Expected Rate Of Return On Roth Ira

These investment accounts offer tax free income when you retire.

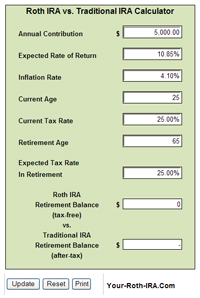

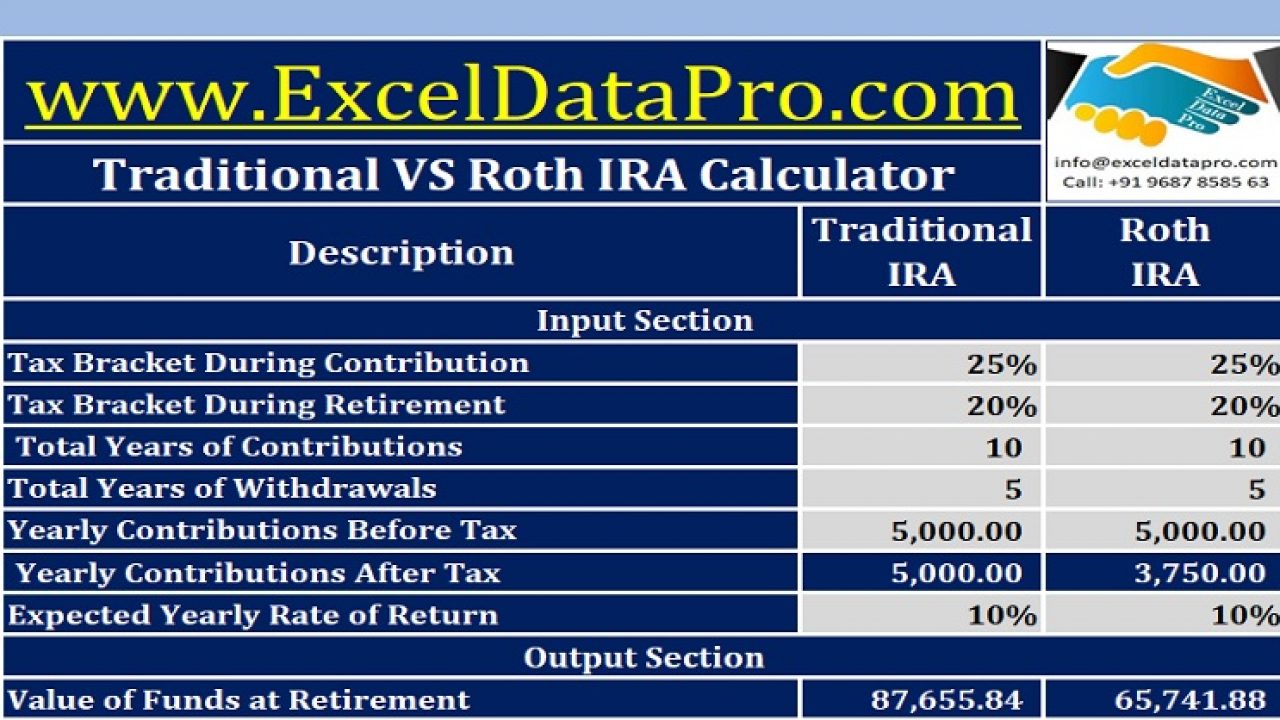

Expected rate of return on roth ira. Roth ira calculator rate of return. Average roth ira returns. This calculator assumes that your return is compounded annually and your contributions are made at the beginning of each year. Smart investments can see much higher roth ira return rates when given ample time to grow.

