Factor Receivables

A factor is an intermediary agent that provides cash or financing to companies by purchasing their accounts receivables.

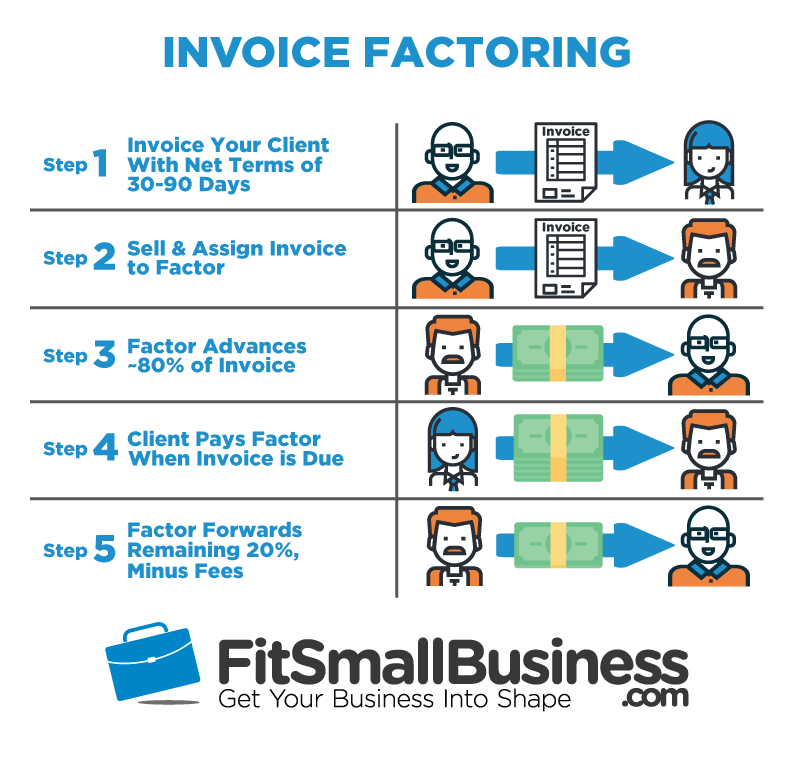

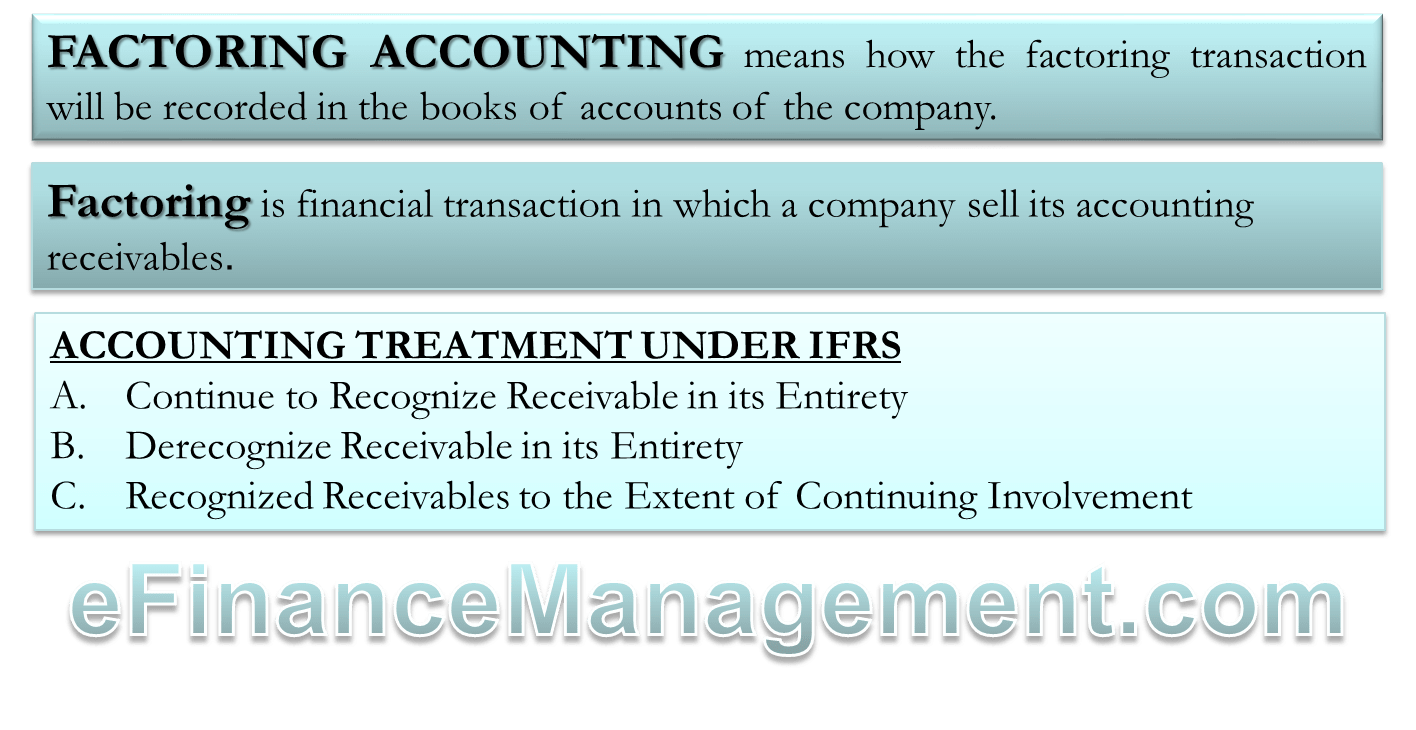

Factor receivables. Then the factor is paid by your customer. Companies choose factoring if they want to receive cash quickly rather than waiting for the duration of the credit terms effective annual interest rate the effective annual rate ear is the interest rate that is adjusted for compounding over a given period. With recourse journal entries when the invoices are factored with recourse the business will bear the loss if the customer does not pay the factor. The receivables factoring company pays the business owner you up to 97 of the value immediately.

