Gold Mining Stocks To Buy

That being said there are are also a small number of gold mining stocks i own due to their long records of good management which is a rarity in this industry.

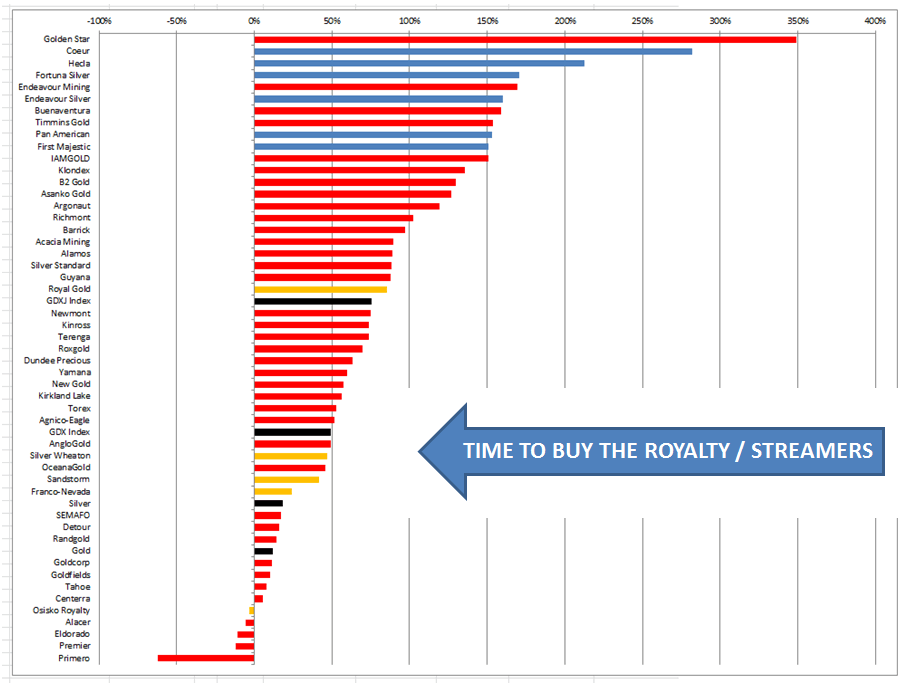

Gold mining stocks to buy. Many investors have gained exposure to the precious metal by buying stocks of companies engaged in exploration and mining. Factors such as effective management production costs reserves mine exploration and project development and hedging activities are some of the factors to consider when deciding whether to buy gold. I keep about 4 5 of my portfolio in gold stocks with a major focus on gold royalty and streaming companies. Within the ftse 100 and ftse 250 companies that mine gold include chile s antofagasta mexico based fresnillo.

