Factoring Company

We re dedicated to helping small business owners just like you secure the funding necessary for growth.

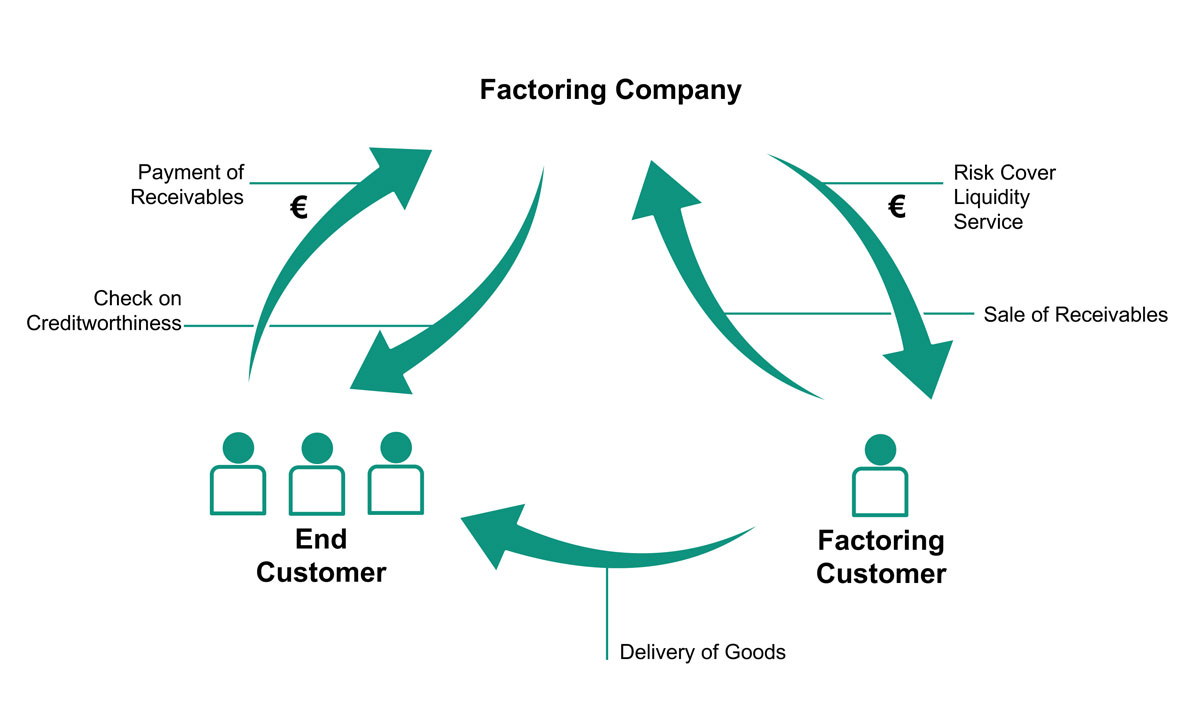

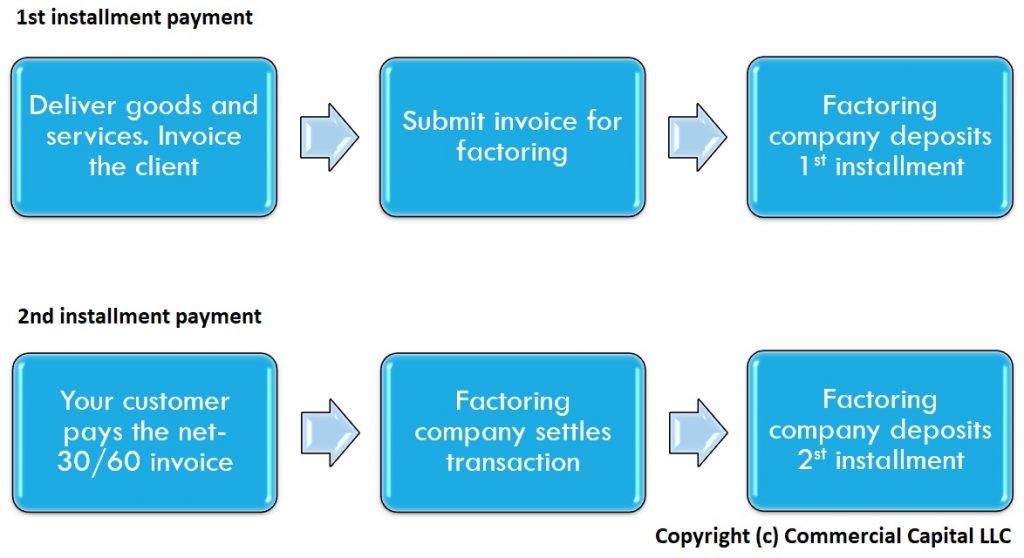

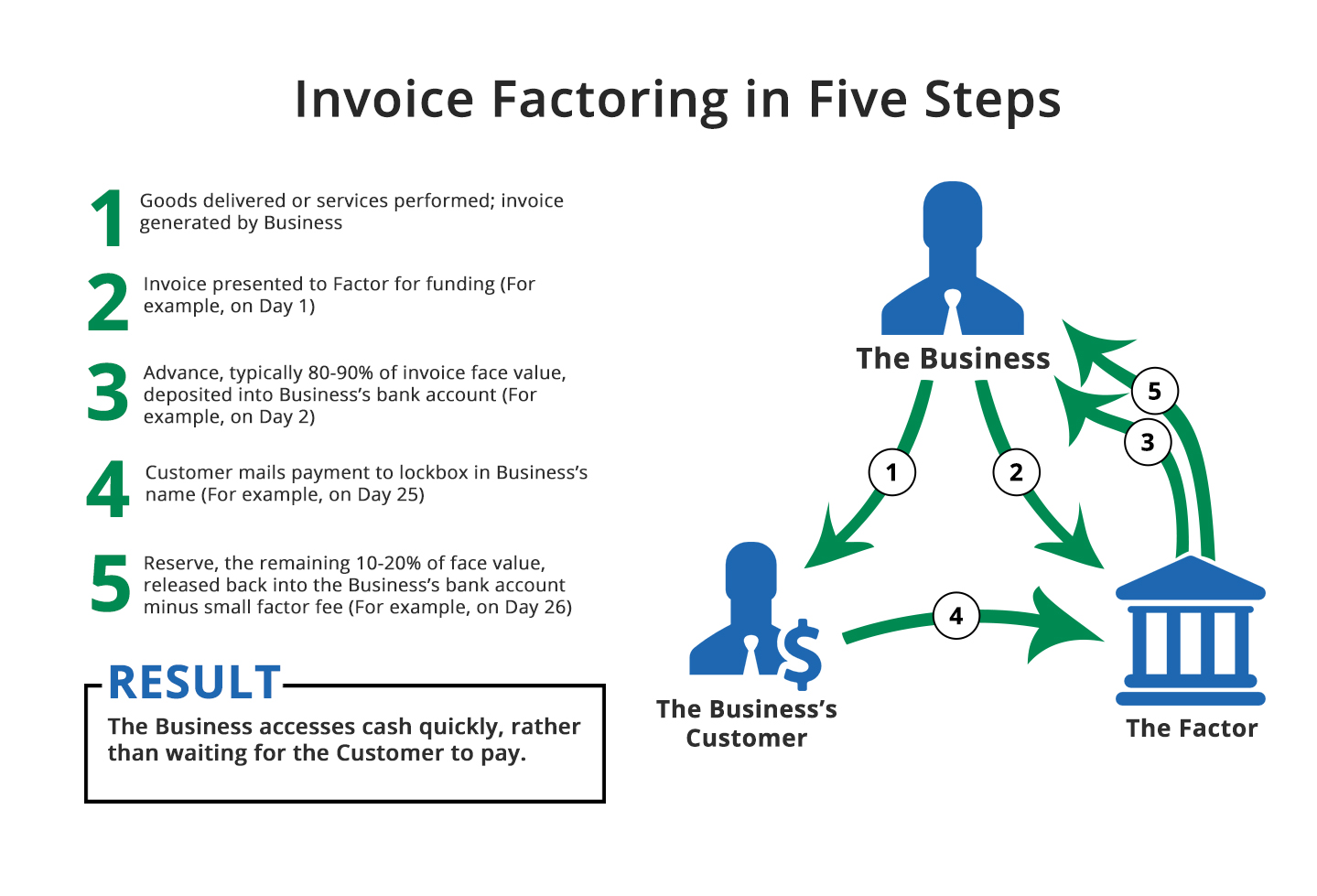

Factoring company. Instead they purchase the accounts receivable from their clients at a small discount. Factoring companies typically advance 70 90 percent of the invoice value up front. A factoring company specializes in financing invoices from businesses that have cash flow problems due to slow paying customers. What is a factoring company.

You usually receive payment for those invoices within 24 hours. The factoring company then collects payment on those invoices from your customers. Factoring is sometimes referred to as accounts receivable financing. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

Factoring is commonly referred to as accounts receivable factoring invoice factoring and. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their receivables to a forfaiter. Invoice factoring is a financial transaction in which a business sells its accounts receivables invoices at a discount to an external financing company known as a factor or factoring company. Factoring companies can get you other types of financing programs such as unsecured business loans purchase order financing merchant cash advances payroll funding and more.

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable to a third party at a discount. Factors don t lend money. Factoring is when a factoring company purchases your open invoices.