Home Insurance Premiums

The insurance premium is the amount of money paid to the insurance company for the insurance policy you are purchasing.

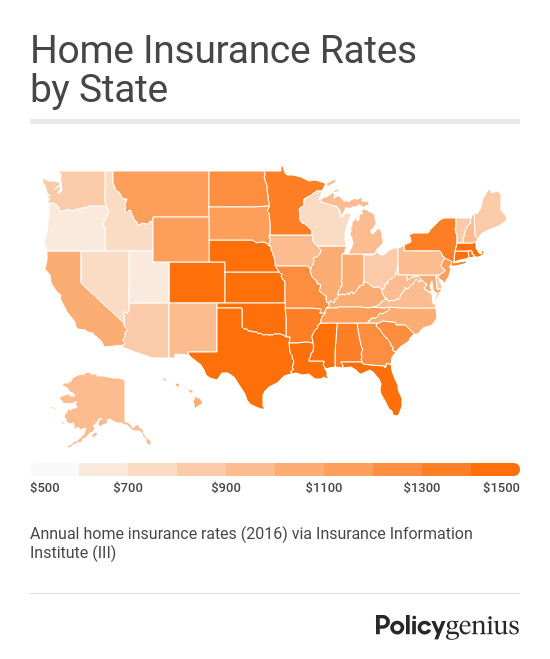

Home insurance premiums. And you want to be sure you buy enough protection to fully protect your home so it s wise to seek guidance to prevent your. In special cases however they might be wholly or partially tax deductible as a business expense. Insurance premiums are paid for policies that cover healthcare auto home and life insurance. Areas with higher rates of crime and extreme weather events are typically more expensive to insure.

Unlike health insurance which involves premiums deductibles copays and other out of pocket expenses the cost of homeowners insurance is a little more cut and dry you only pay premiums to keep your coverage active and a policy deductible on insurance claims. Purchasing a home can provide benefits to the owner but the investment must be protected with homeowner s insurance the premiums of this necessary insurance coverage like the property taxes charged by your local community are expenses that will continue as long as you own the structure. For instance if you are a landlord. Homeowners in texas new york and massachusetts have seen minimal increases after a single insurance claim.

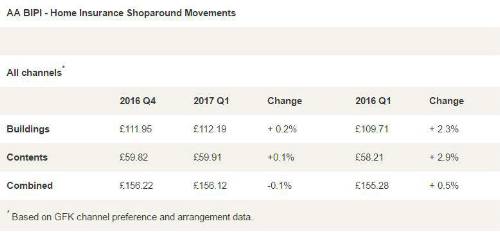

At the start of 2017 the typical cost of an annual combined buildings and contents policy sat at under 115. Home insurance premiums have hit their highest point since 2013 having risen steadily in the last few years. On average home insurance premiums will rise by 32 after a single insurance claim in wyoming. An insurance premium is the amount of money an individual or business must pay for an insurance policy.

That s why it s important to have as much detailed information as possible when planning the home insurance basics for your budget. But even your home s location within a region or city matters. Your insurance history where you live and other factors are used as part of the calculation to determine the insurance premium price. Homeowners insurance premiums are typically not tax deductible.

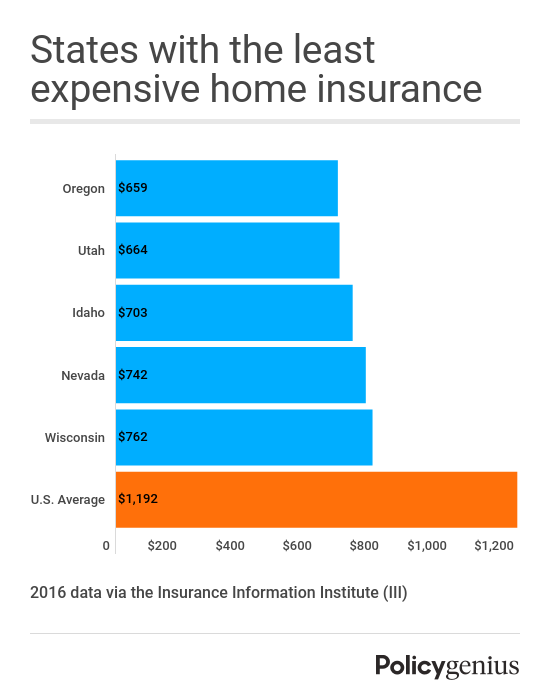

Average home insurance rates can vary a lot depending on where you live your deductible amount and the amount of coverage you need.