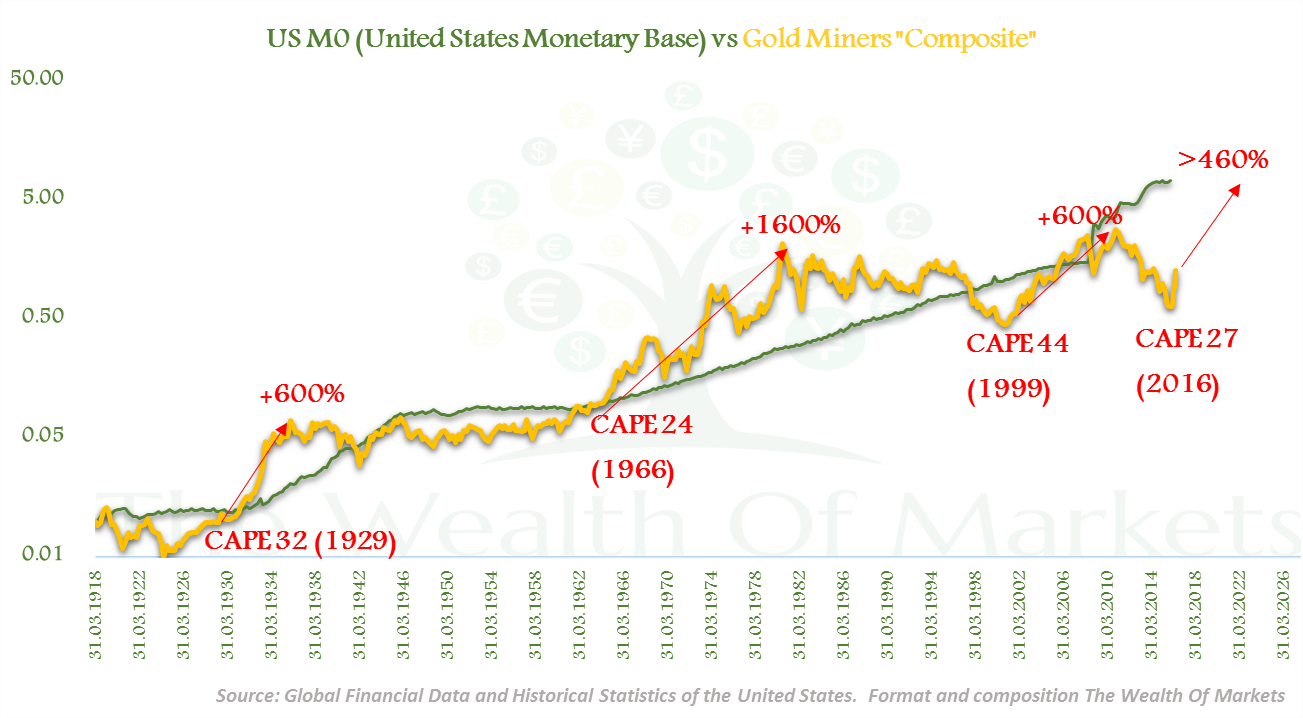

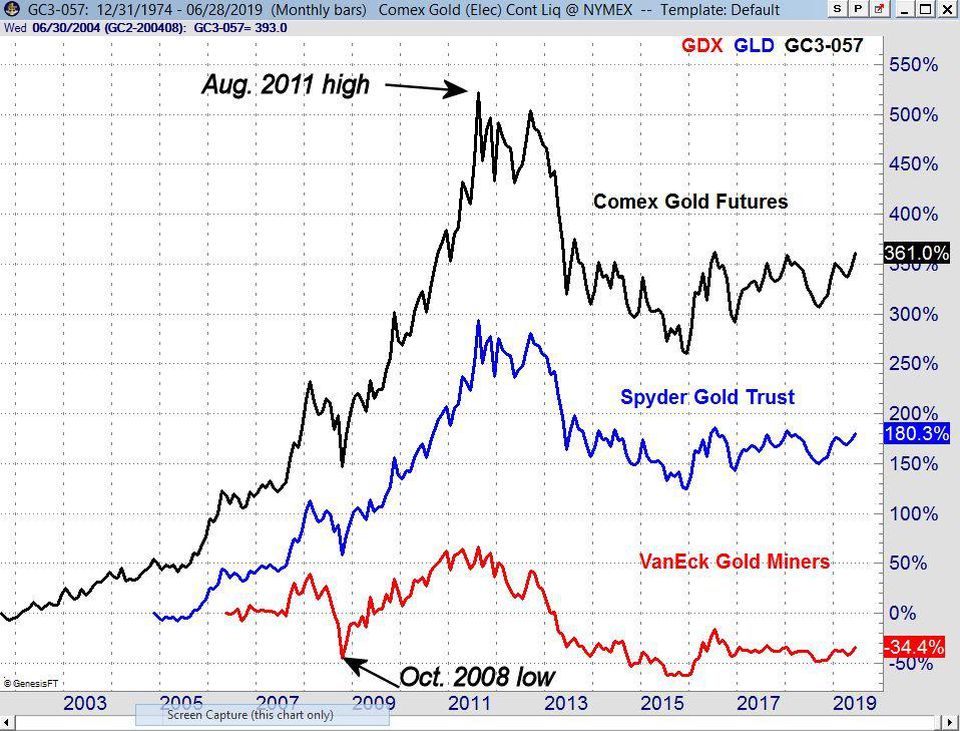

Exceptional leverage to higher gold prices. Buying a mutual fund eliminates the risk of making a poor investment choice buying a company with very high debt for example and limits your risk to broader factors that affect the entire industry. Learn to pick the best mining industry stocks. However the growth and return in the stock depend on the expected future earnings of the company not just on the value of gold.

