Harp Refinance Program Deadline

December 31 2018 features and benefits with harp a homeowner with a mortgage owned by fannie mae or freddie mac may be able to refinance into a more affordable mortgage.

Harp refinance program deadline. Homeowners that visit guide to lenders may find that they qualify for refinance or new home loan plans with incredibly low rates many homeowners don t yet know about a special government program named the home affordable refinance program harp. Updated on 08 16 16 05 01 00 pm. Your home loan must be backed by or owned by freddie mac or fannie mae. In order to be eligible to get in on the benefits of the harp program you must meet the following 5 criteria as well as act before the harp program is ended.

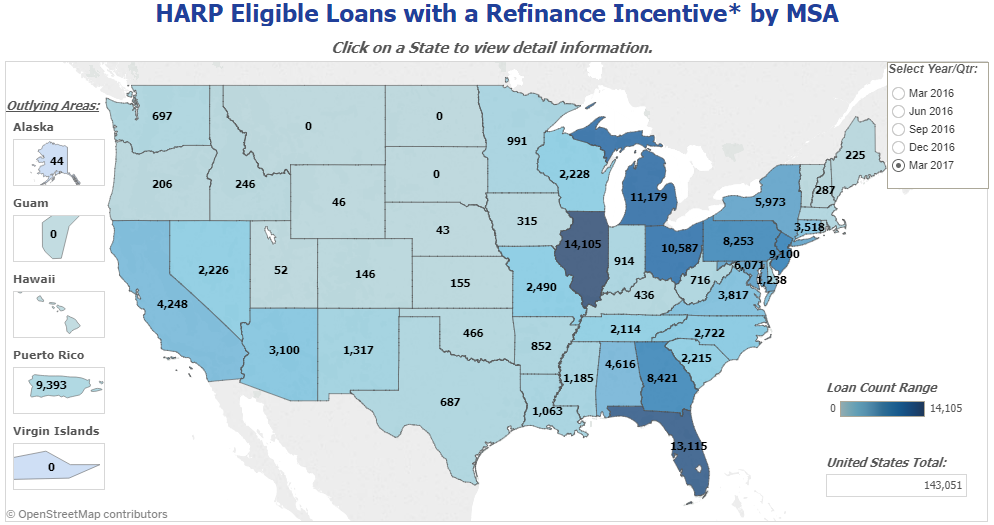

Fhfa announces new refi program. The application deadline for the home affordable refinance program harp was december 31 2018. Several changes in the way the program operates have made many more homeowners eligible. The home affordable refinance program harp is a federal program of the united states set up by the federal housing finance agency in march 2009 to help underwater and near underwater homeowners refinance their mortgages unlike the home affordable modification program hamp which assists homeowners who are in danger of foreclosure this program benefits homeowners whose mortgage payments.

Therefore you should try to get yourself refinanced immediately. An extended program deadline of september 30 2017. Harp program details harp program deadline this program will no longer be available after december 31 2018. The home affordability refinance program harp loan was started by the u s.

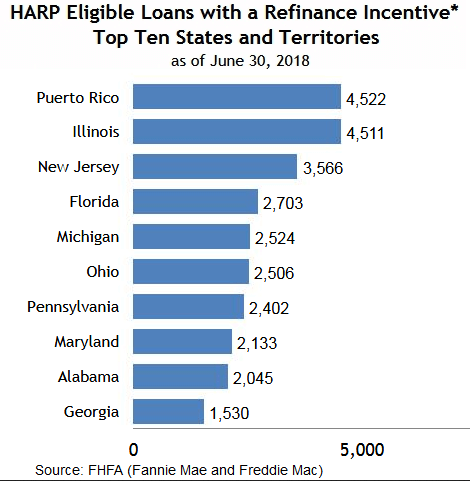

Harp targets borrowers with loan to value ltv ratios equal to or greater than 80 percent and who have limited delinquencies over the 12 months prior to refinancing. You can refinance under the harp program even if you are way under water. Government in 2009 to help out homeowners who had very little or no equity in their homes. Deadline for harp extended september 13 2016 by justin mchood the home affordable refinance program has been extended until september 30 2017 according to a recent report released by the federal housing finance agency.

Lenders are no longer accepting applications for harp. Histor y of harp. Introduced in march 2009 harp enables borrowers with little or no equity to refinance into more affordable mortgages without new or additional mortgage insurance. If you tried to refinance using harp in the past and failed now s the time to try again.

The 5 qualifying criteria for the harp program. The current ratio of your home loan to home value is more than 80. These are the basic harp qualification requirements. This program could benefit millions upon millions of.

No ltv limits it no longer matters how much you owe on your home. The home refinance plan banks don t want you knowing.