Donating Car Tax Deduction

If you would like to help your local make a wish and get the maximum tax deduction then you re already almost done.

Donating car tax deduction. However car donations are a little more complicated than most charitable gifts because the value of the car determines the specific form that must be filed with the irs and the value of the car is not always obvious. However doing a little planning will ensure that you maximize the tax savings of your donation. You do not need to declare the donation amount in your income tax return. In notice 2005 44 the irs and treasury explain rules adopted in the american jobs creation act of 2004 which 1 generally limits the deduction to the actual sales prices of the vehicle when sold by the donee charity and 2 requires donors to get a timely acknowledgment from the charity to claim the deduction.

Taking a tax deduction for your car donation to charity isn t very different from any other gift to charity. Donating your car or vehicle to charity can be a great way to get a 2020 federal tax deduction state income tax deductibility depends on state law and wheels for wishes makes it easy. A guide on how tax deductions for car donations work. Taxpayers who are considering a car donation might be wondering how the tax bill passed into law in december 2017 could affect their decision.

Tax benefits of donating a car. Car donation tax deduction. Donating your car to charity can result in significant tax savings if you include it in your charitable contribution deduction. Understand how much you ll receive for your donation and what steps you must take to ensure a simple process when filing taxes and claiming your deduction.

Accurate paperwork is key when listing all gifts at tax season. Donate car for tax credit van or other vehicle to charity is perhaps the largest single charitable contribution you may give in your lifetime. Tax deduction is given for donations made in the preceding year. For example if an individual makes a donation in 2018 tax deduction will be allowed in his tax assessment for the year of assessment ya 2019.

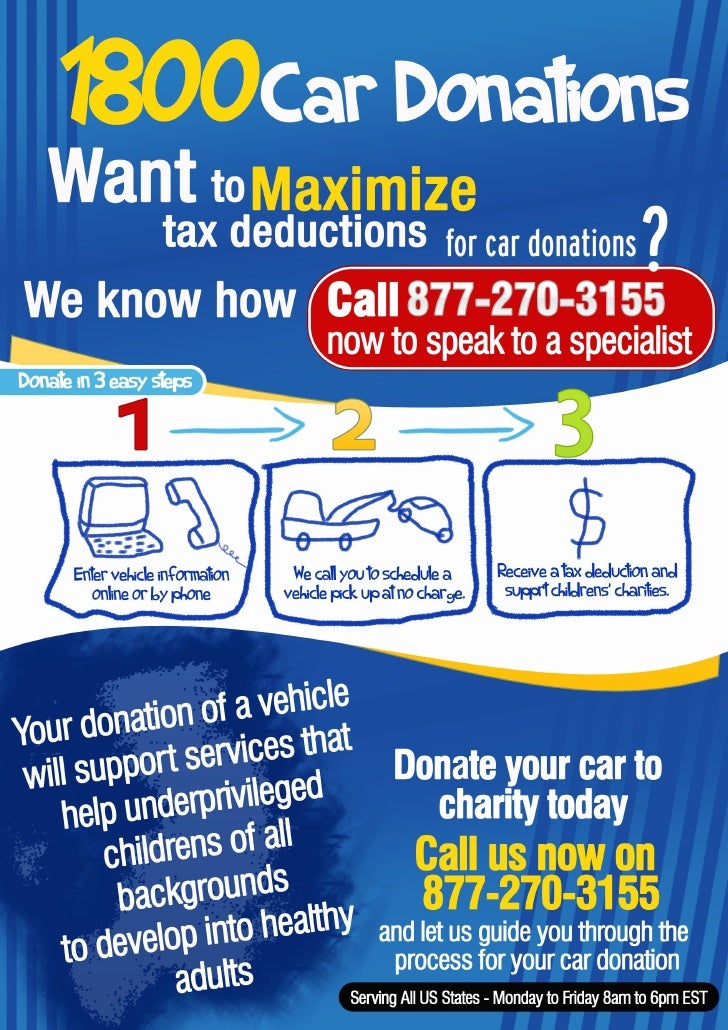

Headache of junking or selling the car help a cause and lower your tax burden all at exactly the exact same time doing a a little planning will make sure that you maximize your donation s tax savings. The gifting of used cars to charities has become a popular way for americans to dispose of vehicles. Your motivation may be an act of convenience or benevolence either way it s important to be assured that you could obtain the maximum tax deduction allowed. The internal revenue service irs requires you to calculate your deduction in one of two ways depending on how the charity uses your donation.

Donating a car is easy with kars4kids and we ll work hard to get you the highest possible deduction.