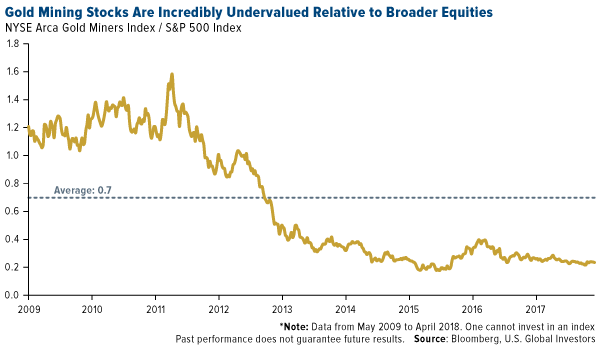

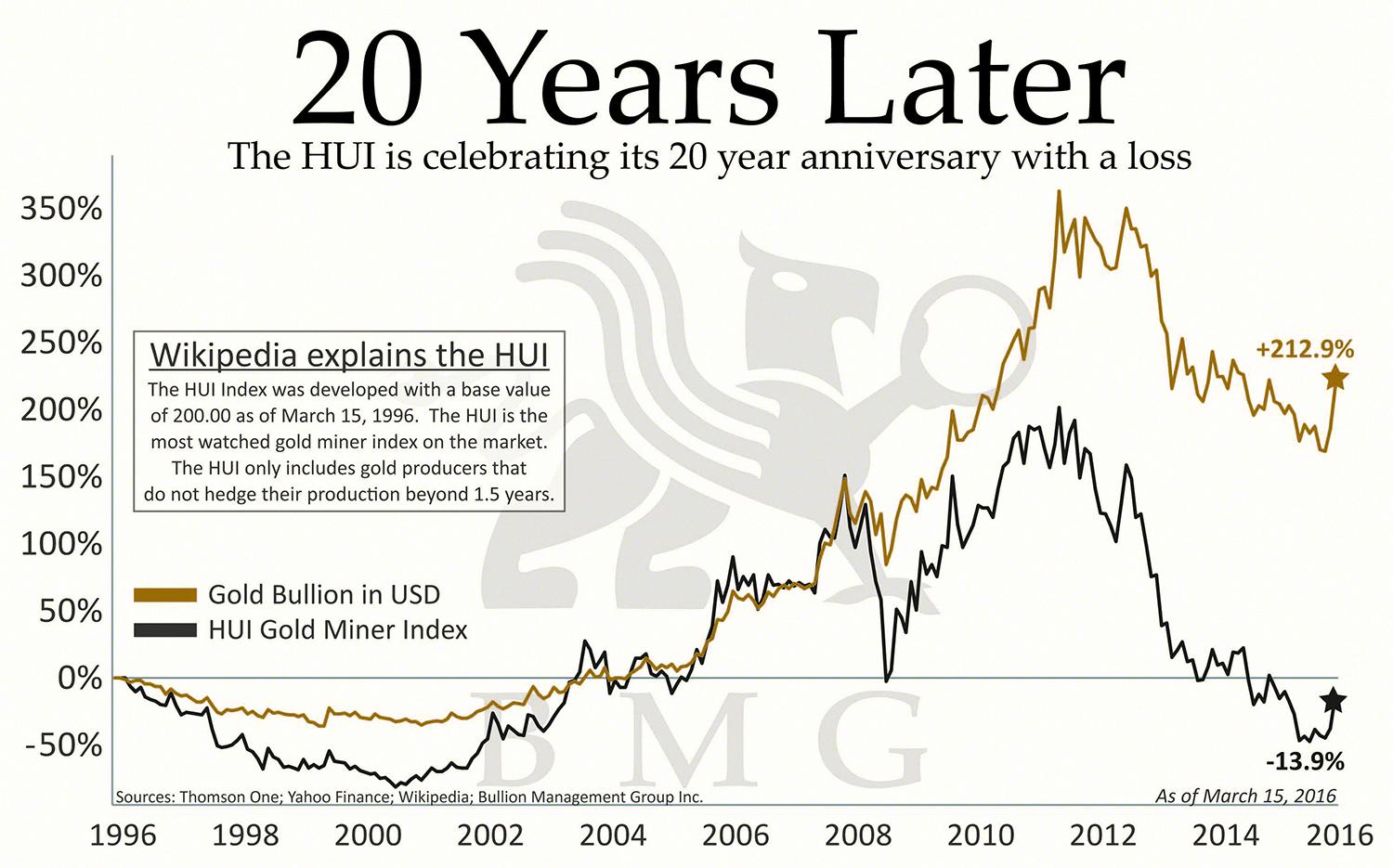

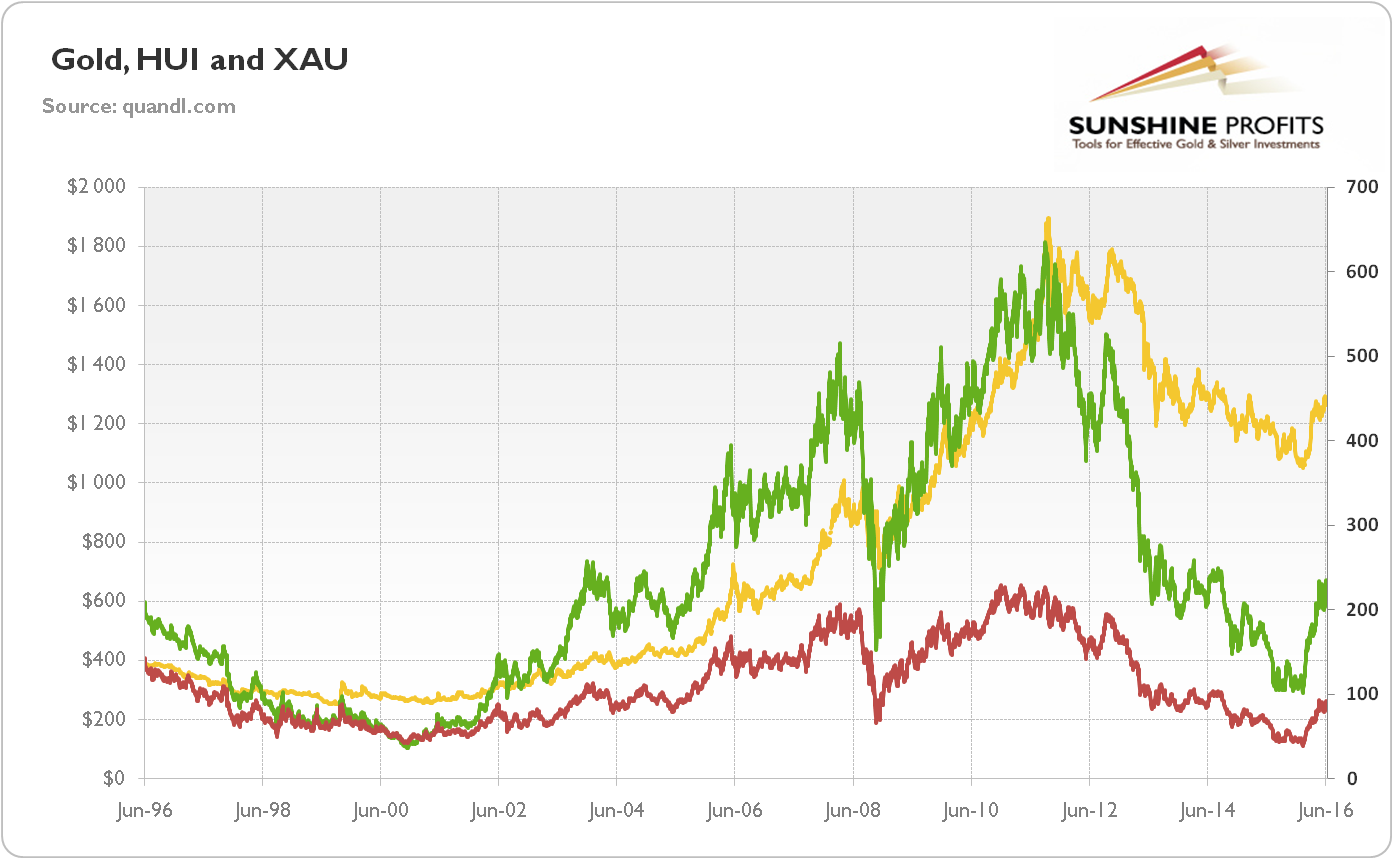

The main draw is that these companies offer the potential of leveraged upside to the price of gold. You can buy gold mining companies stocks. Top gold mining stocks. While gold mining stocks