Does Whole Life Insurance Build Cash Value

How does the cash value benefit work.

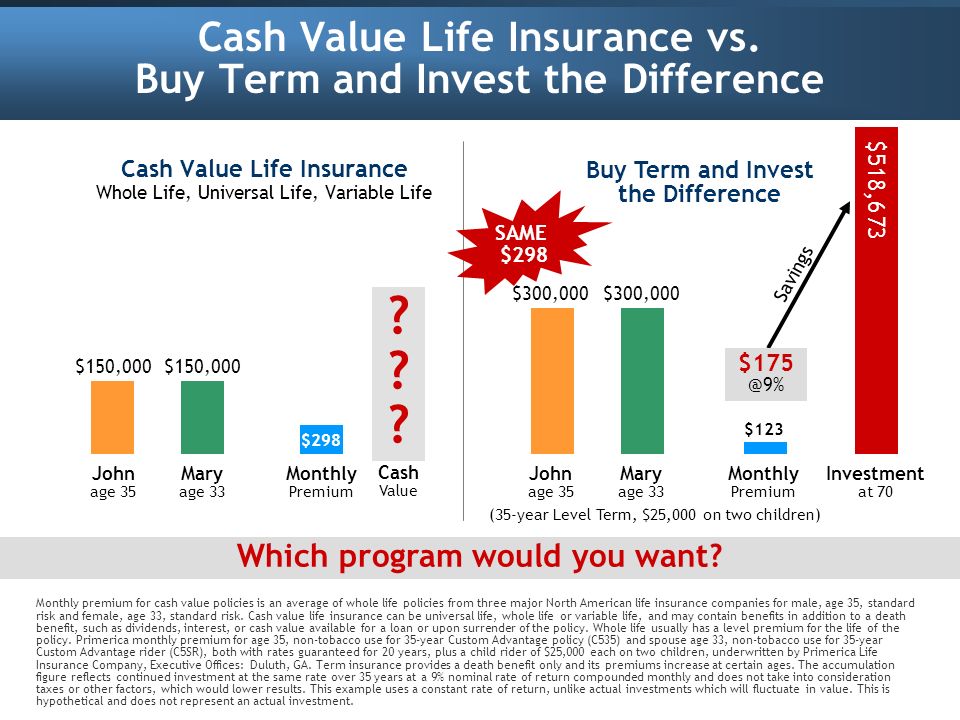

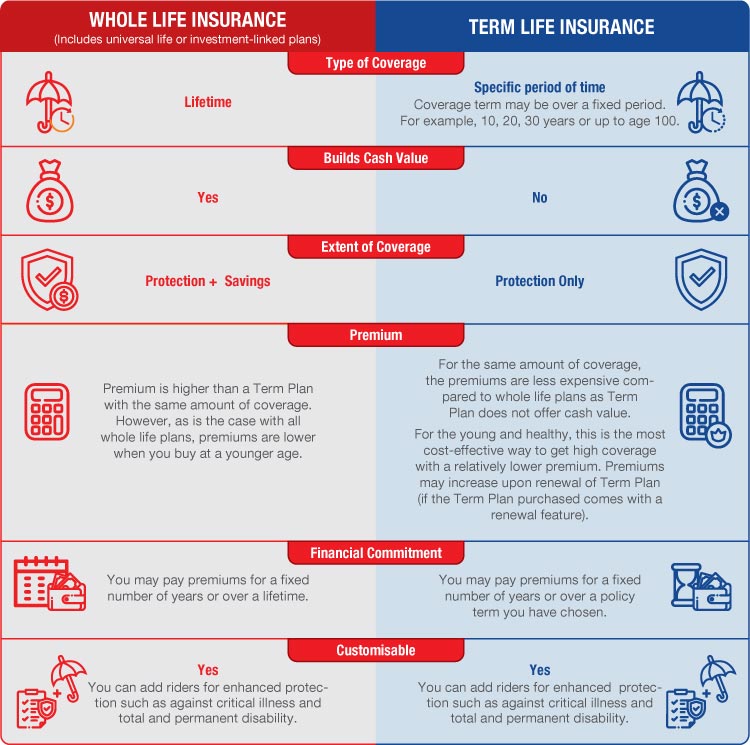

Does whole life insurance build cash value. While variable life whole life and universal life insurance all have built in cash value term life does not. Life insurance can give your family an additional financial safety net. The main benefit of cash value is that it can be withdrawn in the form of a policy loan. A permanent insurance policy like a whole life can build a cash value because it was designed to do just that.

