Finance Companies That Buy Receivables From Businesses Are Called

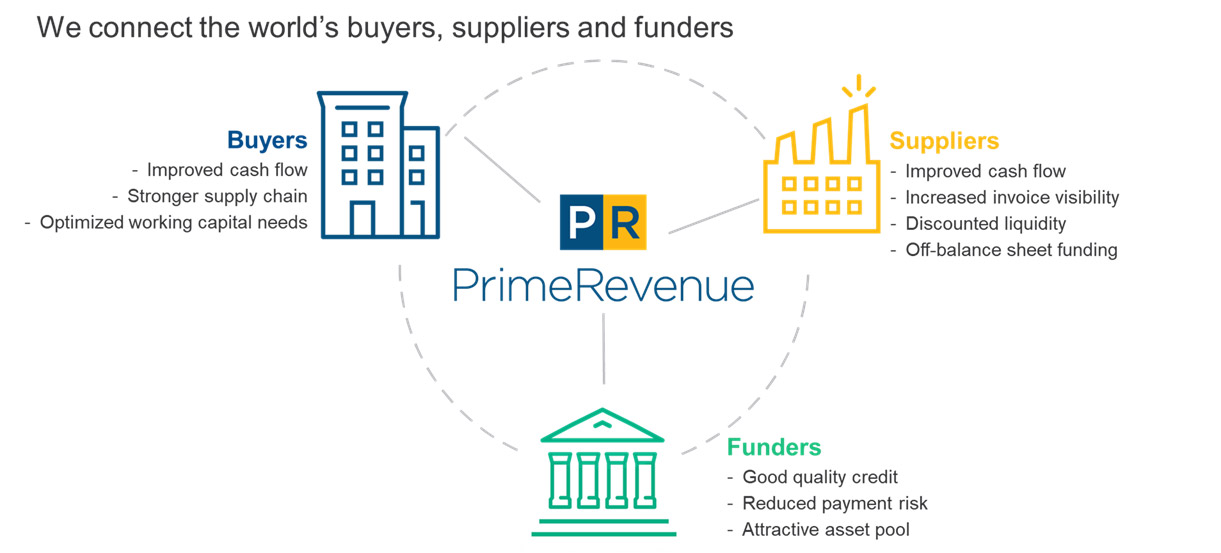

To a financing company that specializes in buying receivables called a factor at a discount.

Finance companies that buy receivables from businesses are called. Finance companies that buy receivables from businesses are called. Most finance companies buy your accounts receivable in two installments. If the company estimates that 8 of its outstanding receivables will be uncollectible. Bank of china assesses a finance charge of 1 percent of the.

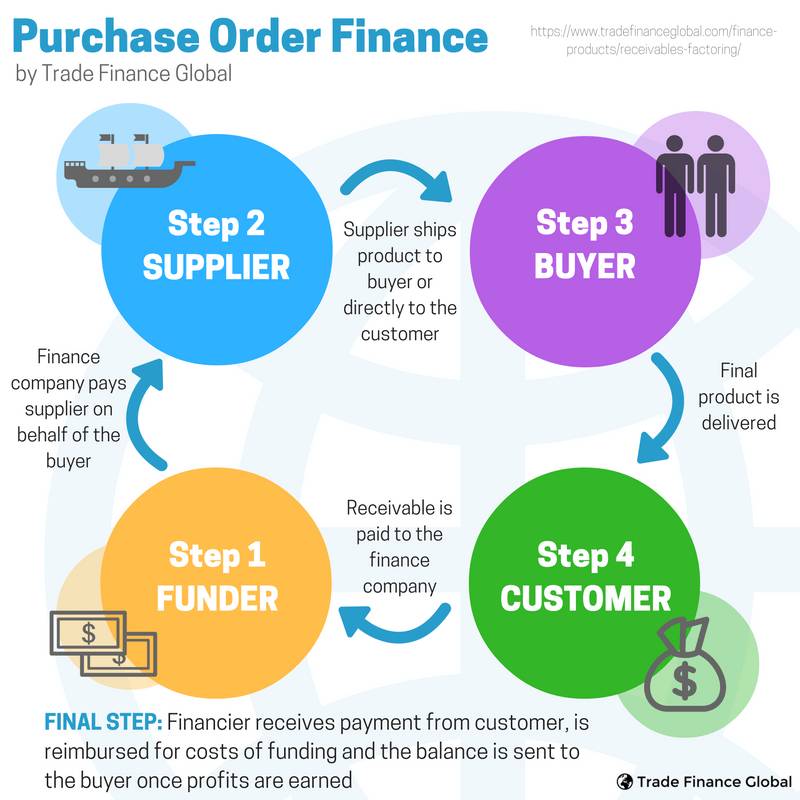

The buyer obviously cannot give you full value on your receivables because they don t know whether they will be able to collect and because it will take a good deal of time and money for them to check credit on all your customers and to run the. It is very useful if a timing mismatch exists between the cash inflows and outflows of the business. Ar financing can take various forms but the three major types are. Companies allow their clients to pay at a reasonable extended period of time provided that the terms are agreed upon.

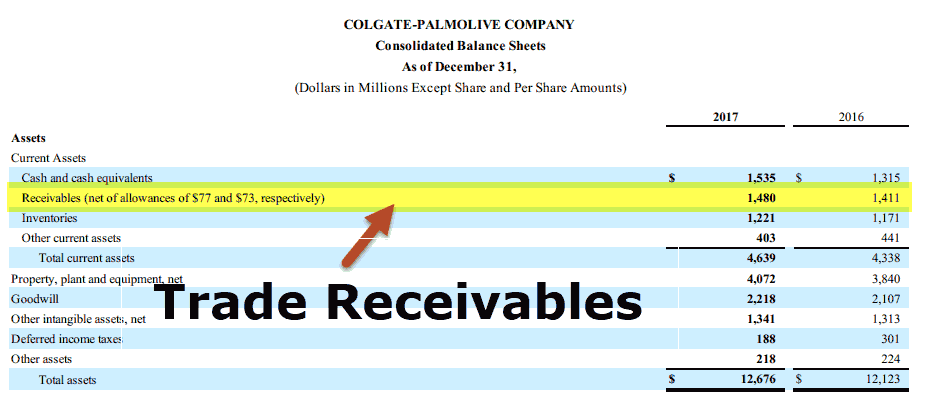

What is the net realizable value of the receivables reported on the financial statements at december 31 2014. Finance companies that buy receivables from businesses are called. Overall buying the assets from a company transfers the default risk associated with the accounts receivables to the financing company which factoring companies seek to minimize. It covers 70 90 of the gross value of your invoices.

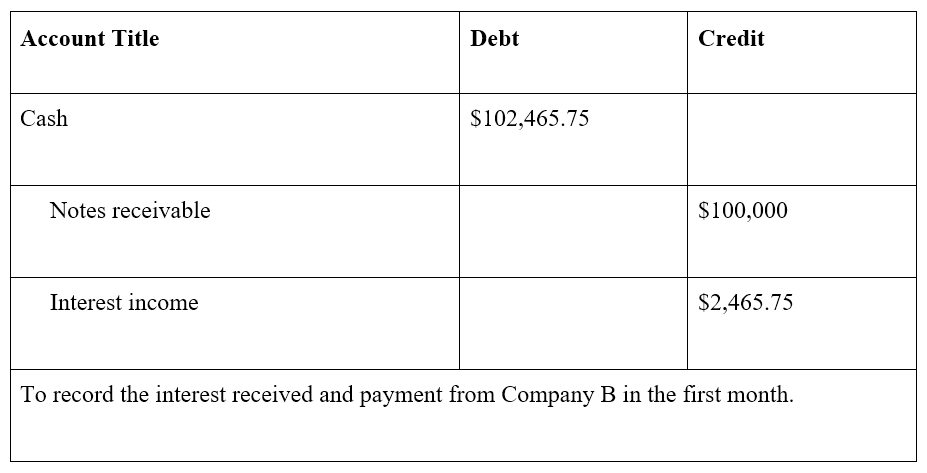

Factors buy other companies receivables for a fee. The advance is wired to your bank account shortly after you sell your invoices to the factoring company. The advance and the rebate. Bank of china assesses a finance charge of 1 percent of the accounts receivable and interest on the note of 12 percent.

Factoring enables a business to change over its receivables promptly into money as opposed to sitting tight for due dates of installment by clients. They make their money by knowing the value of receivables and being good at collecting on them. On march 1 2014 beijing pasta company assigns 1 400 000 of its accounts receivable to bank of china as collateral for a 1 000 000 note. Finance companies that buy receivables from businesses are called factoring receivables.

Usually it s done online through a website or by email through a document called a schedule of accounts the schedule of accounts lists the details of the invoices that you are selling to the factoring company. The process of selling your receivables to a finance company is straightforward. On march 1 2014 beijing pasta company assigns 1 400 000 of its accounts receivable to bank of china as collateral for a 1 000 000 note. Accounts receivable financing is a means of short term funding that a business can draw on using its receivables.

Buying the first batch of receivables. The actual purchase of the accounts receivable is relatively simple.

:max_bytes(150000):strip_icc()/dotdash_Final_How_should_investors_interpret_accounts_receivable_information_on_a_companys_balance_sheet_Apr_2020-01-93d387c085e04ab4bf99fa38dcdfd48d.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)