Definition Tax Exemption

Under section 13 9 of the income tax act tax exemption will be granted when all of the following three conditions are met.

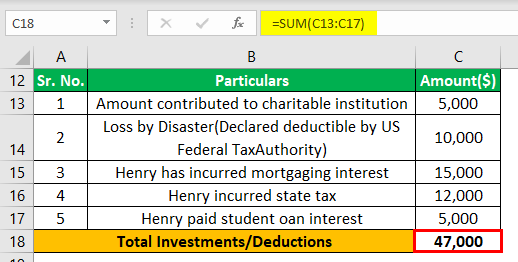

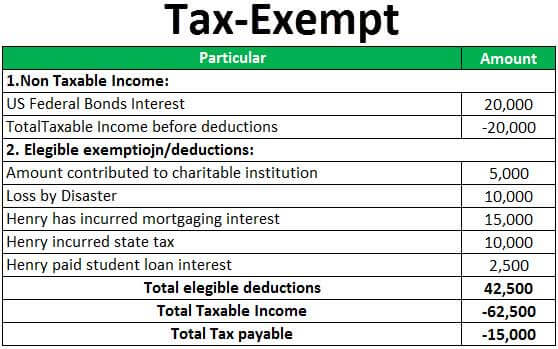

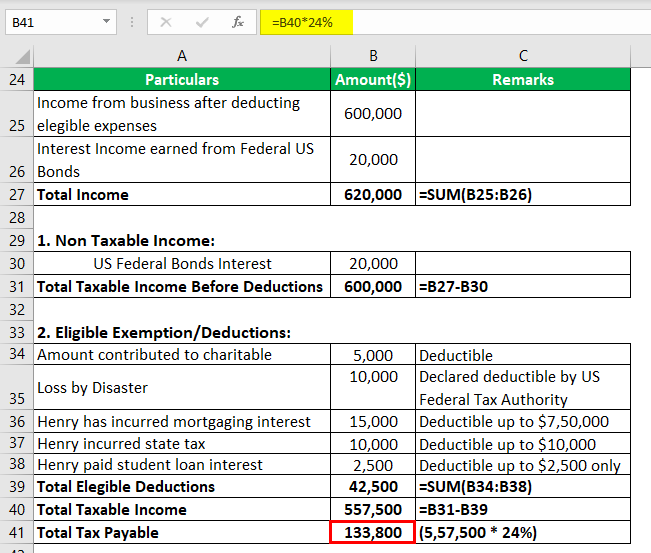

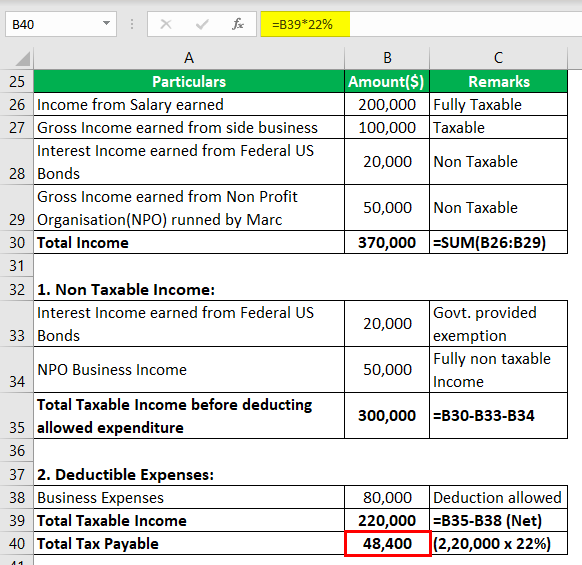

Definition tax exemption. An exemption is a lawful reduction of the amount of income that would otherwise be taxed for a qualifying reason. A tax exemption is the right to exclude all or some income from taxation by federal or states governments. Tax exemptions are related to but distinct from tax deductions. Exemption definition the circumstances of a taxpayer as age or number of dependents that allow him or her to make certain deductions from taxable income.