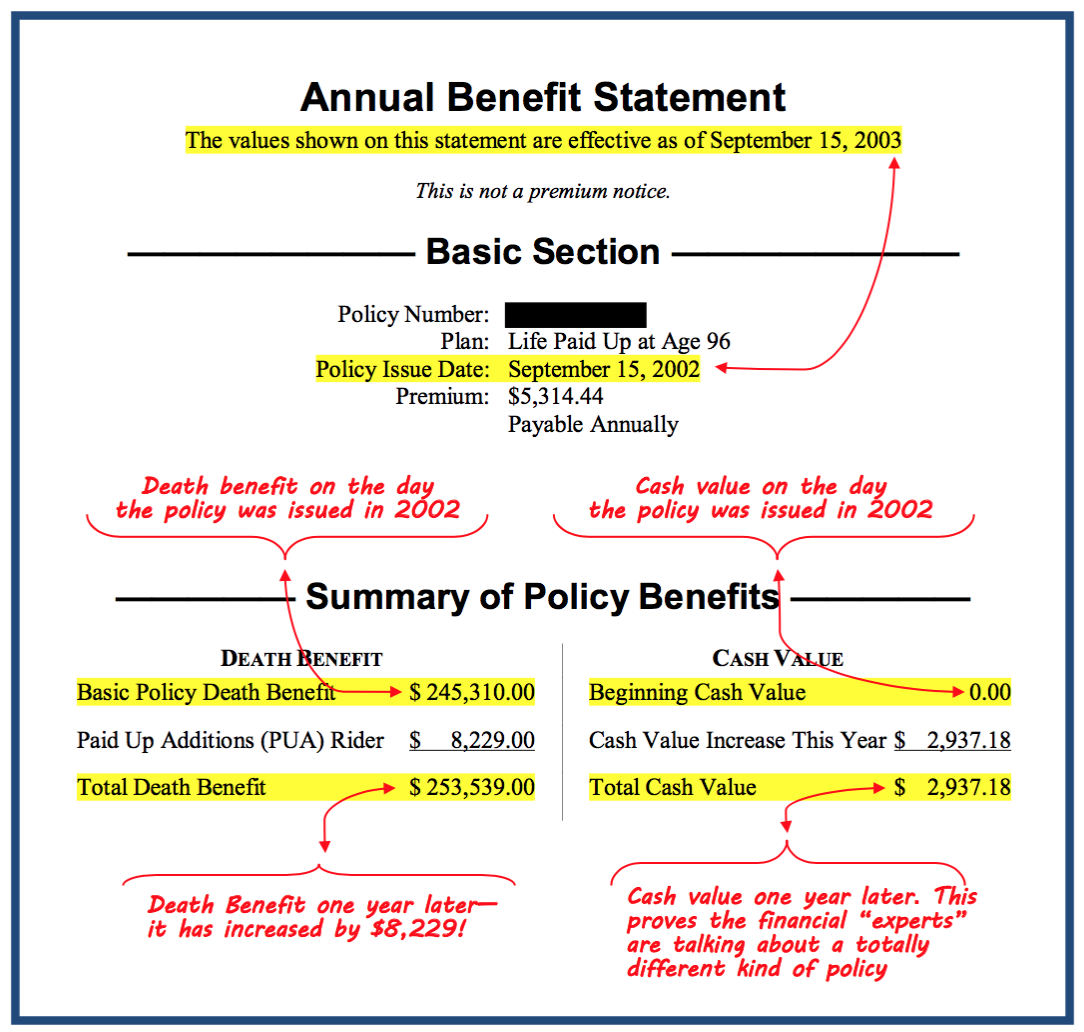

Whole life insurance is a type of permanent life insurance that offers cash value. So you re paying for two things here the life insurance part the bit that covers your family if you die and the cash value part the savings account that supposedly grows your money over time. At the age of purchase your insurance company knows how long you will live by average. A whole life insurance cash surrender value on a policy with a face value of 275 000 after 15 years might be as much as 21 000 depending on how well the investment fund has performed.

These policies allow you to build up cash that you can tap into while you re alive. Imagine this cash value portion like a savings account that you can access at any time. The length of time it takes to build cash value on a life insurance policy depends on the type of policy you purchase. If you already have other life insurance or are able to switch to a less costly term life policy cashing in may be the best option for you.

It can take decades to build up a substantial cash value but some policies. There are big differences between term life insurance and the multiple types of permanent life products like whole life and universal life. Once you have accumulated a sizeable cash value you can use these funds to. Whole life insurance which is also called permanent life insurance offers a death benefit and also accumulates cash value you can borrow against or use for other purposes.

Term life insurance expires once the term is up and doesn t build cash value but other types of life insurance last for life and do offer a cash value component. Cash value builds inside of whole life insurance policies. Cash value is one of them. It never fluctuates up and down.

Cash value life insurance is a type of life insurance policy that s in place for your whole life and comes with a sort of savings account built into it. Cash value is what makes every whole life insurance a desirable asset for many people. Cash value is generated when premiums are paid the more premiums that have been paid the more cash value there is. So in that way it can be seen as a kind of investment as well as a way to provide for loved ones after the die.

Whole life policies are one of the few life insurance plans that generate cash value. Term life policies don t.