How Many Checking Accounts Should I Have

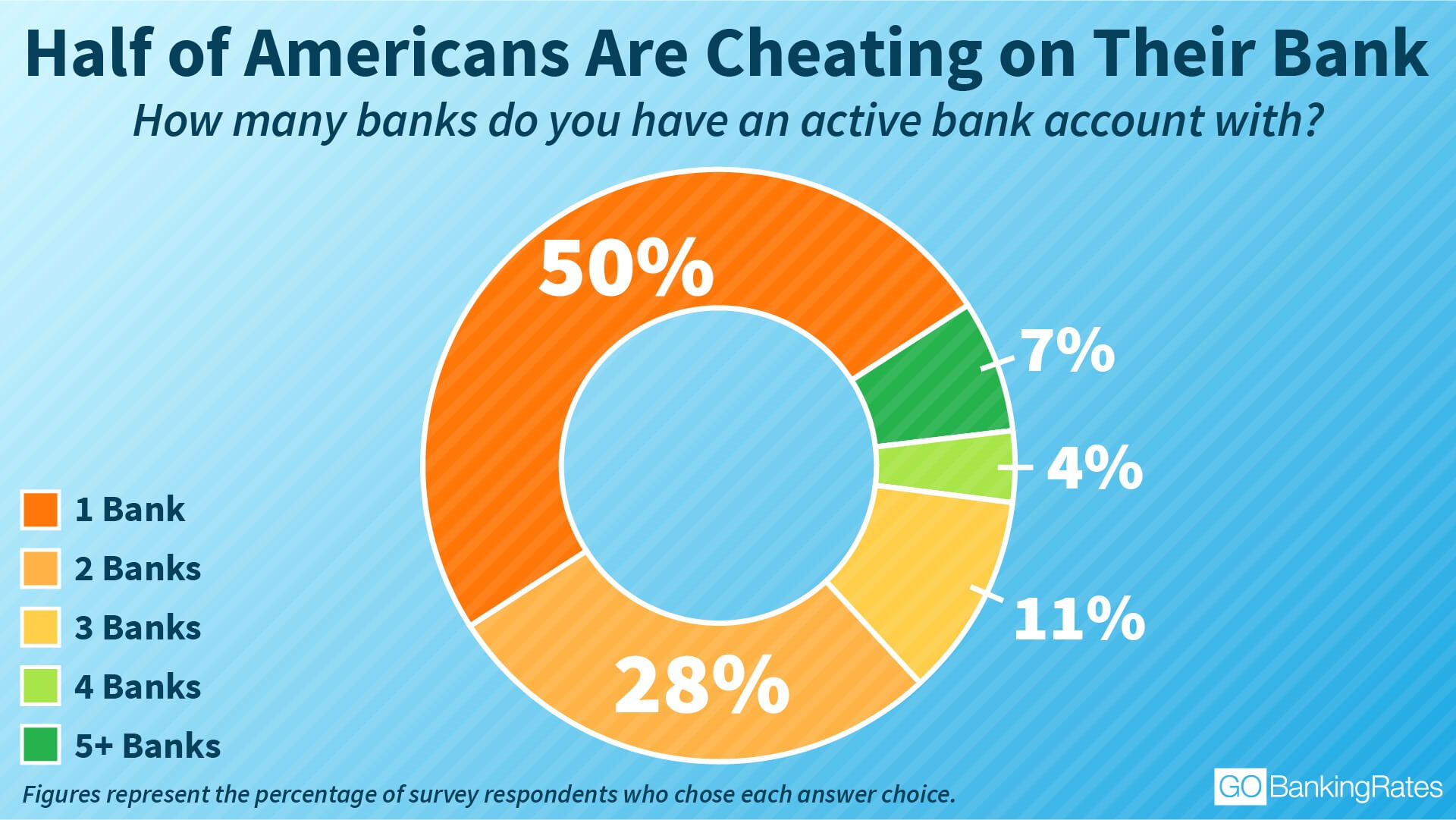

For the vast majority of people having your basic banking services a checking account and a savings account at a single bank is probably the best move.

How many checking accounts should i have. If you want to earn more interest try looking at one of the fdic insured online banks that made team clark s list of the best. I strongly suggest that you maintain enough balance in the account to meet your budgeted monthly expenses. Balance waivers are a common way you can qualify to have fees waived if you maintain a large enough balance. Although many checking accounts pay some interest fees are so large that they should be the primary factor you consider when choosing a checking account.

