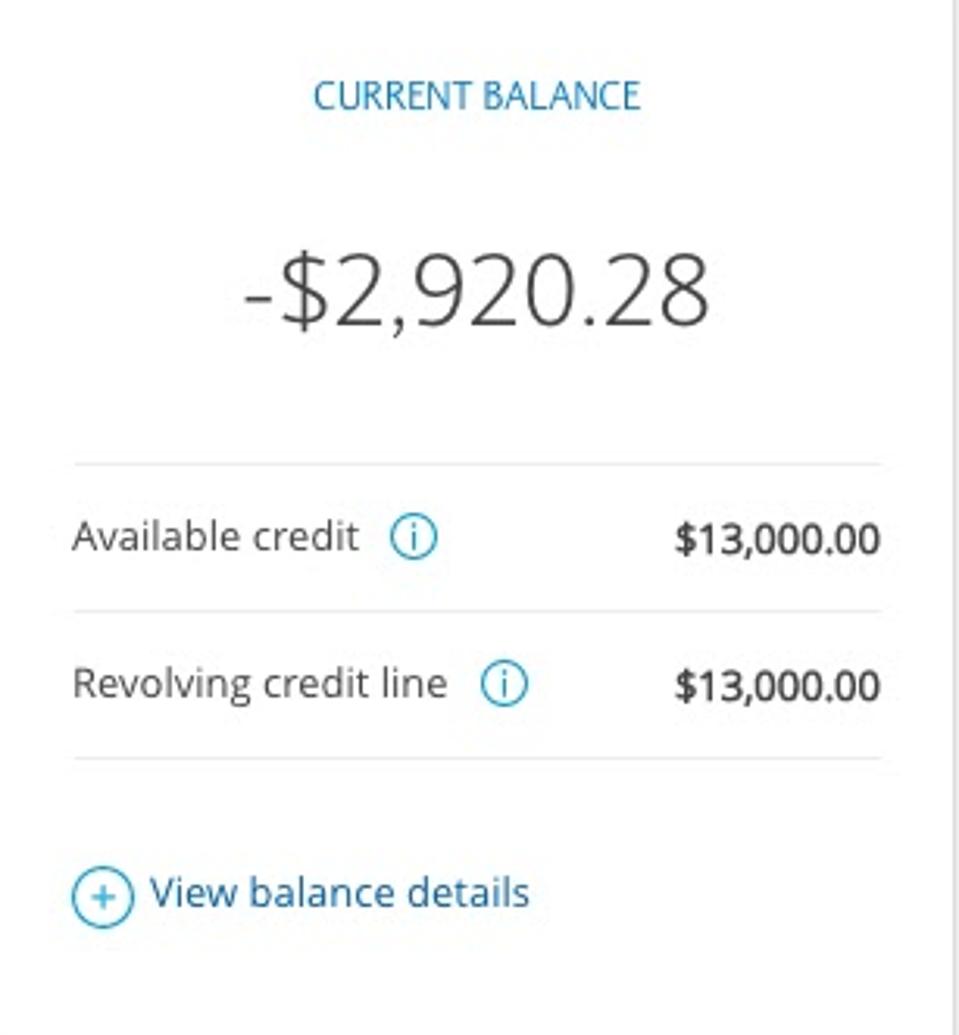

With the original 5 000 debt that puts your credit utilization at 33. Keep in mind that this would mean you kept your original credit card after transferring the balance. Instead of focusing solely on how your credit score will react consider how eliminating credit card debt will affect your overall financial health. A balance transfer can be a good way to pay down credit card debt depending on several factors though balance transfers can help or hurt a credit score as well.

Most major balance transfer credit cards require that you have at least good credit which is typically a 700 fico score or above. How transferring a balance impacts scores. So before you apply for a balance transfer credit card check your credit score through a credit monitoring service like credit karma or capital one and make sure your credit score is good enough. Fortunately you can regain lost credit score points by paying down your balance quickly.

If you transfer a balance to a credit card with a lower credit limit than the previous card your credit utilization will go up and you could lose credit score points. Generally the higher your credit utilization the lower your credit score will be. If you re approved for a balance transfer credit card with a 10 000 limit you d then have 15 000 in total available credit. Your credit utilization would be 100.

Balance transfers can help you get out of debt if you avoid spending on other credit cards and you have a plan to pay off your balance transfer card before the 0 rate expires. Opening a new card for a balance transfer could lower your credit utilization depending on the limit and your spending habits. A credit utilization rate also known as your balance to limit ratio compares your total balances to your total credit limits. A balance transfer can hurt your credit score in many ways but in every case responsible credit card use can make it easy to recover over time.

The content on this page is accurate as of the posting date. However some of our partner offers may have expired. When you transfer a credit card balance from one card to another you lose points on your credit score. But if the rate is lower and the limit is higher you gain more.

:max_bytes(150000):strip_icc()/how-opening-a-new-credit-card-affects-your-credit-score-96050-final-5b60bade46e0fb0025b3bc98.png)

/pen--on-the-business-paper--report-chart-816878990-e4bb54bc72e148f4a707bac9c9046737.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/4613732ca96cd79a1e64a282b8a041ac_new1-5f9a5a13ccc74c0c9d373ca39f23dcfc.jpg)