Dodd Frank Fx

It was created as a.

Dodd frank fx. Information regarding these reports and studies will be published as it becomes available. All mid market marks provided on this website required pursuant to cftc regulation 23 431 d the mid. The dodd frank wall street reform and consumer protection act required the cftc to conduct a number of studies and reports on a wide variety of issues that affect the derivatives market. The dodd frank wall street reform and consumer protection act is a massive piece of financial reform legislation that was passed in 2010 during the obama administration.

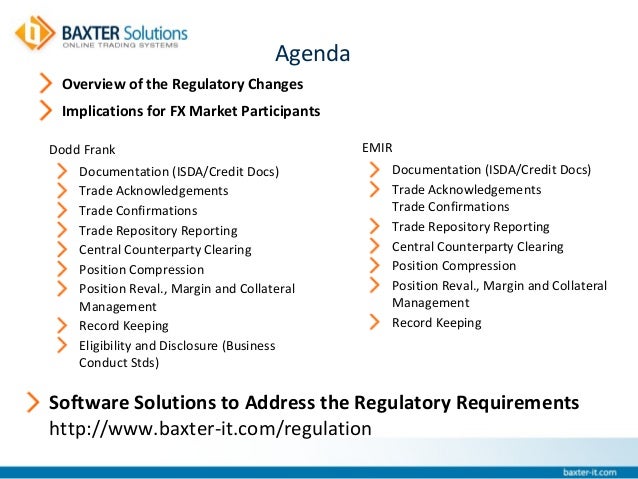

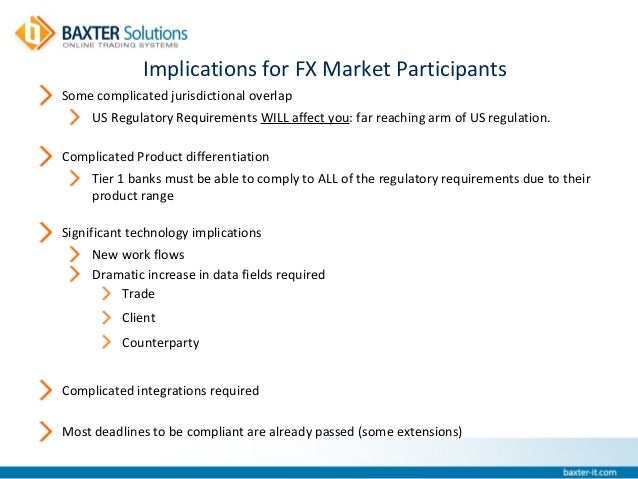

This post is a summary of certain recent developments under the dodd frank wall street reform and consumer protection act dodd frank that impact corporate end users of over the counter foreign exchange fx derivative transactions and should be read in conjunction with the four prior wsgr alerts on dodd frank fx issues from october 2011 september 2012 february 2013 and. For more downloads reports interviews q as and to find out more about the conference visit tradetechfx co uk. Where this refers to we or hsbc it refers to the relevant hsbc entity with which you are transacting the hongkong and shanghai banking corporation limited hsbc bank usa na or hsbc bank plc as applicable and where this refers to you it refers to you or your organisation. Dodd frank and all the current and upcoming regulatory reforms will be under the spotlight at tradetech fx 25 57 september 2012 london.

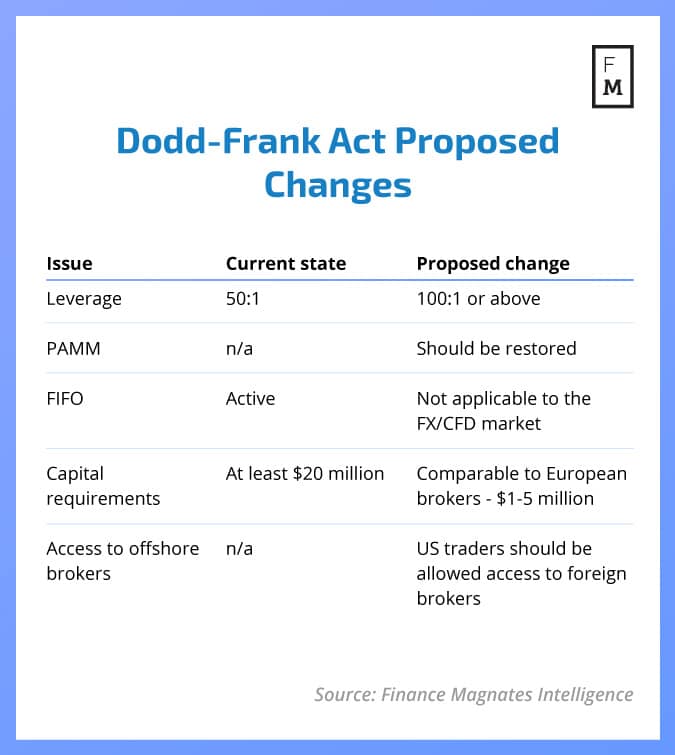

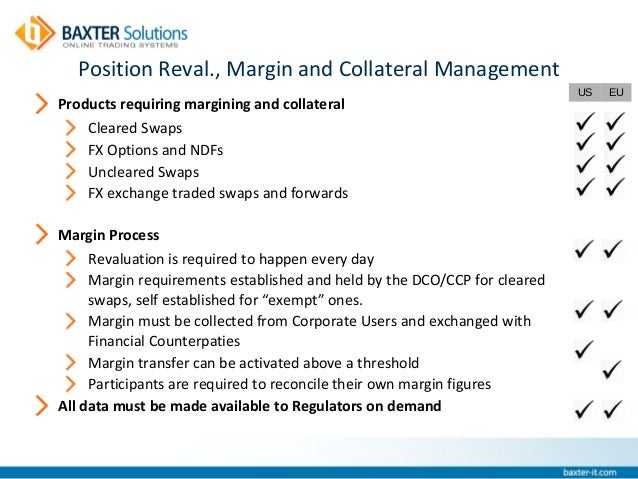

Dodd frank impact to the fx market participant ricardo salaman. Regulators have authority over the swaps market and as a result different rules will attach to transactions depending on both product and counterpart. Products mixed swaps several u s. As a result fx swaps and forwards are not subject to dodd frank central clearing and exchange trading requirements.

Dodd frank provides the registration and regulation of swaps dealers and major swap participants as well as the implementation of clearing and trade execution requirements for swaps. The dodd frank act was created to restore public confidence following the financial crisis and to prevent another crisis from occurring. Under the term swaps are a varied selection of foreign exchange derivatives including fx swaps fx forwards currency swaps currency options and non deliverable forward contracts. Where more specific disclosures of material risks may be necessary with respect to a transaction between you and nab in addition to the isda dodd frank disclosure you will be provided with alternative or supplementary disclosures suitable for such transactions.