tend to move up and down together along with the price of gold there are large variations in performance depending on how efficient and well managed the companies are.

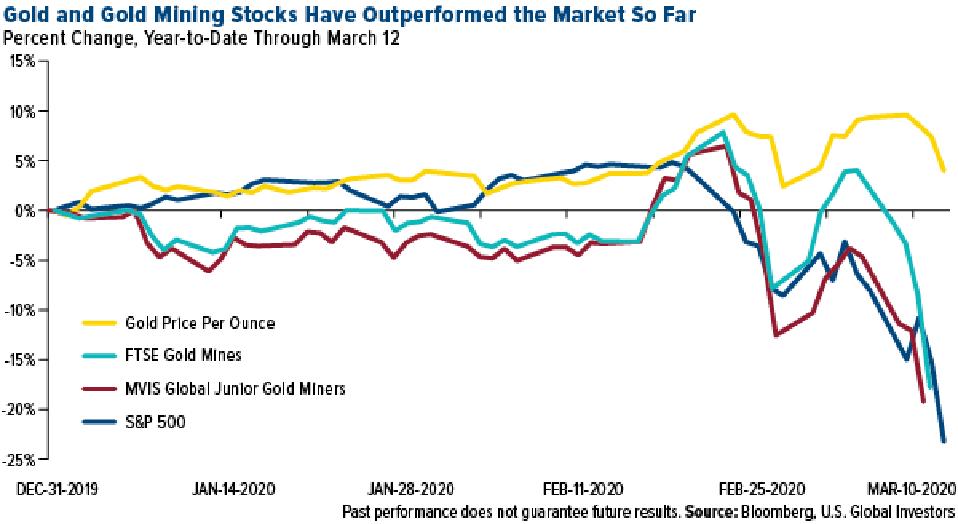

4 gold stocks i m buying in 2020. Gold has long been regarded as a safe haven in times of market turmoil. Quality properties with long life mines. There are many benefits to buying gold stocks instead of the physical metal.

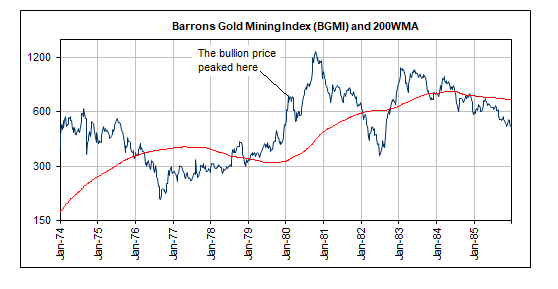

Gold mining company stocks may correlate with the gold price. My favorite risk reward gold mining stocks for 2020. Low valuations versus their upside potential.