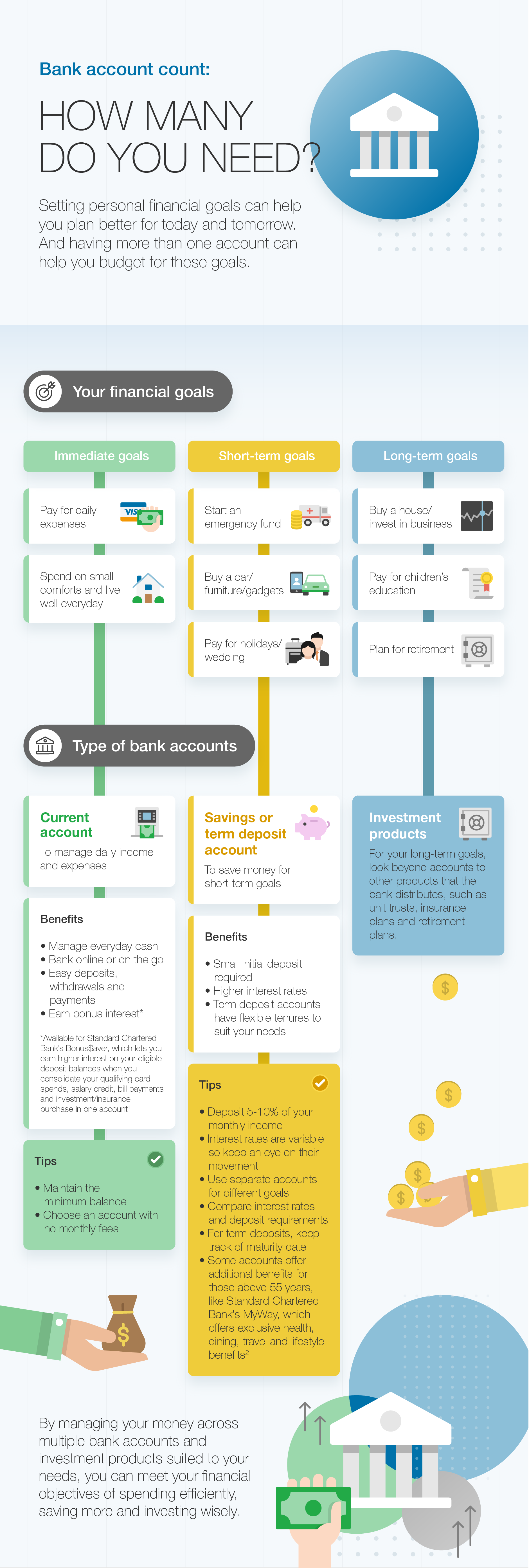

So many people are better off keeping the minimum amount of money to cover their spending in their checking account and using a savings account to earn higher interest rates. For example you may choose to keep your personal checking account open when you open a joint account with your spouse at a different bank. A checking account and a savings account. A checking account a savings account and an account for retirement savings although this can be held at a brokerage instead.

How many bank accounts you should have depends on your individual situation and your financial goals. So you should run your normal spending through your checking account. For most people there s no reason to have accounts at multiple banks. Most people prefer three bank accounts at a minimum.

Where there was once a single checking account to house your first paycheck now there are savings accounts money market accounts credit cards 401 k s mortgages 529s and maybe even a home. If you re like most people you probably have a daily checking account a savings account and maybe an account at another bank to avoid overseas atm withdrawal fees. It is possible to have a checking account at more than one bank and you may have specific reasons why you want to do this. Too many people have both their checking and savings accounts with a traditional bank.

That s the core of all of my banking advice right there. Checking accounts do not offer much interest but there is usually no charge for cash withdrawals bank transfers or pos transactions. How many bank accounts you should have to keep things simple according to a financial planner. Online checking accounts generally do not charge monthly maintenance fees.

But as we all know the interest rates the big banks pay on your hard earned money are paltry. You should have one checking account that should be used for monthly expenses and purchases.

:strip_icc()/should-you-have-joint-or-separate-bank-accounts-1289664-final-5bd08bd946e0fb0026ee9838-5bec6d0bc9e77c0051fcd280.png)

/should-you-have-joint-or-separate-bank-accounts-1289664-final-5bd08bd946e0fb0026ee9838-5bec6d0bc9e77c0051fcd280.png)