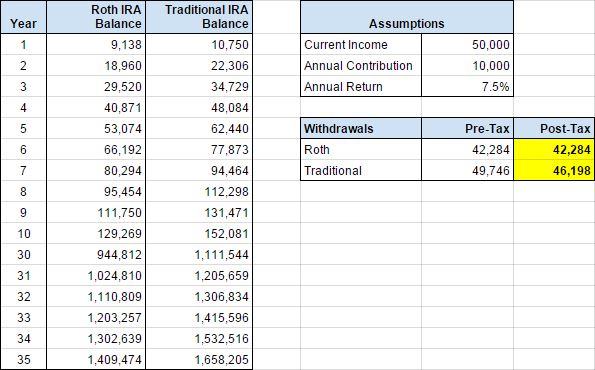

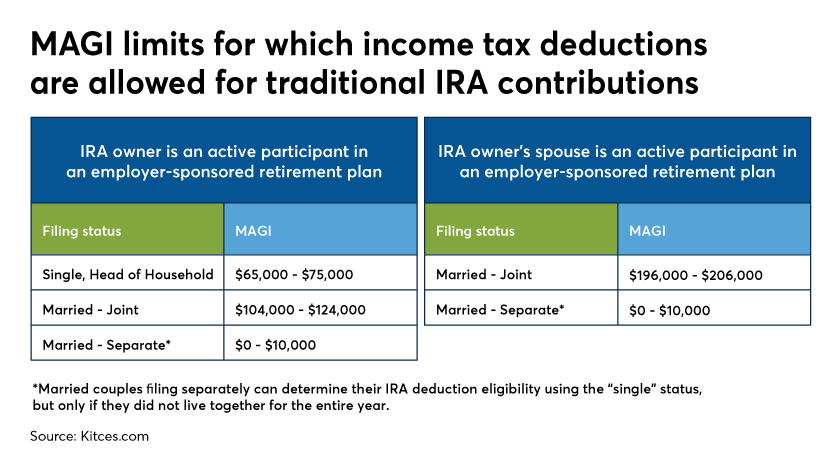

To find the overall rate of return for your portfolio divide your return in dollars by your original investment. Roth ira certificates of. A roth ira is a type of individual retirement account that allows you to invest after tax money each year and to withdraw both money and earnings tax free from. Find the best roth ira rates.

Here s what to know about roth ira interest rates. A self directed individual retirement account sdira. You get an automatic 100 return on part of the money you invest in your 401. The return on your roth ira is determined by the investments you choose not a set interest rate.

