Factoring Receivables Companies

Not the whole book.

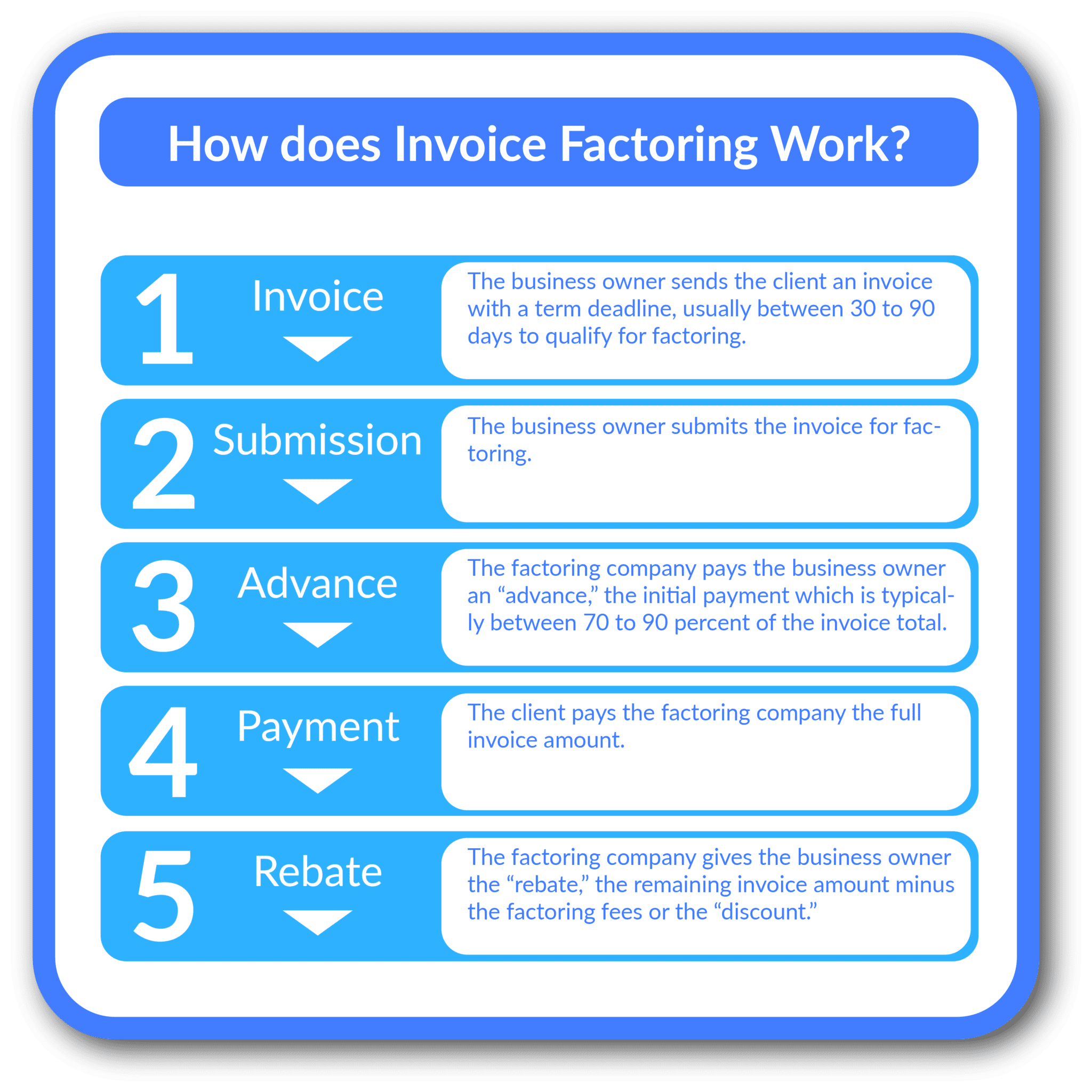

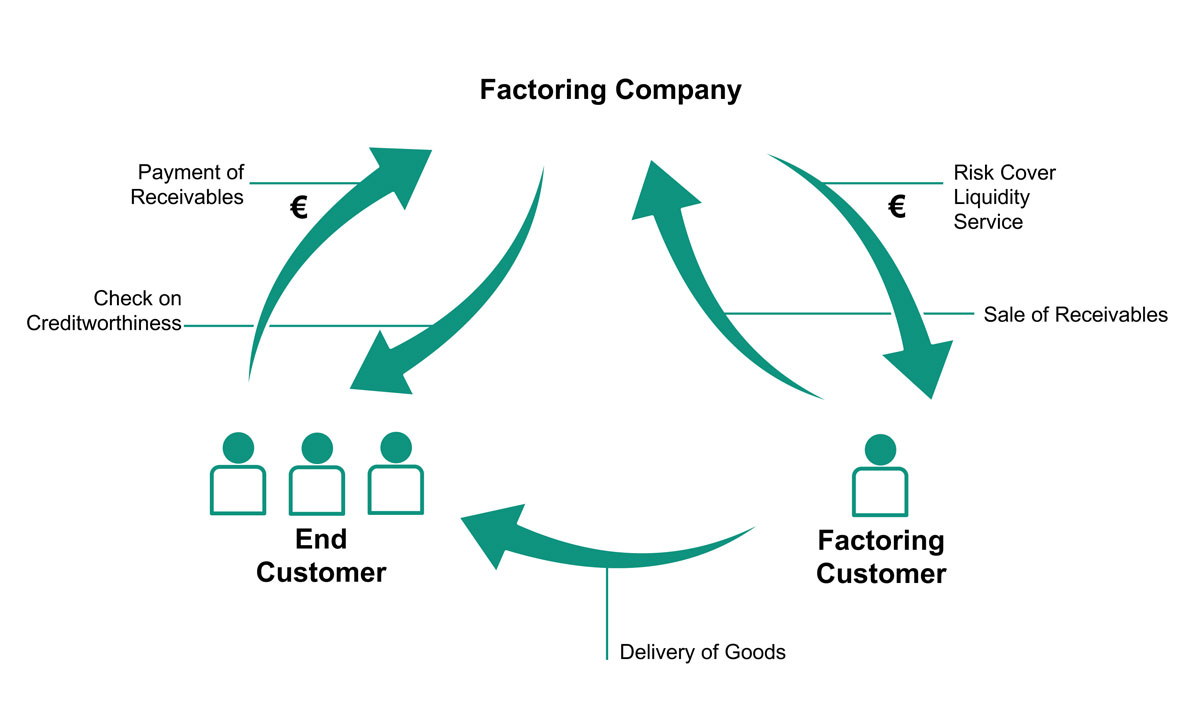

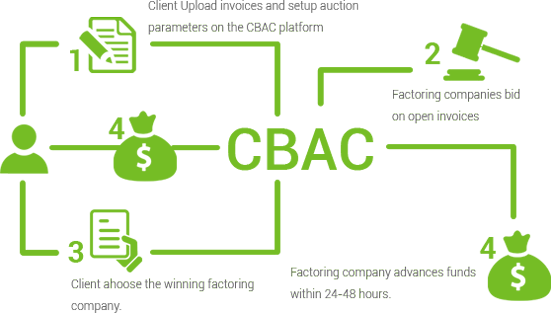

Factoring receivables companies. Typically this will entail an in person meeting to review why the company is in need of factoring as well as the provision of a company s financial statements and supporting schedules such as receivables and payables aging schedules to document its operating. After you deliver a product or service to your client you send them an invoice. Factoring uses an intermediary a factoring company to buy your invoices and advance you money against them. So when you sell your accounts receivables to a third party factoring company the discounted purchase price gets calculated using what s known as a factor rate.

However these companies easily qualify for factoring. An example of accounts receivables factoring. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. The first step in receiving factoring financing is to be pre qualified by a factoring company or a bank s factoring department.

With new companies being added on a regular basis factoring directory is your go to resource for all things related to factoring from conducting searches to learning about how factoring accounts receivables works. Receivables or invoice discounting will conversely mean that individual invoices are discounted and this may be selective invoices or customers of a company. And let s say the factor rate is 3. Factor king is a direct financial service provider that specializes in the factoring of invoice receivables for companies that maintain commercial accounts receivables.

With recourse factoring the company selling its receivables still has some liability to the factoring company if some of the receivables prove uncollectable. Simply put the only criteria is that your receivables be from other businesses. Our quick and easy approval process makes dealing with factor king a pleasure from the very beginning. Overall buying the assets from a company transfers the default risk associated with the accounts receivables to the financing company which factoring companies seek to minimize.

Because top factoring companies like tci business capital have experience in a number of industries companies can gain insight and information on industry best practices and current trends. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. Receivables factoring is a term used interchangeably with invoice factoring.

In effect it is when the whole ledger of invoices or debts are factored. Let s say you sold 20 000 of outstanding receivables. There are also situations where factoring receivables is a better choice than bank financing.