Eo Insurance Coverage

E o insurance has exclusions that limit the scope of its coverage.

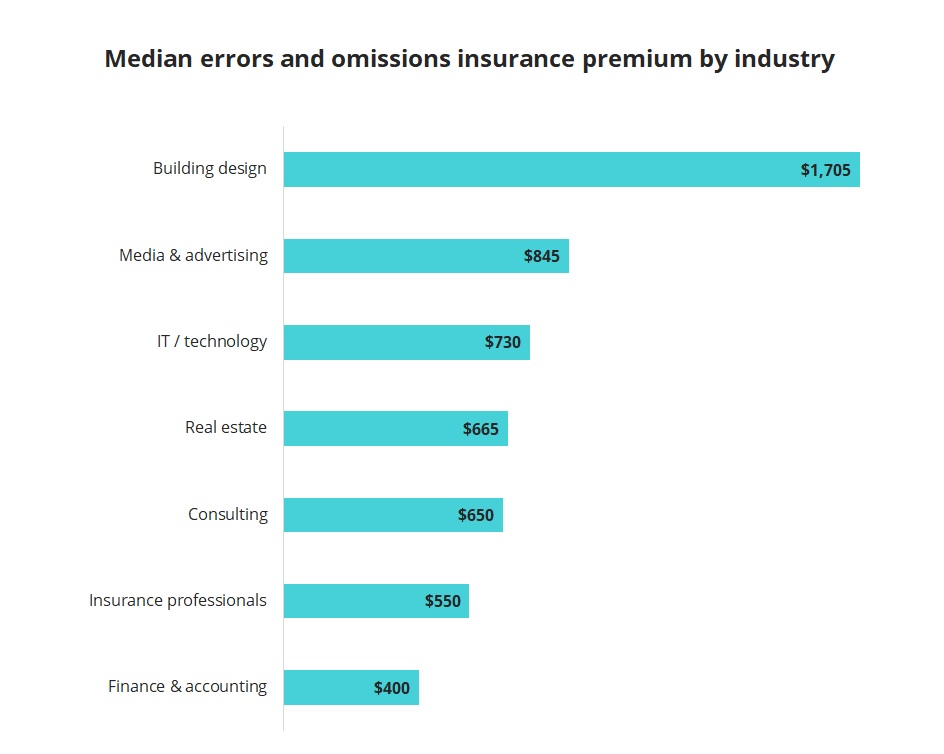

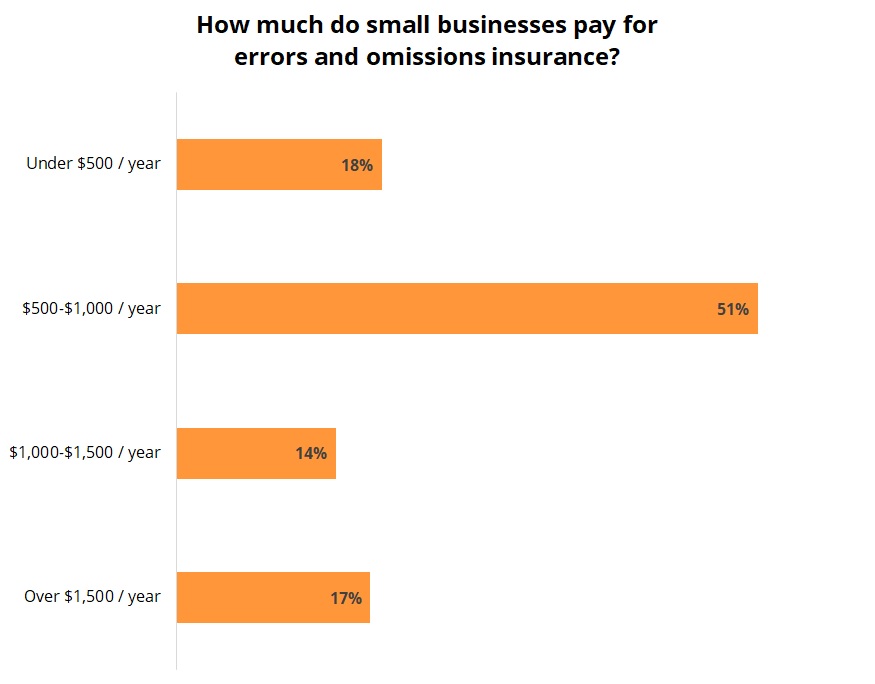

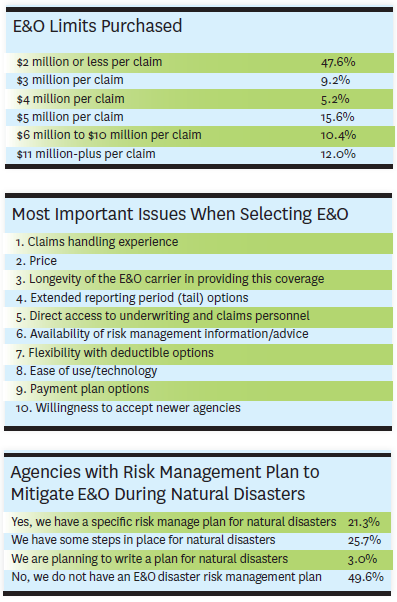

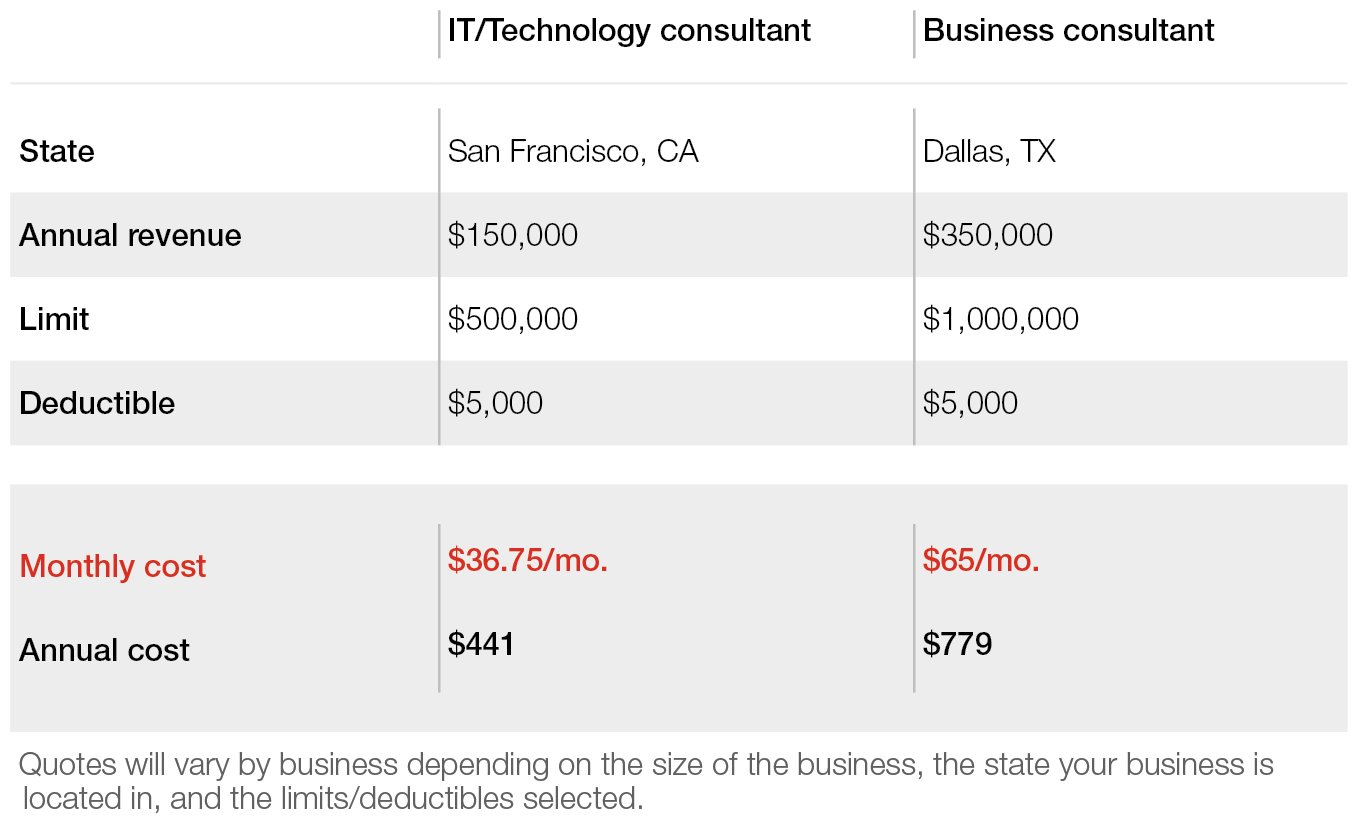

Eo insurance coverage. Failing to provide insurance and misrepresenting one s products cause big e o headaches for p c and life and health agents respectively. When it comes down to it errors and omissions insurance can be expensive on average small businesses pay anywhere from 500 to 1 000 per year about 42 to 83 per month for this type of coverage 1. Directors and officers coverage and errors and omissions coverage types of liability insurance that for mutual fund insureds are frequently combined into a single d o e o policy protect individuals and entities against the financial impact of judgments settlements and legal defense costs incurred