Home Loan Assumptions

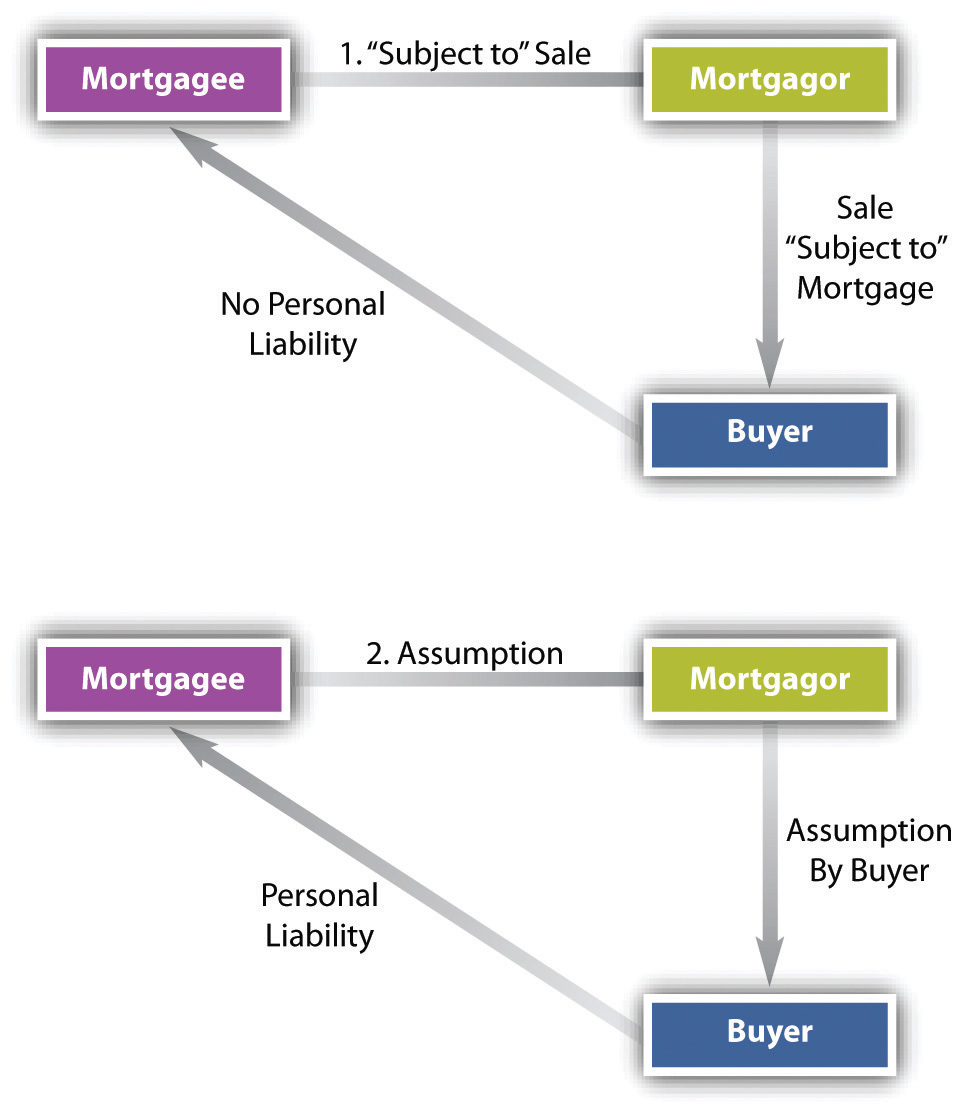

A home loan assumption allows you as the buyer to accept responsibility for an existing debt secured by a mortgage on the home you re buying.