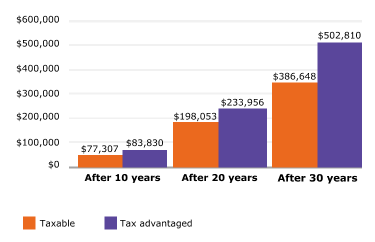

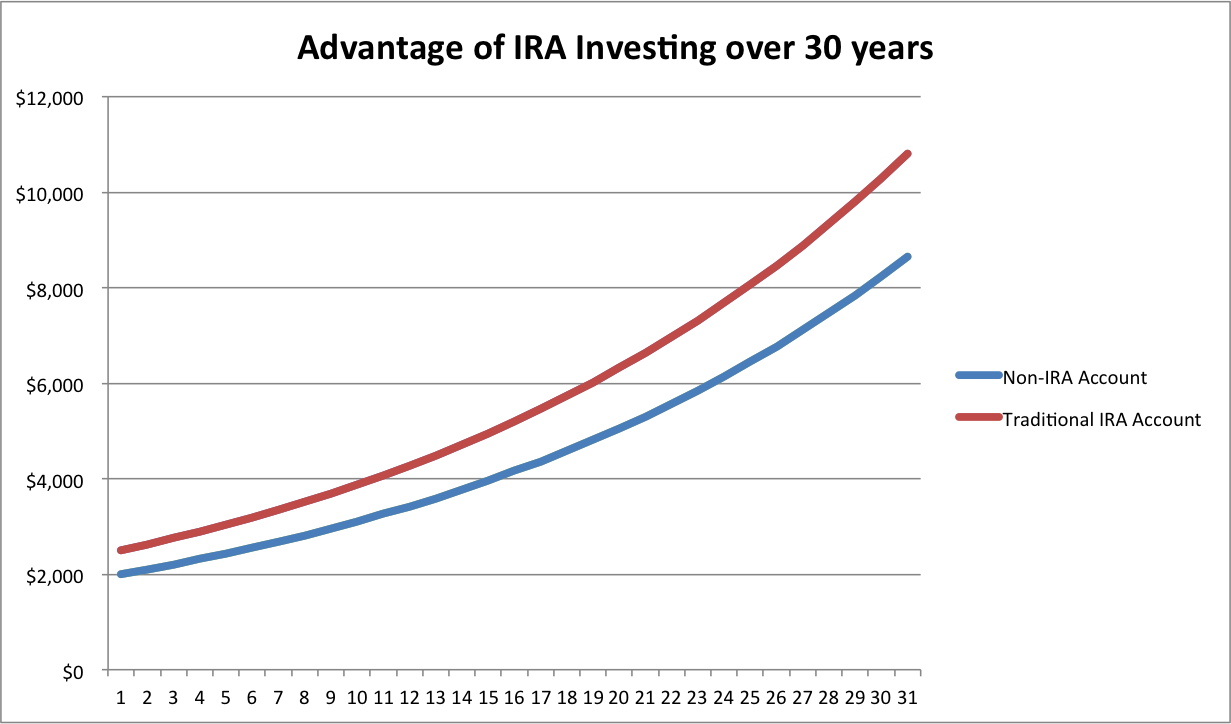

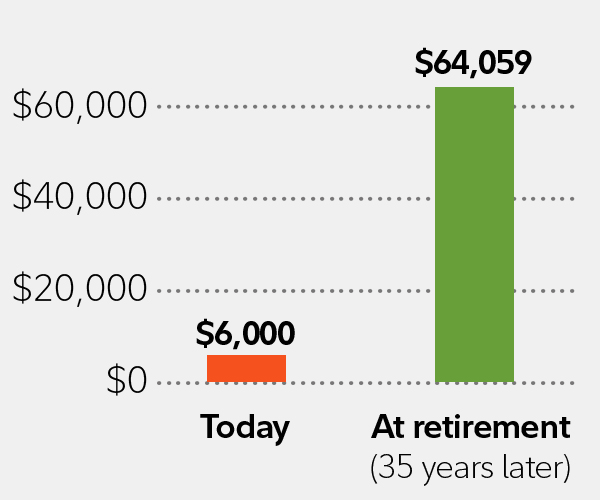

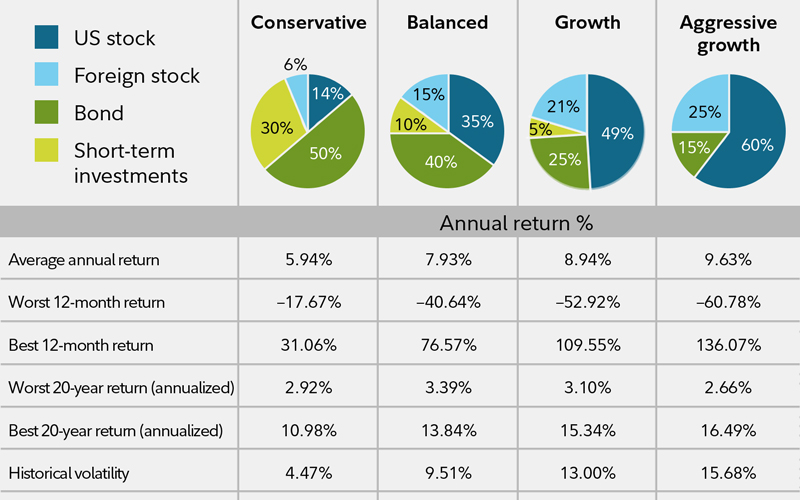

Planning for retirement with a roth ira is a great way to take advantage of tax advantages provided by the irs. A roth ira which i ve dubbed america s greatest retirement tool at an average rate of return of 7 which is the long term return rate for the expected rate of return the annual rate of return for your ira. For our example your return is 0 588 or 5 88 294 5 000. That said roth ira accounts have historically delivered between 7 and 10 average annual returns.

The average rate of return on stocks depends on the size of the company you choose to invest in. A roth ira is a smart way to grow your savings for the future. Of course any return you see on a roth ira account depends on the. According to january 2011 data provided by new york university large company stock such as ibm and apple computer have earned an average annual rate of return of 11 31 percent since 1928.

Let s say you open a roth ira and contribute the maximum amount each year.