Debit Vs Credit Bank Account

All normal asset accounts have a debit balance.

Debit vs credit bank account. Debit is an accounting entry made on the left hand side that which leads to either increase in the asset account or expense account or lead to decrease in the liability account or equity account of the company whereas credit is an accounting entry on the right hand side which leads to either decrease in the asset account or expense account or lead to. You will record these transactions in two accounts. When the opposite is true it has a net credit balance. When accounting for these transactions we record numbers in two accounts where the debit column is on the left and the credit column is on the right.

A debit is an entry made on the left side of an account. A debit is an accounting transaction that increases either an asset account like cash or an expense account like utility expense. When you hear your banker say i ll credit your checking account it means the transaction will increase your checking account balance. The word credit is originated from the latin word credere which means to entrust.

If you are new to the study of debits and credits in accounting this may seem puzzling. If a debit increases an account you will decrease the opposite account with a credit. There are several different types of accounts in an accounting system. For non accounting individuals debit refers to the amount drawn or deducted from the particular bank account.

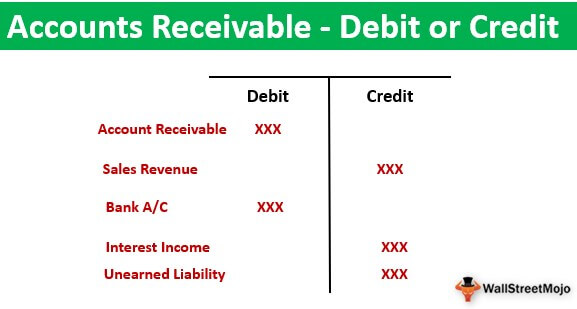

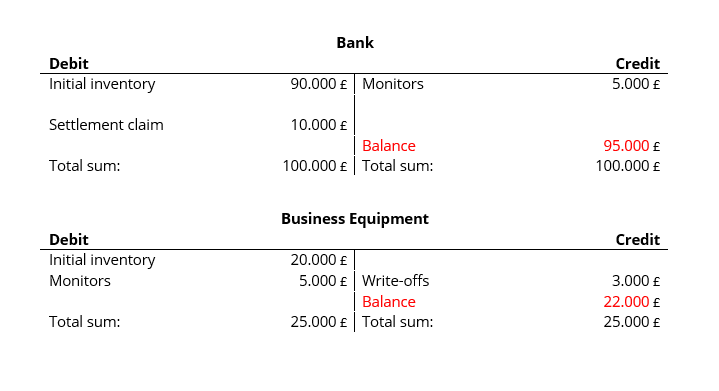

Bank s debits and credits. Each account is assigned either a debit balance or credit balance based on which side of the accounting equation it falls. Debit and credit accounts and their balances. Differences between debit and credit.

To debit an account means to enter an amount on the left side of the account. Outside of the accounting world the term debit usually refers to money removed from a consumer bank account such as money removed from your checking account when you buy groceries. If the debit side of an account exceeds credit side it is considered as debit balance. Business transactions are events that have a monetary impact on the financial statements of an organization.

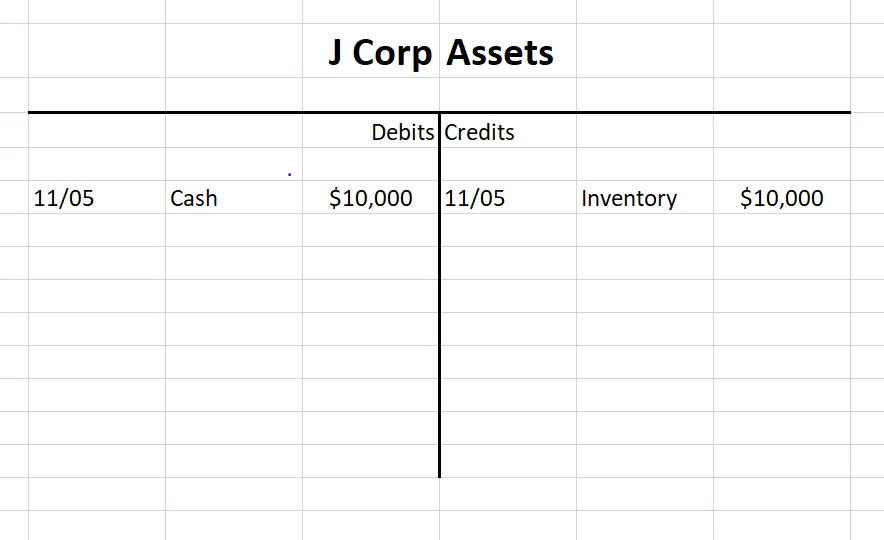

For a particular account one of these will be the normal balance type and will be reported as a positive number while a negative balance will indicate an abnormal situation as when a bank account. Debits are always entered on the left side of a journal entry. Conversely if your bank debits your account e g takes a monthly service charge from your account your checking account balance decreases. After you have identified the two or more accounts involved in a business transaction you must debit at least one account and credit at least one account.

Debit and credit definitions. Debits and credits are equal but opposite entries in your books. When the total of debits in an account exceeds the total of credits the account is said to have a net debit balance equal to the difference. A debit and credit account.

/difference-between-a-credit-card-and-a-debit-card-2385972-Final-5c4731cbc9e77c00018a49e9.png)

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

:max_bytes(150000):strip_icc()/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)