Due Diligence In Mergers And Acquisitions

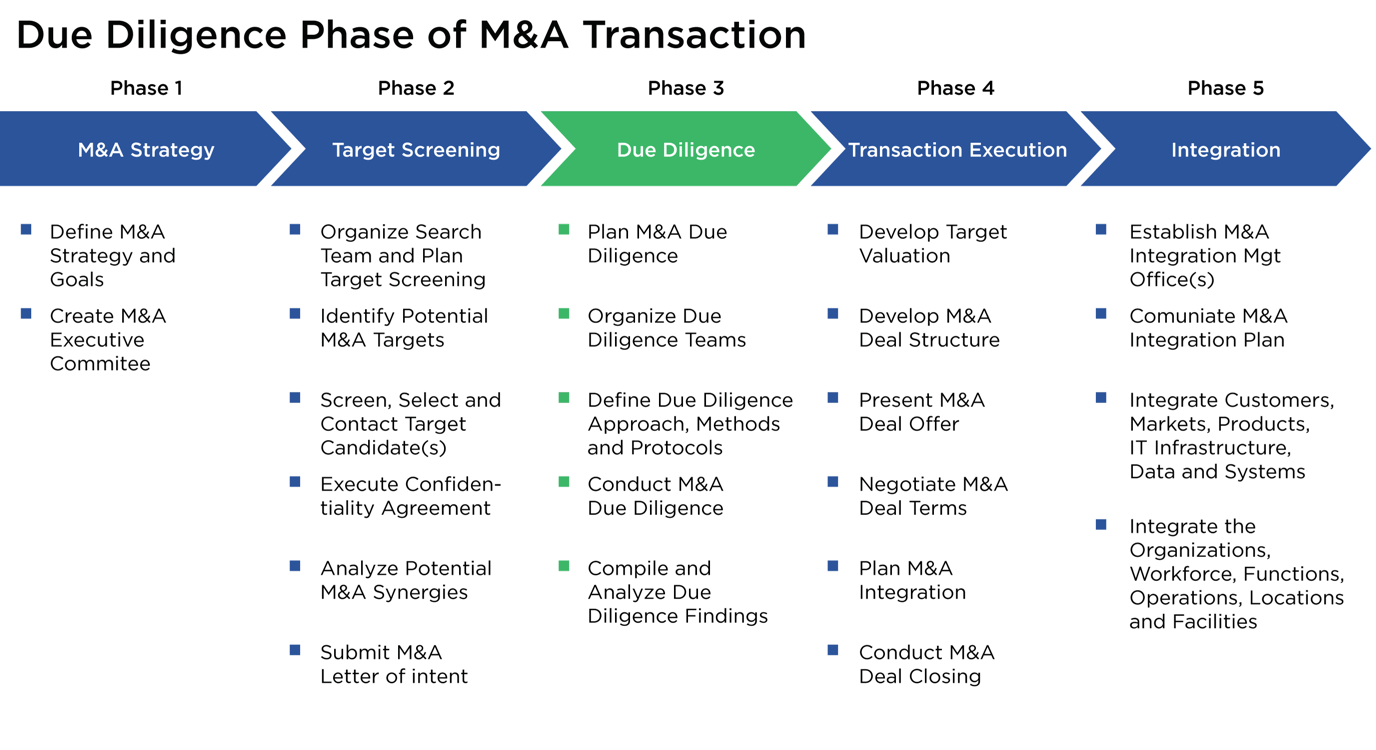

In mergers and acquisitions m a purchasing a business without doing due diligence substantially increases the risk to the purchaser.

