Eliminate Tax Debt

We have successfully reduced or eliminated irs debt nationwide for thousands of fresh start clients.

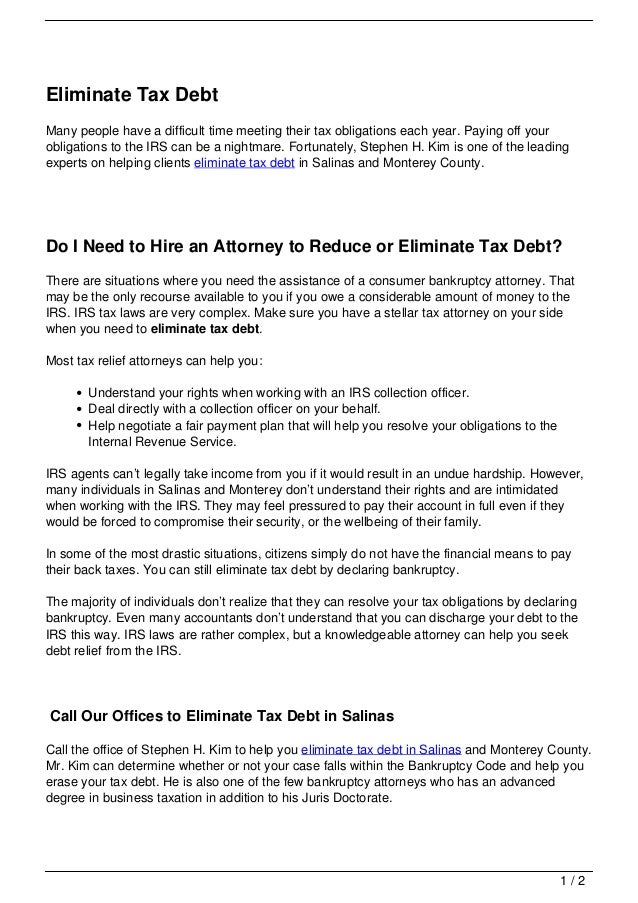

Eliminate tax debt. For tax debt to be dischargeable three elements must be satisfied. Let s say you owe the irs 30 000 for your last two years tax returns. To remove bad business debt from your business you must plan to systematically review every outstanding loan and try to find a way to either pay it off without compromising growth of course or refinance it at a lower rate. To eliminate a tax debt the tax return must have been originally due at least three years before you filed for bankruptcy.

A debtor is more likely to have tax debt discharged in chapter 7 than in a chapter 13 bankruptcy. Finally the income tax debt must have been evaluated by the irs at least 240 days before you file for bankruptcy. Consumer proposal and tax debt a consumer proposal is a process through which you make an offer to your creditors to repay them a portion of what you owe over a period of time. The tax debt in question must be at least three years old.

With the irs fresh start program this office would prepare and file all the necessary paperwork on your behalf to reduce or eliminate up to 99 ninety nine percent of your irs debt depending on your financial information and criteria. The debt is at least three years old. Your tax debt has to be at least three years old in order for you to be able to get rid of it through bankruptcy. You can use the same online payment agreement link or apply by using form 9465.

Then in legal terms here s how tax debts may eligible for discharge or elimination. However bankruptcy law allows the discharge of tax debt only in some circumstances. Once you have made the agreed upon payments and completed the consumer proposal all remaining outstanding debt is eliminated. You can use this option to pay off a tax debt of up to 25 000 over as long as 60 months.

Discharge depends on the type of tax debt you have if you filed a return and how old your tax debt is. Keep in mind that tax debt can get out of hand quickly if you procrastinate about dealing with it. Even if your tax debt is discharged any tax lien the irs recorded before you filed for bankruptcy would stay in place. This can make it impossible to sell the property unless the debt is paid.

Apply for the installment plan. You must have filed a tax return for the debt you wish to get rid of at least two years before filing for bankruptcy. For instance 2018 taxes. Eventually it will run out of patience and take more serious measures imposing levies and liens.

In chapter 13 tax debt along with other debt enters a repayment plan. You filed a tax return. You must have filed a tax return for the debt you wish to discharge at least two years before filing for bankruptcy. Other kinds like payroll taxes or penalties are not eligible.

1 if the debts are income taxes.

/will-the-u-s-debt-ever-be-paid-off-3970473-finalv2-acb523b4dacf43529f4915254c600777.png)