How Are 401k Withdrawals Taxed In Retirement

/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8.png)

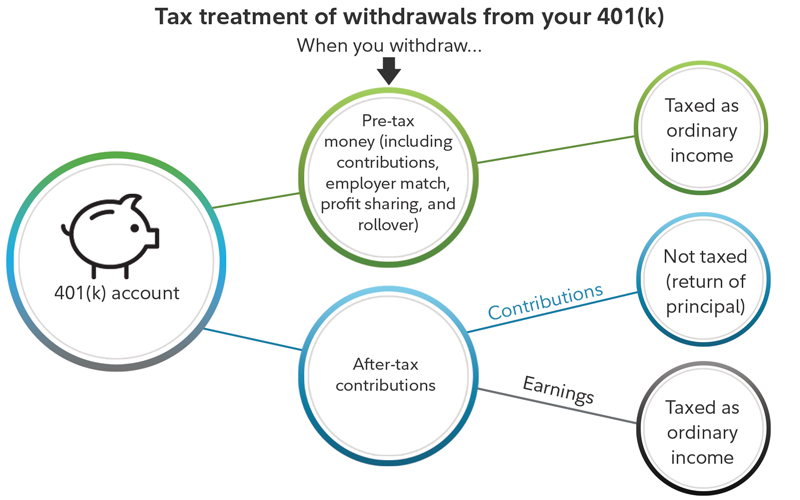

If you re building your retirement saving 401 k plans are a great option these employer sponsored plans allow you to contribute up to 19 000 in pre tax money in 2019 and 19 500 in 2020.

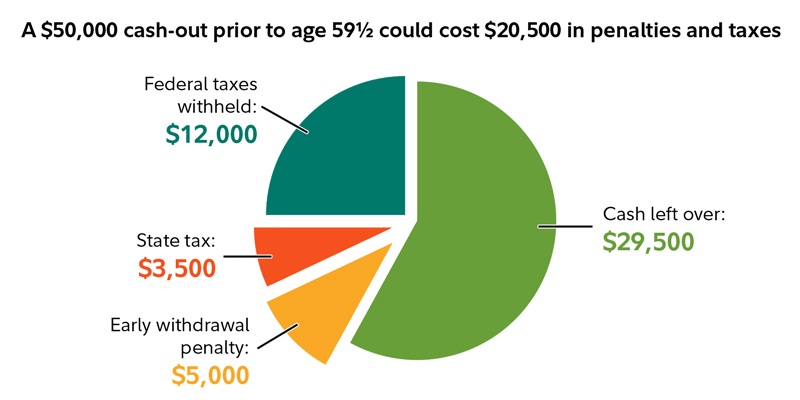

How are 401k withdrawals taxed in retirement. The law permits withdrawals up to 100 000 or the. Part of the cares act allowed individuals to tap iras or 401 k retirement plans if they were impacted by the coronavirus and needed cash. The short answer is yes your 401 k distributions are taxable. Previously you could borrow.

You can now borrow up to 100 000 or 100 of your balance and pay it back over time. Generally if you lose your job with a 401 k loan on the books the amount borrowed is treated like a withdrawal and you re on the hook for taxes. The cares act eliminates the 10 percent penalty on withdrawals. Provisions for loans or withdrawals from 401 k plans have been relaxed for 2020.

Tax day is july 15. More from smart tax planning. People often refer to retirement accounts like 401 k s as tax advantaged or tax deferred. What this means is your investments within your 401 k or ira grow tax free.

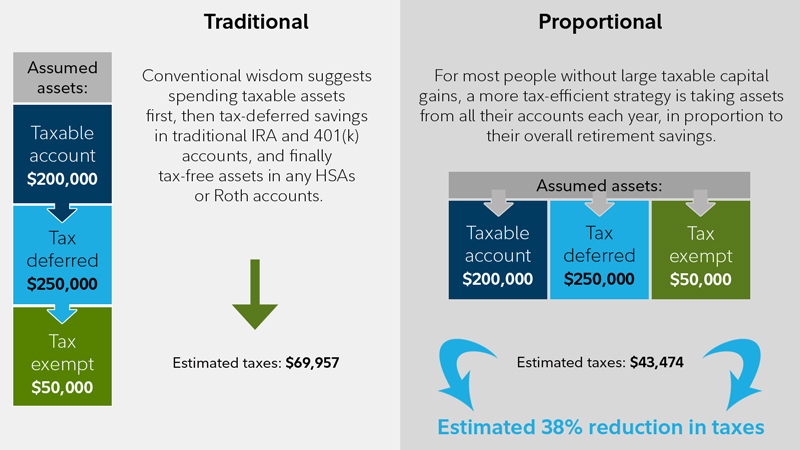

New retirement rules under the relief bill. A lack of tax nine of those states that don t tax retirement plan income simply have no state income taxes at all. If you re thinking of moving somewhere else consider one of the 12 states that don t tax distributions from pensions or defined contribution plans such as 401 k plans. If you choose a 401k withdrawal you will have to pay income taxes on that money though you can spread those tax payments out over time up to three years.

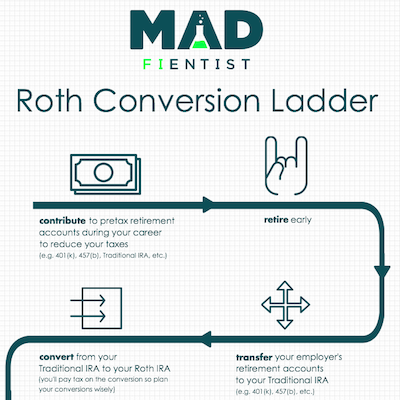

Previously if you wanted to withdraw cash from your 401 k or traditional ira before age 59 and a half you d face income taxes and a 10 penalty on. Convert to a roth. One of the easiest ways to lower the amount of taxes you have to pay on 401 k withdrawals is to convert those funds to a roth 401 k or a roth individual retirement account. Traditional 401 k withdrawals are taxed at an individual s current income tax rate.

Some employers will also match some of your contributions which means free money for you. 401k loans incur no penalties as long as they re paid back within the prescribed time frame.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png)

/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

/what-to-know-before-taking-a-401-k-hardship-withdrawal-2388214-v2-211c0d162ae64a95bbe3813f1f9243ad.png)

/exceptions-ira-early-withdrawal-penalty-2388980-Final-38a20015611944799acc47f83bba47af.png)

/GettyImages-534599661-42322be5b1f047229707b9f8bbce84b5.jpg)