Convert 401k To Traditional Ira

Learn more about roth conversions.

Convert 401k to traditional ira. You can also convert traditional 401 k balances to a roth ira. Our goal was to convert her traditional 401 k to a traditional ira and convert her roth. Roll over a roth 401 k into a roth ira tax free. Convert a roth 401 k to a traditional ira.

The inspiration from this post came while i was helping my wife rollover her traditional and roth 401 k she had two was because her employer matched contributions with before tax money. Roll over a traditional 401 k into a roth ira this would be considered a roth conversion so you d owe taxes. Roll over a traditional 401 k into a traditional ira tax free. In part that s because nearly one third of employers simply don t offer a roth option.

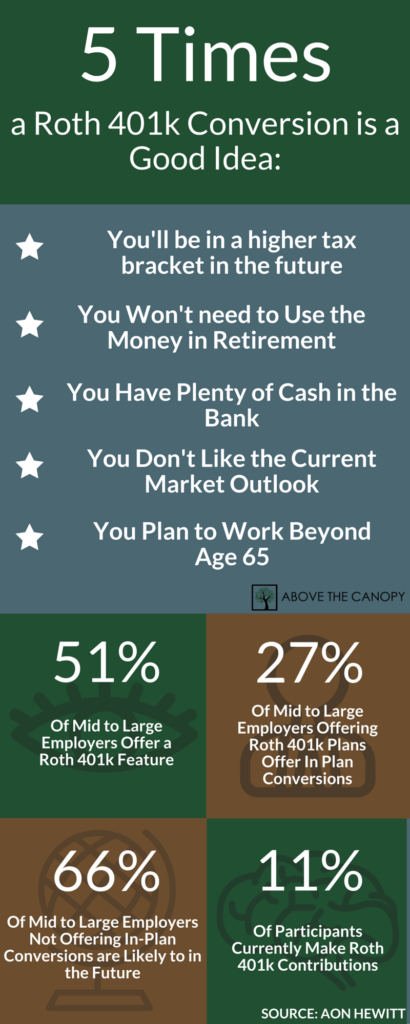

Then you convert that ira from the traditional variety into a roth ira. An ira rollover is a transfer of funds from a retirement account into a traditional ira or a roth ira via direct transfer or by check. For some savers the lure of moving assets to a roth individual retirement account from a traditional ira or 401 k plan often boils down to the tax free income it will deliver in their golden years. Converting 401k into a roth ira.

Generally you ll only be able to transfer a 401 k to a roth ira once you ve left the company that provided the 401 k or once you reach the age of 59 which is the age most plans allow for in service withdrawals. The conversion is reported on form 8606. Same trustee transfer if your traditional and roth iras are maintained at the same financial institution you can tell the trustee to transfer an amount from your traditional ira to your roth ira. For example if you have 5 000 in a nondeductible ira and 95 000 in a deductible ira and convert 50 000 to a roth then only 5 of the nondeductible ira funds or 250 will be tax free.

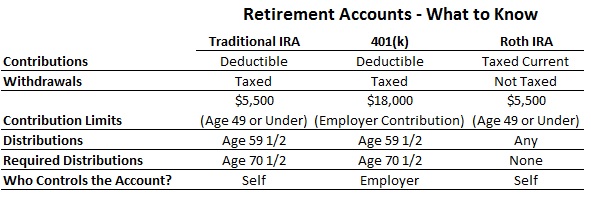

A conversion to a roth ira results in taxation of any untaxed amounts in the traditional ira. Here s what to know about converting your 401k to a roth ira. In the world of retirement account rollovers there s one type that doesn t get much love. Roth 401 k or traditional 401 k steps to convert 401 k to ira.

Most workers still have the lion s share of their retirement money tucked inside a traditional 401 k. What you can t do. Converting a 401 k to a roth ira. Converting a traditional 401 k to a roth ira is a two step process.