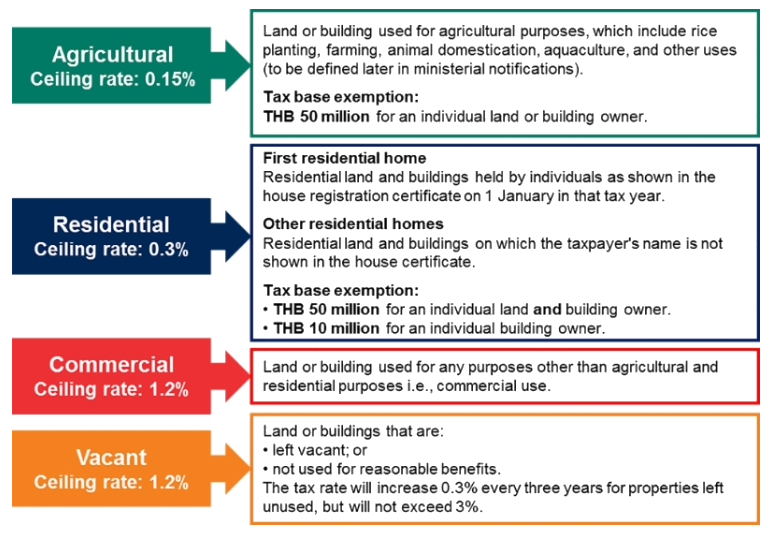

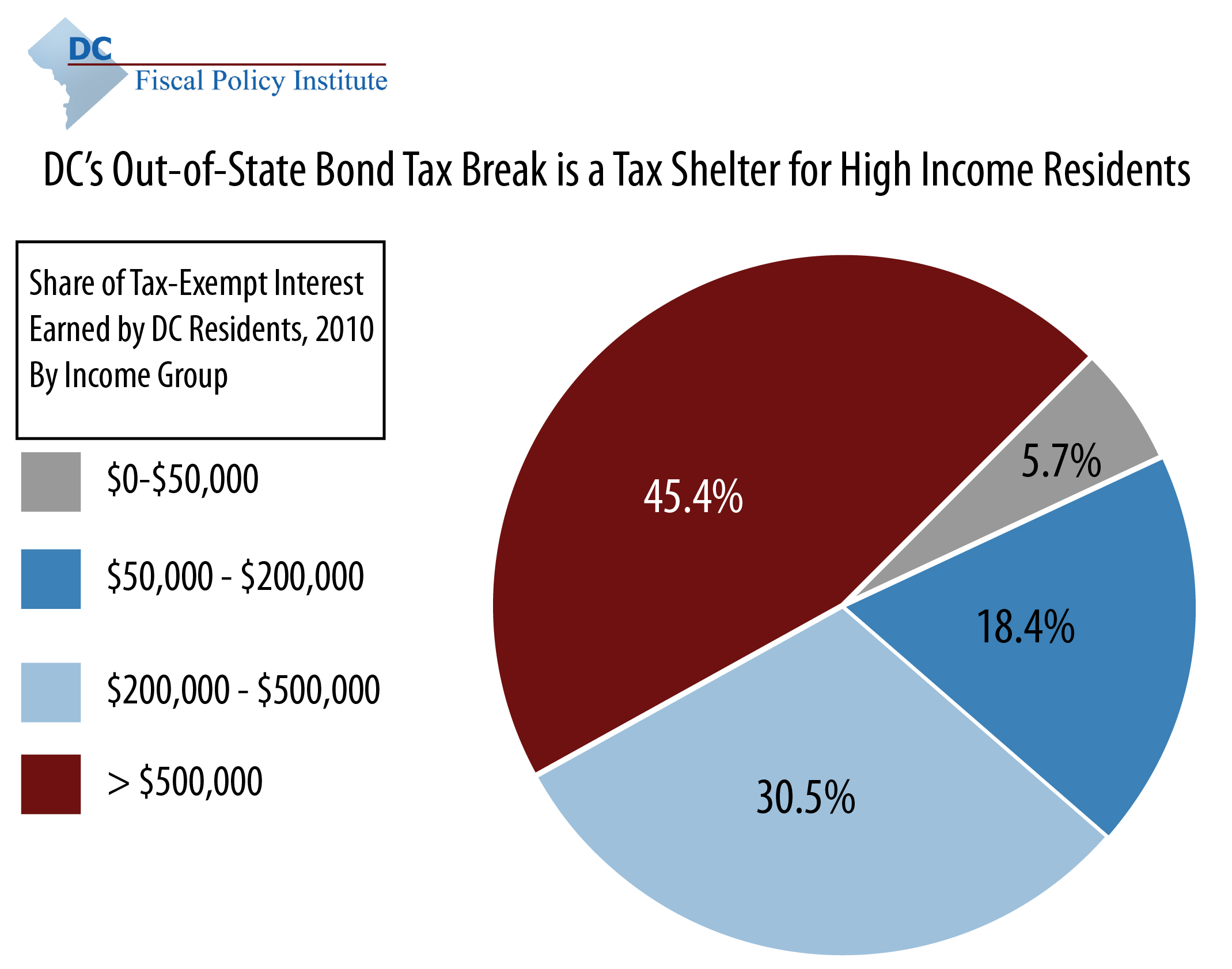

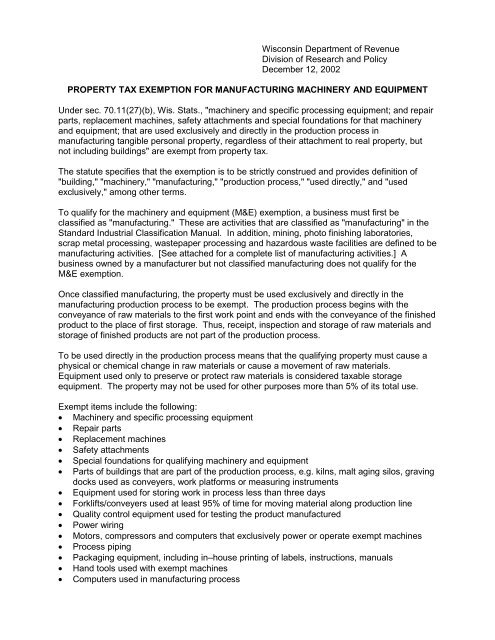

The foreign income had been subject to tax in the foreign jurisdiction from which they were received known as the subject to tax condition the rate at which the foreign income was taxed can be different from the headline tax rate. How to use tax exempt in a sentence. Companies can enjoy the partial tax exemption and tax exemption for new start up companies as provided in the tables below. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons property income or transactions.

Personal exemptions have been repealed and replaced by higher standard deductions. The reporting of tax free items may be on a taxpayer s individual or. Tax exempt status may provide complete relief from taxes reduced rates or tax on only a