in certain shareholder lawsuits or other claims made against them relating to their. But if you ve made insurance your career of choice you should understand better than anyone that it might not be a matter of if but when.

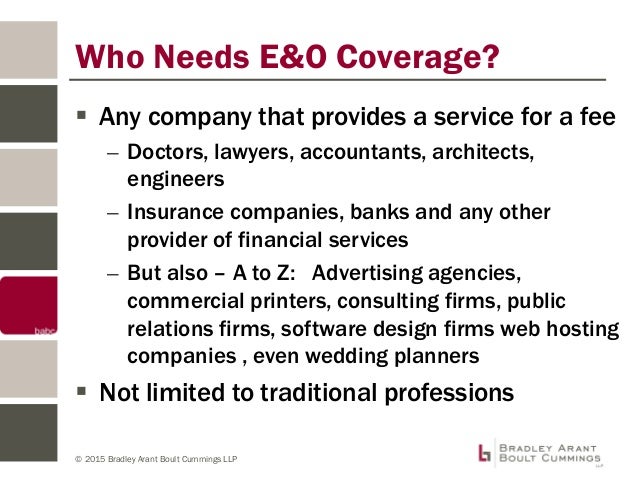

Insurance business magazine reports that 1 in 7 agents will have an e o claim during their career while insurance risk management knowledge alliance. Even if you have the best e o coverage you can find of course you hope you ll never have to use it. If you file a lawsuit against a client who refuses to pay you e o won t provide coverage. Professional liability insurance pli also called professional indemnity insurance pii but more commonly known as errors omissions e o in the us is a form of liability insurance which helps protect professional advice and service providing individuals and companies from bearing the full cost of defending against a negligence claim made by a client and damages awarded in such a civil.

However even though they each account for roughly a quarter of all errors and omissions insurance claims there are many other claim triggers. E o insurance for coverage for owner s employees and independent contracted agents with at least 51 of revenues derived from the sale and servicing of life health products starting at 127 92 month. Our program is administered by melgro insurance holdings. Best a rated excellent carrier.

Here are the main ones in order of frequency for each agent type. Our coverage is insured by aspen insurance an a m. Errors and omissions insurance e o. It also only covers lawsuits filed against your business by clients.

If you think your business might need e o insurance you re likely wondering how much this type of coverage costs.

/GettyImages-1134608647-d06eff10dc3746119683550068860dae.jpg)