Discover Increase Credit Line

Credit card issuers may look at both overall credit utilization and utilization on individual lines of credit when determining the size of a credit card limit on a new account.

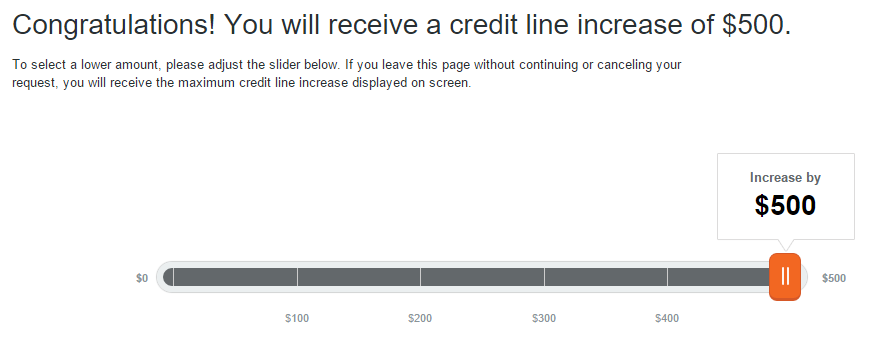

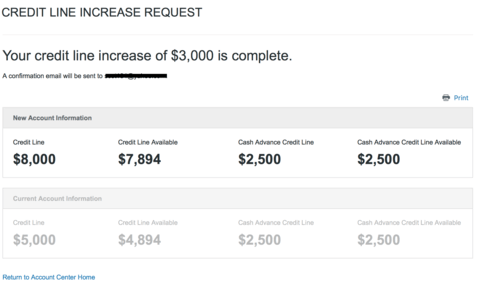

Discover increase credit line. I started with a credit line of 3100 and it was increased to 3700. Here are some self reported data points. I never asked for a credit line increase because i didn t really need one. If you don t have an online account yet click the orange register button.

Credit card companies look for a long history of good repayment behavior. First is an automatic credit limit increase where the issuer will boost your credit line without any action required from you. Data points suggest that having a credit score in the mid to upper 600s can be good enough for a credit line increase. This can affect your credit score by lowering it a few points.

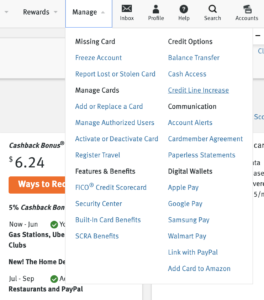

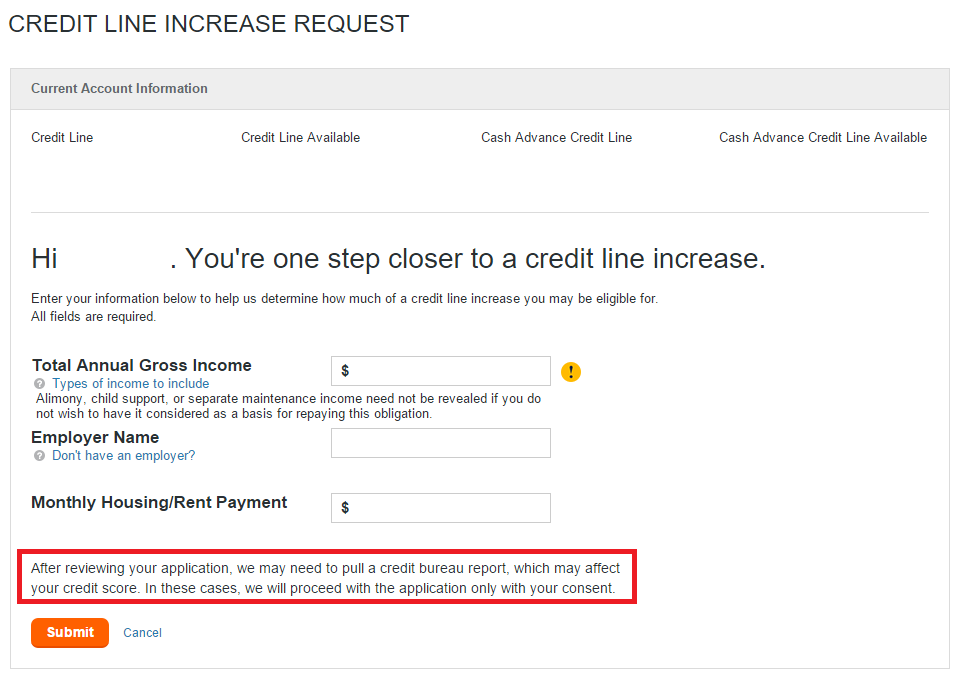

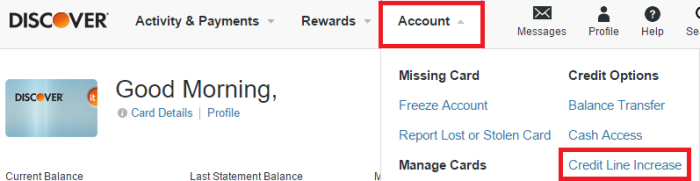

A higher credit limit gives you more purchasing power helps your credit utilization can help improve your credit score and can even help you qualify for credit cards with higher limits in the absence of an automatic credit limit increase from your credit card issuer you may request an increase many card issuers like chase allow you to apply online. Rbfcu premier 25k sam s club mc 25k citi exec wemc 34k alliant signature 20k ssfcu 20k cap1 venture 20k employer cu loc 20k navy gorewards 18k 2nd nfcu plat 14 7k citi simplicity 18 2k penfed power cash 10k penfed ploc 10k navy platinum 12 7k smg 10k penfed promise 12k total rewards 8 5k discover it 2 5k discover it 2k cap one qs1 850 overstock 32k. Cardholders can call discover s main number 1 800 discover or 1 800 347 2683 in order to make their request orally. Request a credit limit increase through discover s online account center.

If you plan on applying for a new card in a few months paying down some existing balances could help raise your credit limit. Process for requesting a credit limit increase. I ve had discover for 2 1 2 years and just received a credit line increase automatically. If your credit score has increased since first getting a credit card you re in a good position to request a credit line increase.

Building a good credit history is partially about showing the credit issuer you can repay your balance on time every month. I pif almost all of the time except maybe two months and was never late. If you plan to fill out a joint application to increase your credit line you will have to contact customer service at 1 800 347 2683. According to their website discover may pull a credit bureau report in order to process your credit limit increase application.

There are a few ways you can get an increased credit limit with discover. Discover s two main avenues for making a credit limit request are.