Home loan assumptions. An assumable mortgage is very favorable if the mortgage carries an interest rate lower than today s rates. It s an avenue that some sellers can try if they don t want to go through the pain of surrendering their home to the bank i e. Interest rates and all other loan terms transfer to the buyer as is and this can be beneficial if the assumable mortgage comes with a comparatively low interest rate. Assuming a mortgage loan is not always as straightforward as it seems.

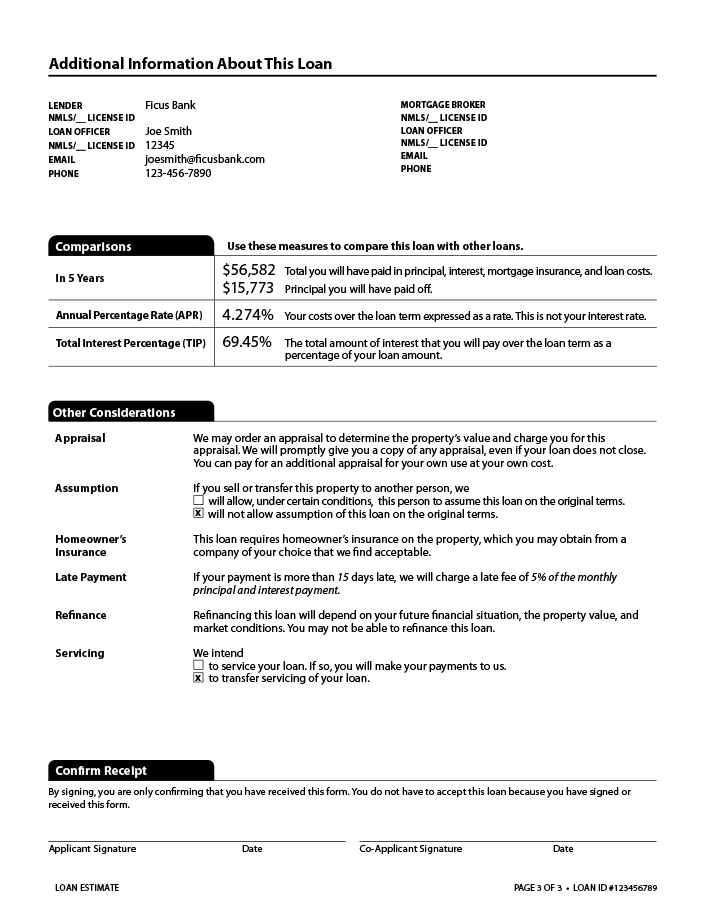

Not all loans allow for assumptions and if you can assume the loan it might not remove the other party s responsibility to pay back the loan if the loan goes into default. An assumable mortgage is an existing loan held by a homeowner who can transfer the loan to a buyer with the lender s approval when they sell. Mortgage assumption is the process of one borrower taking over or assuming another borrower s existing home loan. Loan assumptions can often be fully approved and documented in less than 30 days.

Mortgage assumption is the conveyance of the terms and balance of an existing mortgage to the purchaser of a financed property commonly requiring that the assuming party is qualified under lender or guarantor guidelines. Assumable mortgages may be hard to come by but they have the capacity to be worthwhile for many home buyers. One of the important things to note is that certain mortgage investors have policies prohibiting certain types of assumptions. A word of caution on mortgage assumption.

The two processes available to suit your needs are qualified assumptions and the name change and title transfer requests. A single point difference in interest rates could end up saving you thousands of dollars on interest payments throughout the life of the loan compared to taking out the same mortgage product at today s rising rate climate. Acquiring their original mortgage loan with the interest rate principal balance and repayment date intact in most cases. When you re assuming a loan the outstanding balance mortgage interest rate repayment period and other terms attached to that loan often don t change.

Fannie mae freddie mac fha va etc have to agree to your taking over the payments. All mortgages are potentially assumable though lenders may attempt to prevent assumption of a mortgage loan with a due on sale clause. With lower rates comes lower monthly mortgage payments. For an assumption to move forward both the lender and investor in the mortgage e g.