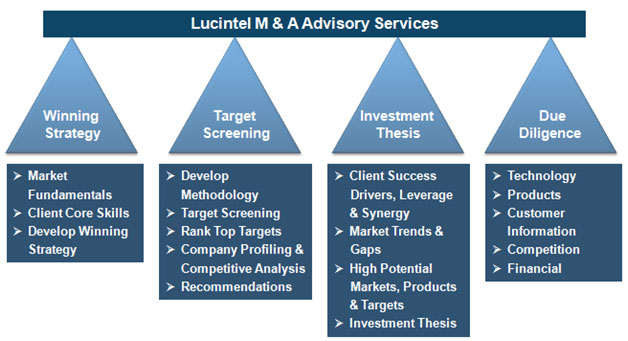

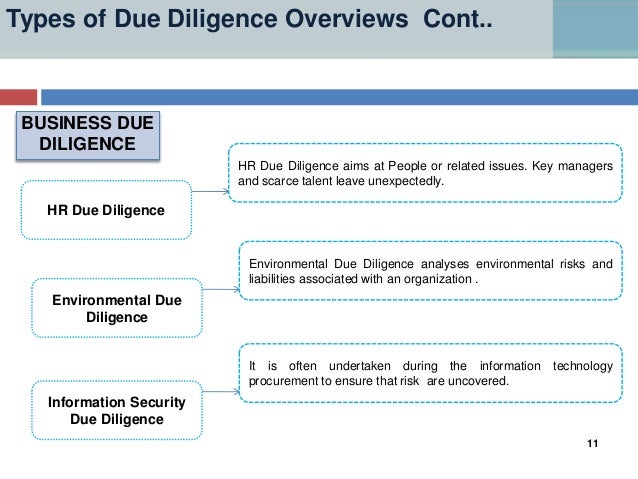

Due diligence in mergers and acquisitions. Smith and john cook. An investor or an analyst has to cover a variety of areas to conduct due diligence of a prospective deal. Mergers and acquisitions typically involve a significant amount of due diligence by the buyer. Hr due diligence checklist for mergers acquisitions hr plays a key role during a merger or acquisition.

