How Does Donating To Charity Help Taxes

If you re going to donate mutual fund shares or other appreciated investments the process can take longer.

How does donating to charity help taxes. Tax deductible donations are contributions of money or goods to a tax exempt organization such as a charity. That in turn will help you figure out the net amount you can deduct as you generally have to offset your donation by the value of what you receive from the charity in exchange for the gift unless. However the deduction is limited to 30 of your adjusted gross income agi compared to the 50 limit for donating cash to charities. With your giving account at fidelity charitable you can become eligible for a charitable tax deduction and improve the world.

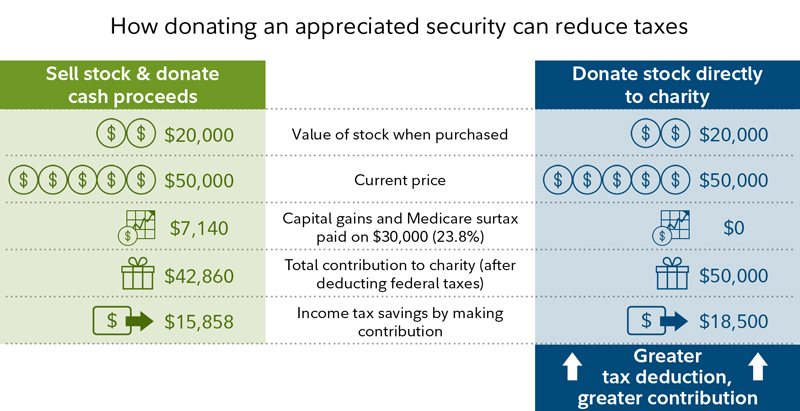

However as a concession certain donations made to ipcs on or after 1 may 2006 will be deemed as pure donations although there is benefit given in return for the donation. In most cases you can deduct long term securities that you have held for more than one year. For example if you have 25 000 in taxable income this year and donate 15 000 to charity you will receive the deduction for the whole gift and what you save on taxes lowers the cost of the. Contact your charity and your broker as soon as possible.

To claim tax deductible donations. John waggoner has been a personal finance writer since 1983. Donating your stocks directly to a charity can offer more tax benefits and can lower your income tax bracket. Cash donations with benefits.

Most transfers go smoothly but you don t want a gift meant for the current tax year to get credited to the next one. Only outright cash donations that do not give material benefit to the donor are tax deductible. 7 charitable tax deduction questions are answered in our basic guide to help you understand the potential tax implications and advantages of donating to charity.

/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif)