Factoring Receivables

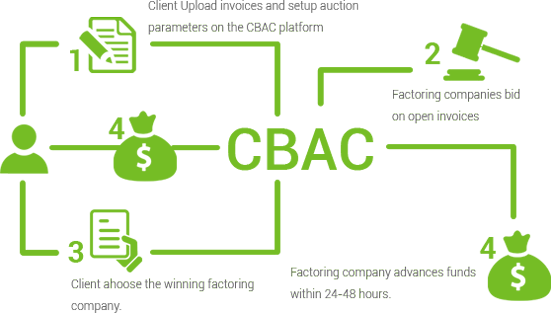

The factor collects payment on the receivables from the company s.

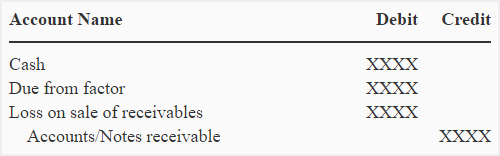

Factoring receivables. Factoring receivables is the sale of accounts receivable for working capital purposes. When a business sells products and services to a customer on account the goods are delivered and the sales invoice is created but the customer does not have to pay until the invoice due date. When they collect the invoice the lender pays the remaining 20. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their.

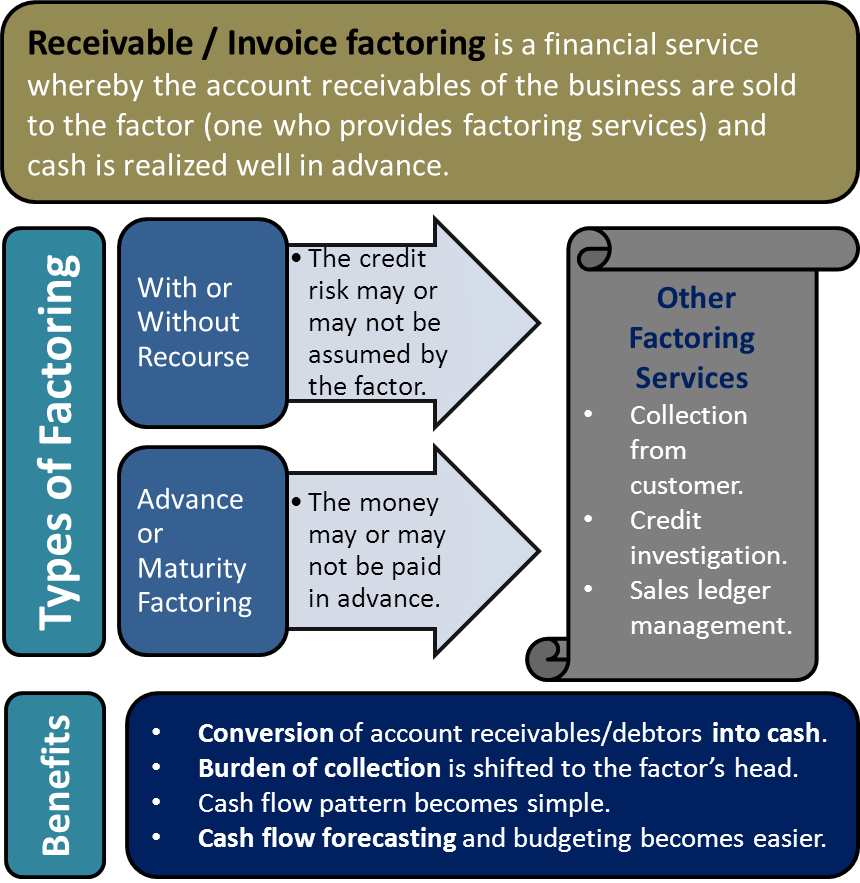

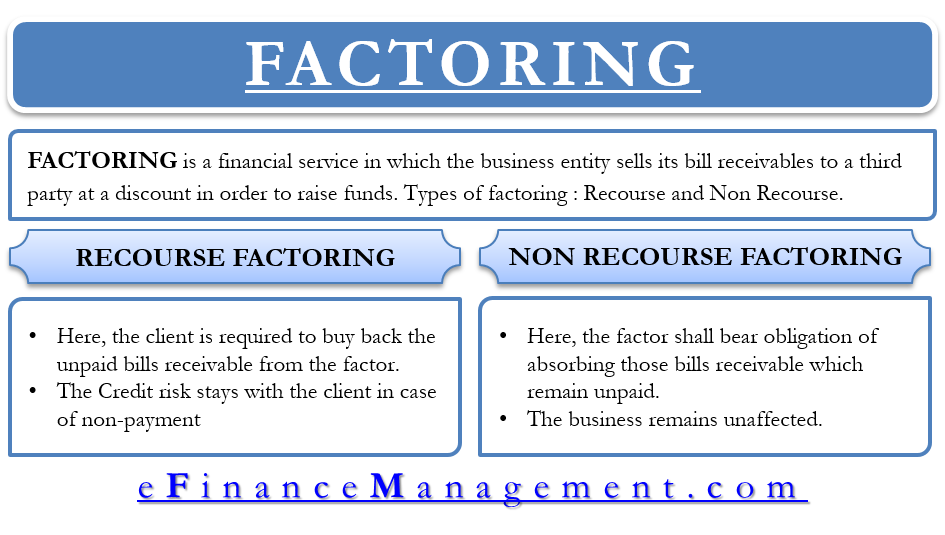

A company will receive an initial advance usually around 80 of the amount of an invoice when the invoice is purchased by the lender. Accounts receivable factoring is also known as invoice factoring or accounts receivable financing. Under this invoice factoring arrangement only early payment of invoices is provided by the accounts receivables factoring companies in return for factor fees to the business. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount.

That s why even when a business hits a rough patch or has a bad year a receivables financing company can continue to stand strong and be a reliable source of capital. Factoring companies are more concerned with the creditworthiness of a client s customers and not just on the strength of the client itself. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. Factoring is the selling of accounts receivables to a third party to raise cash.