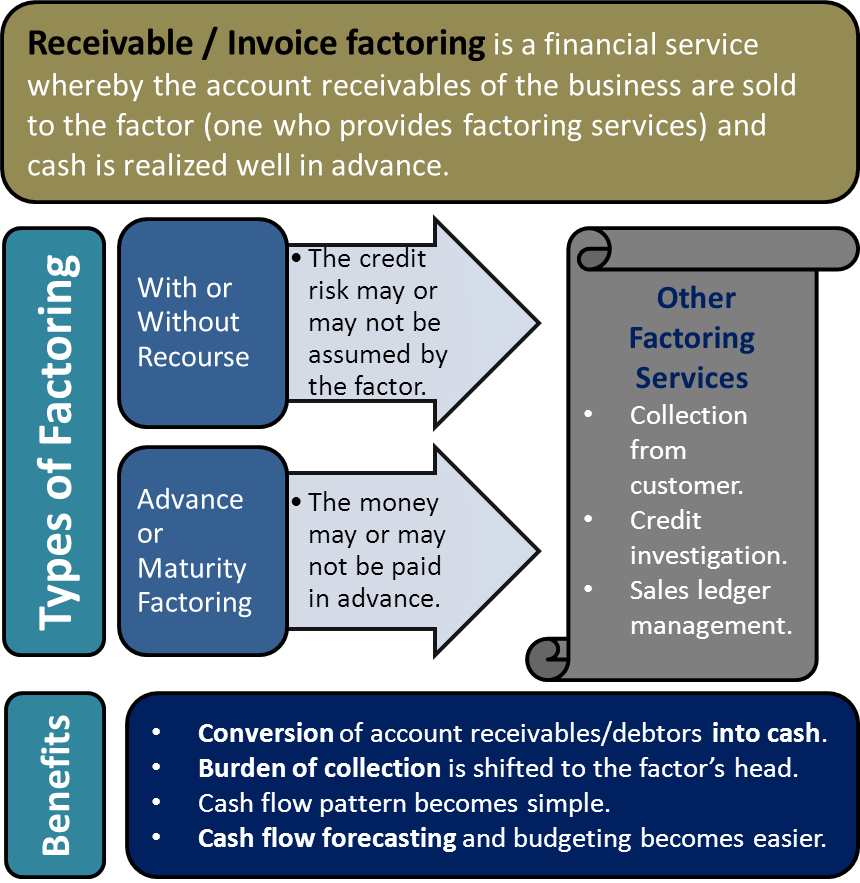

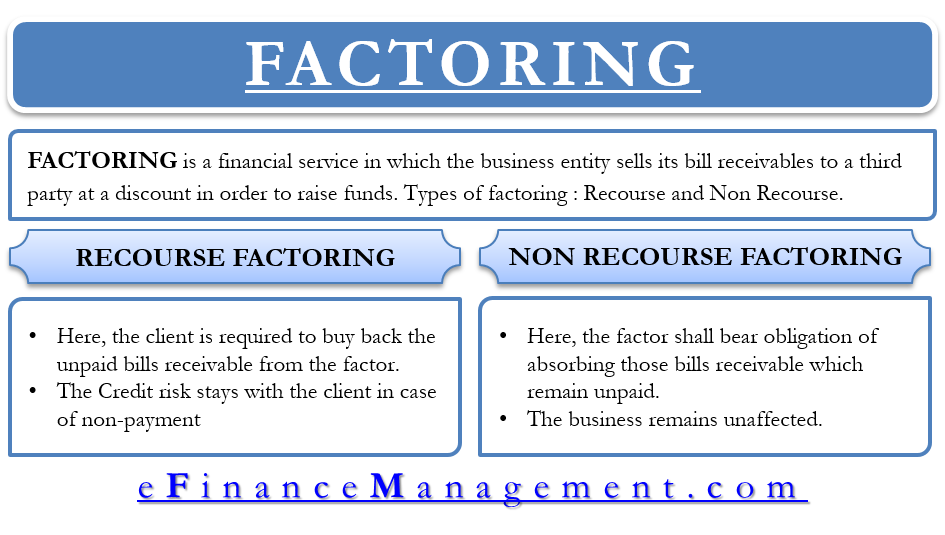

The factor then takes over the receivables along with all relevant records and pays the cash to the seller after deducting the agreed fee. Sometimes the factor s charges paid by the seller the factor s client covers a discount fee additional credit risk the factor must assume and other services provided. Factoring receivables is the sale of accounts receivable for working capital purposes. The factor takes all responsibility for analyzing the creditworthiness of the customer collection of payment on the due date and also and credit loss arising on account of nonpayment by the customer credit risk is transferred from the business to the accounts receivables factoring companies.

Also known as accounts receivable financing factoring is a transaction which involves selling receivables to a factoring company. The factor s holdback receivable amount to cover merchandise returns and e any additional loss or gain the seller must attribute to the sale of the receivables. A company will receive an initial advance usually around 80 of the amount of an invoice when the invoice is purchased by the lender. In addition to this fee the factor may also retain a small percentage of receivables for probable adjustment for discounts returns and allowances.

The factor collects payment on the receivables from the company s customers.