Easiest Way To Get Pre Approved For A Mortgage

Get pre approved for a mortgage.

Easiest way to get pre approved for a mortgage. The approved mortgage amount will depend on the value of your home and the amount of your down payment. From there the mortgage broker is going to ask those clients for lots of information. The first thing a mortgage broker or lender will look at is your credit report. And on the other hand you avoid falling in love with a house that you can t afford.

What is the easiest most stress free way to get approved for a mortgage. In the world of homebuying think of a mortgage pre qualification as a learner s permit while a preapproval letter is a license to drive. Pre approvals include everything from how much you can afford to the interest rate you ll pay on the loan. Qualifying for a mortgage takes a good credit rating a proven ability to repay and some cash.

Decrease your overall debt and improve your debt to income ratio. It may be a good idea to also look at properties in a lower price range so that you don t stretch your budget to its. By checking the box that says i want to get pre approved by a lender you ll be connected with up to three lenders right away. In general a debt to income ratio of 36 percent or less is preferable.

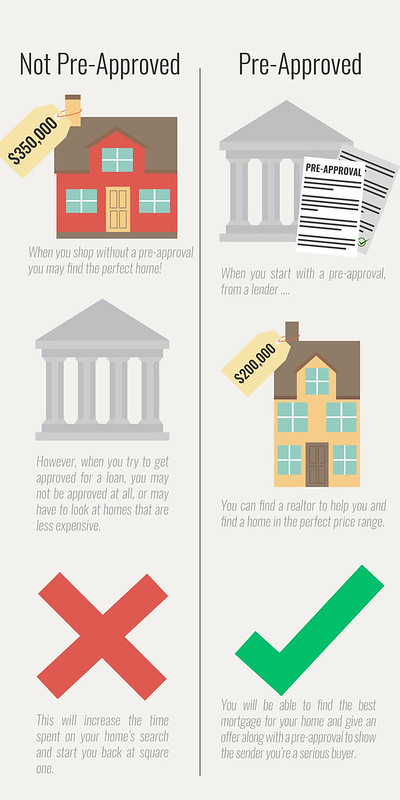

A pre qual letter can get you on the road to. Getting pre approved for a mortgage loan before looking at houses is emotionally and financially responsible. Your credit report will contain all of your credit activity including your loan paying history and status of your current credit accounts. However the lower your credit score the more you may need for a down payment to compensate.

Review your credit report. Staying safe before you apply online read through the. If you are ready to become a homeowner learn how to get pre approved for a mortgage. To get pre approved for a mortgage you ll need five things proof of assets and income good credit employment verification and other types of documentation your lender may require.

On one hand you know what you can spend before bidding on properties. The pre approval process is fairly simple. 43 percent is the maximum ratio allowed. The easiest home loans have lenient credit score requirements.

Even if you are deemed to have bad credit there are ways to still get pre approved for a mortgage. First whatever realtor you use to help you buy your property they should have a great mortgage broker behind the scenes that they can match with their clients. 6 tips to get approved for a home mortgage loan get pre approved for a mortgage.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)