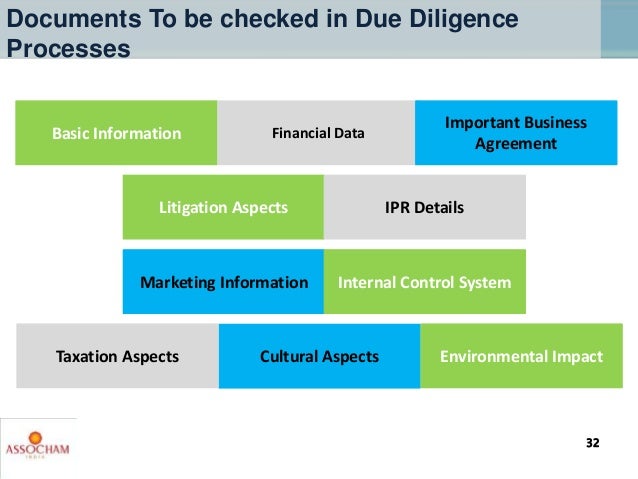

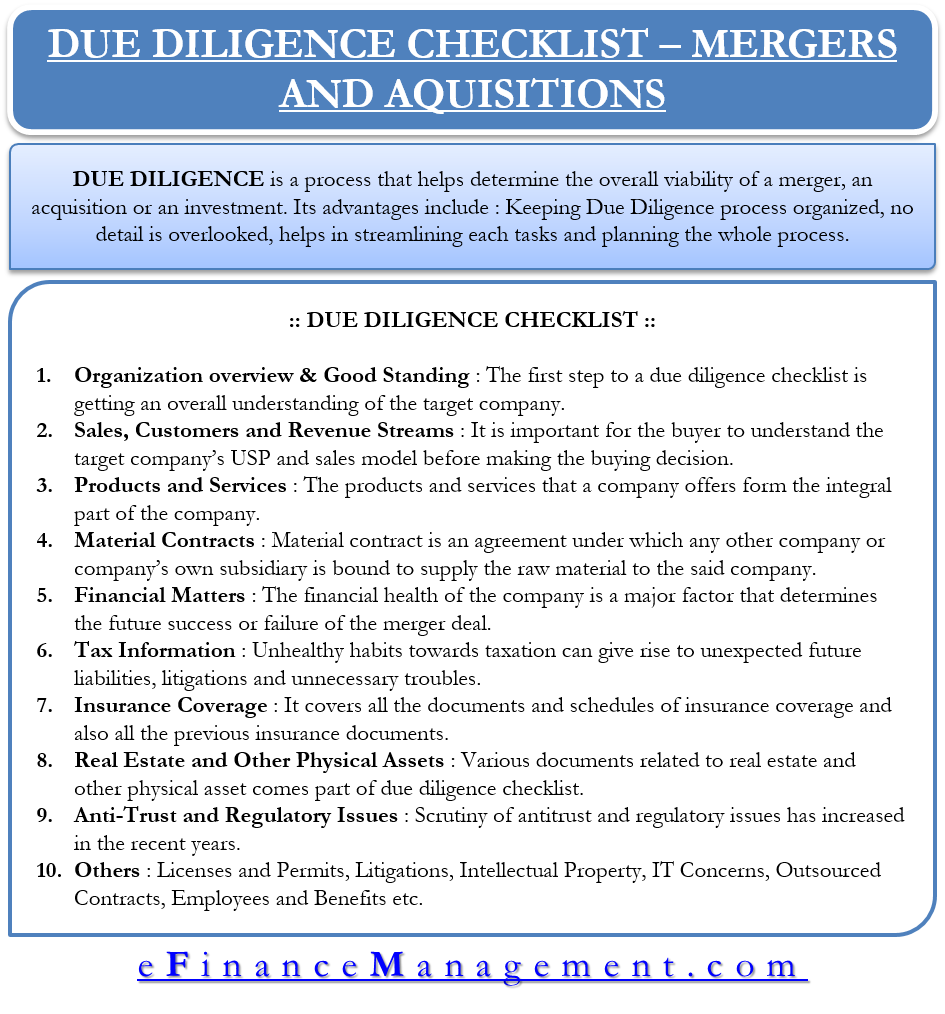

From a seller s perspective. Due diligence is a broad concept that can cover a significant number of areas as highlighted below. Therefore it is a common practice to make a due diligence checklist. Harroch and david a.

