Getting A Mortgage After Chapter 13 Discharge

You will need to wait at.

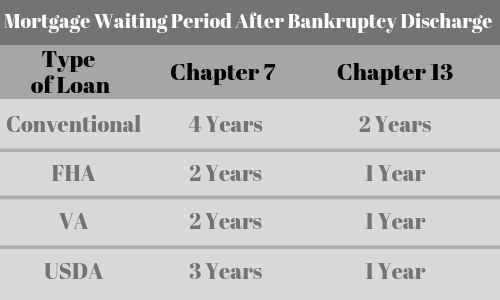

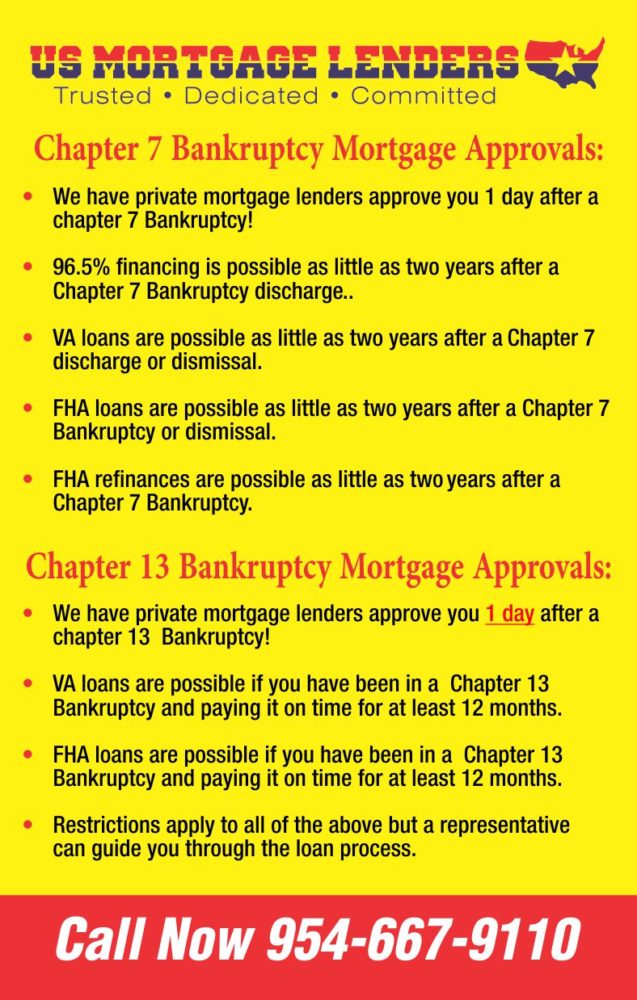

Getting a mortgage after chapter 13 discharge. As long as you ve waited long enough after your chapter 11 bankruptcy has been discharged you should be eligible to get a mortgage. Multiple bankruptcy filings if you have more than one filing within the past 7 years the waiting period is 5 years from the most recent discharge or 3 years with extenuating circumstances. Usda loan after bankruptcy. Here s what the handbook says about getting an fha loan after a chapter 13 filing.

The minimum down payment on fha loans is 3 5. In a chapter 7 bankruptcy filing your second mortgage probably won t be discharged which means you re still responsible for repaying it and the lender can foreclose on your home to get paid. Additionally you will need to provide the court trustee s written approval. Fha loans required a borrower to have a credit score of 500 or higher.

The waiting period for these chapter 13 bankruptcies is two years from the discharge date with a government sponsored mortgage. The usda rules are similar to the fha. Before you receive a discharge in chapter 13 bankruptcy you have to pay back a certain amount of your debts through a repayment plan. A chapter 13 bankruptcy allows for lien stripping which removes junior liens on your home.

Some banks may require a longer time to pass but many fha lenders will approve an application only after 2 years. You ll need to wait 24 months after receiving your discharge or 48 months after a dismissal cases often get dismissed for failing to complete a plan. Also keep in mind that the clock doesn t start upon filing but rather once the bankruptcy has been discharged. By jayne thompson updated july 18 2017 chapter 13 bankruptcy does not disqualify you from obtaining a mortgage but you ll need to build your credit score before refinancing.

A chapter 13 bankruptcy does not disqualify a borrower from obtaining an fha insured mortgage if at the time of case number assignment at least 12 months of the pay out period under the bankruptcy has elapsed. A severe illness or disability a company layoff or death of the. You d be eligible 24 months after the discharge or dismissal if the bankruptcy were beyond your control or after 48 months if the discharge was due to financial mismanagement. The waiting period is 2 years from discharge and 4 years from dismissal or 2 years from dismissal with extenuating circumstances.

But it isn t dependent on the total amount of debt that you owe. Rather your repayment plan amount depends on the type of debt you have the value of your property your income and your expenses. Below are some of the basic requirements to get an fha loan after a chapter 13 bankruptcy discharge.

/185321843-56a066573df78cafdaa16a2e.jpg)

/introduction-to-chapter-13-bankruptcy-0fc6cb64d60042ebacab9efb1e22d883.png)