Divorce Tax Filing Status

We ve got tips for you on which filing status to choose after the divorce who can claim the exemptions for the kids and how payments to an ex spouse are treated for tax purposes.

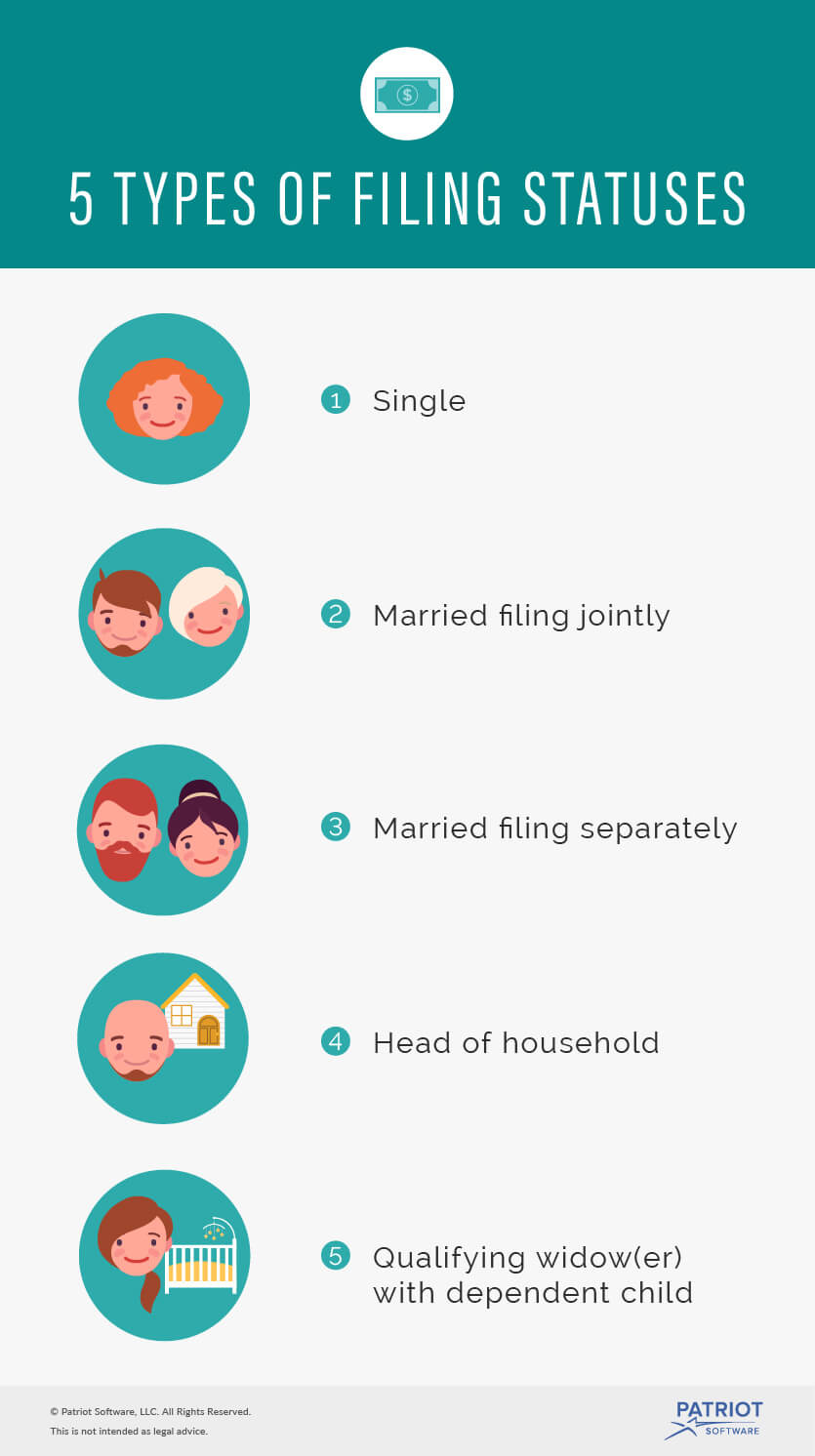

Divorce tax filing status. The child tax credit the credit for other dependents and the additional child tax credit. If you were divorced by midnight on december 31 of the tax year you will file separately from your former spouse. Your filing status will be either single or head of household. If you re still unsure it s a good idea to talk to a tax attorney or another tax professional to make sure you choose the correct filing status.

For more on tax filing status after divorce see irs publication 501 dependents standard deduction and filing information. If you are separated but have not obtained a final decree of divorce or legal separation by december 31 of a tax year you can only file as married filing jointly or married filing separately since you are considered married for the entire year. Your filing status is determined as of the last day of the calendar year. These different tax filing statuses can be tricky so it may be a good idea to utilize a tax accountant during or after a divorce to make sure you are filing correctly.

For couples who can not tolerate being together in the same room to have a joint tax return prepared an alternative is to agree on one tax preparer and separate appointments. The alternative married filing separately has a much higher tax rate. Going from a married tax filing status to a single tax filing status often entails paying different tax rates than when you were married. And you don t receive a final decree of divorce by the due date for filing the gift tax return you must report the transfer on form 709 and attach a copy of your written agreement.

Head of household filing status. The last thing you need after an exhausting divorce is a friendly audit from the irs. Your marital status at the end of the year determines how you file your tax return. Your marital status affects your filing status tax rate alimony payments and who gets to claim your children as dependents.

Your marital status affects your filing status. The irs has an online tool you can use to help determine your filing status. Under irs rules you re technically still married if your divorce is not yet final as of dec. For each filing status the internal revenue service applies tax rates from varied charts.

If you are the custodial parent for your children you may qualify for the favorable head of household status. If you re going through a divorce taxes may be the last thing on your mind so we re here to help.