portion of items. Tax exemptions come in many forms but one thing they all have in common is they either reduce or entirely eliminate your obligation to pay tax.

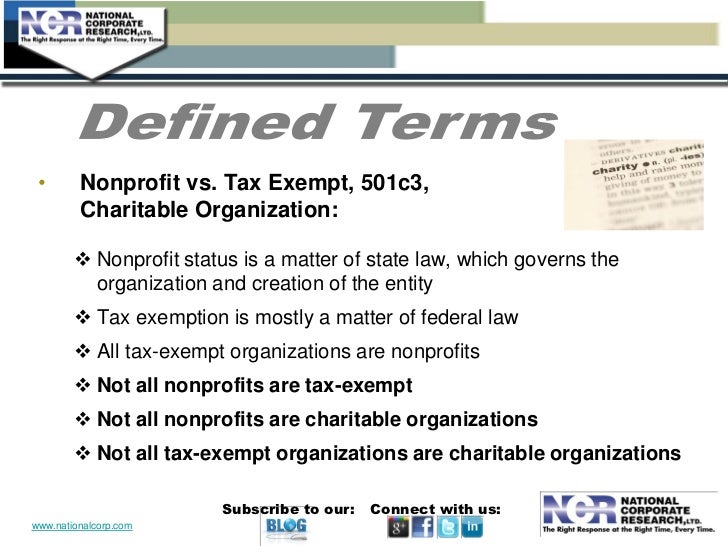

Defining tax exempt. Meaning of tax exemption. 2013 and subsequent yas. Tax exempt refers to income or transactions that are free from tax at the federal state or local level.

What does tax exemption mean. Federal and state governments frequently exempt organizations from income tax entirely when it serves the public such as with. Partial tax exemption for companies from ya 2020. Partial tax exemption and tax exemption scheme for new start up companies.

Most taxpayers are entitled to an exemption on their tax return that reduces your tax bill in the same way a deduction does.

/GettyImages-989124584-3d388da139694016a7c9da74898fb95e.jpg)