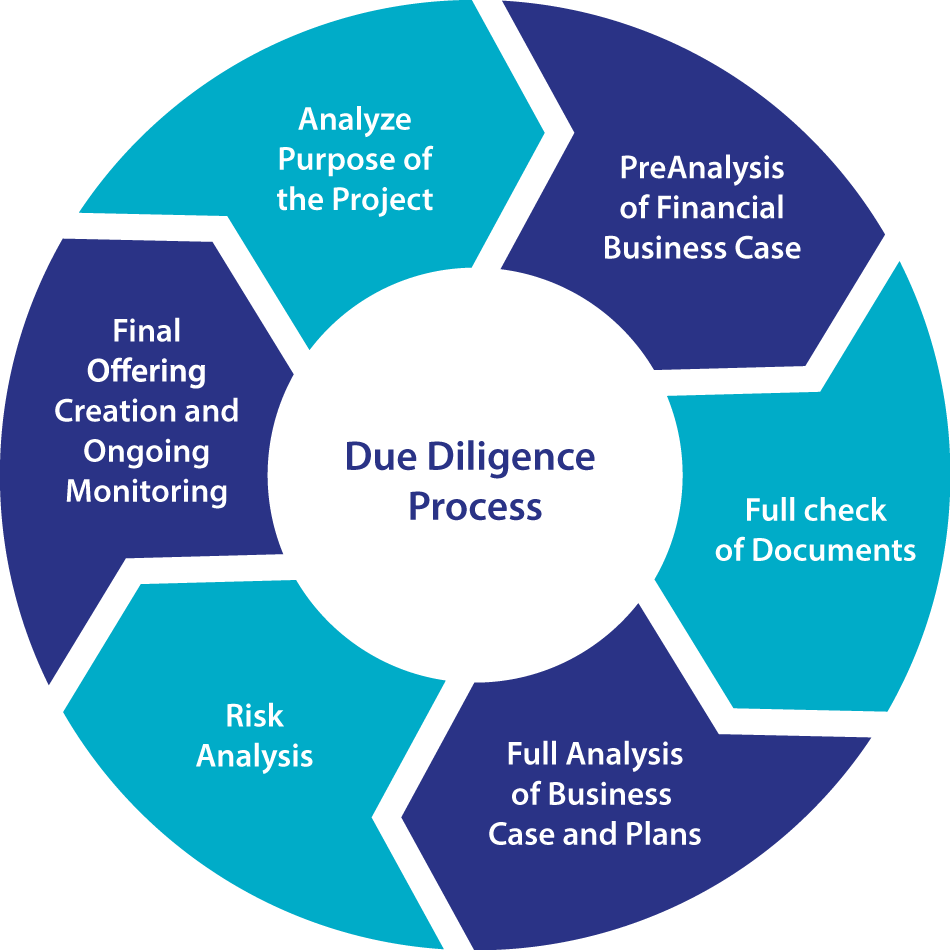

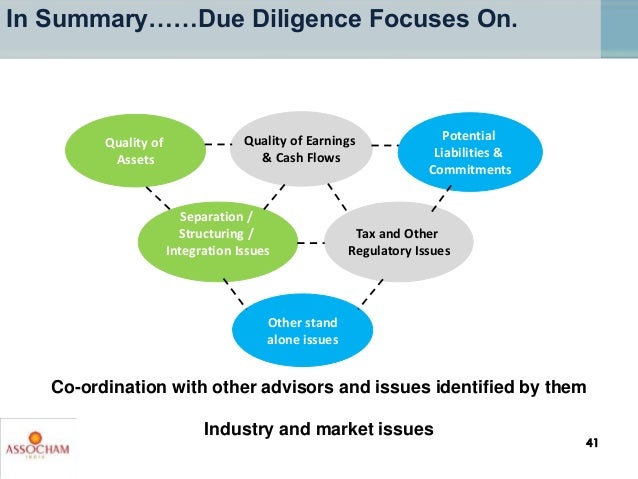

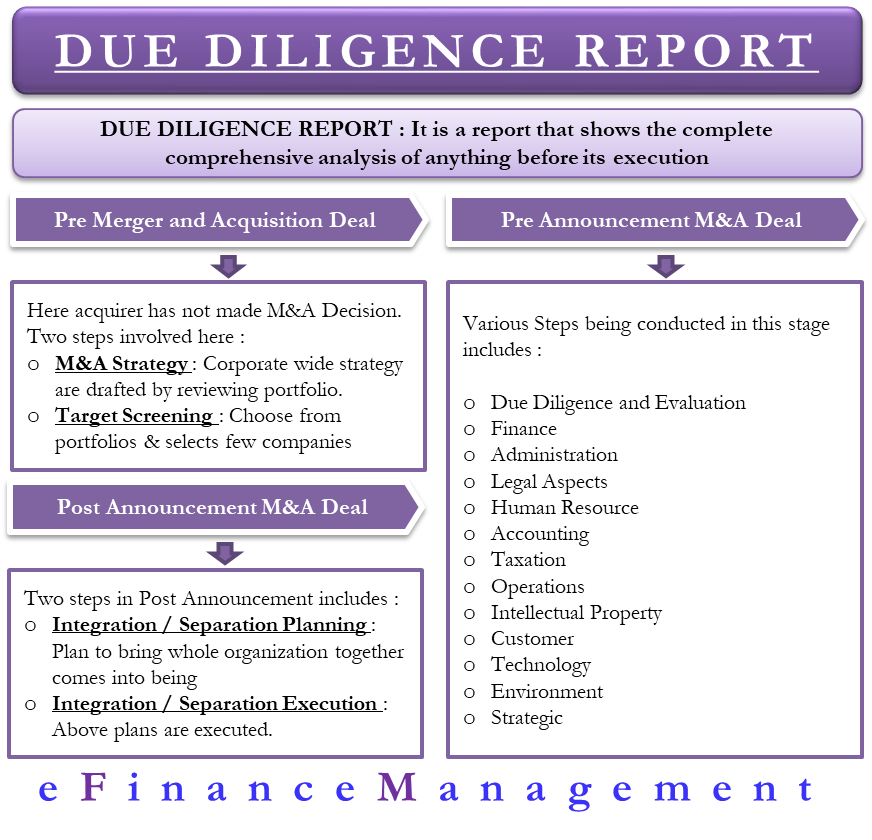

Before committing to the transaction the buyer will want. Due diligence is conducted to provide the purchaser. Key elements of due diligence. Due diligence is a process that helps determine the overall viability of a merger an acquisition or an investment.

Due diligence can be performed in different ways e g by internal teams external advisors specialists experienced senior industry players or as is often the case by a combination of the above leveraging the buyer s knowledge with the deep transaction.