Delaware Llc Filing Requirements

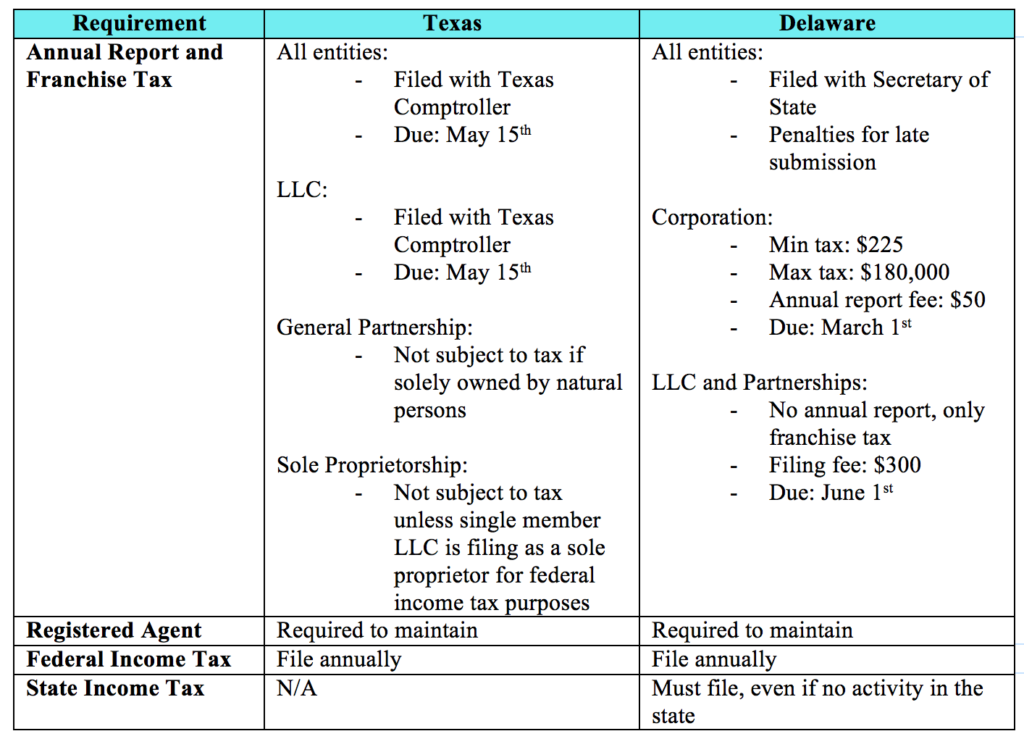

The annual taxes for the prior year are due on or before june 1st.

Delaware llc filing requirements. Limited liability companies classified as corporations must file either delaware form 1100 or form 1100s. Your de llc needs to pay various fees to the federal government delaware government and other agencies. If you want to start and run a delaware limited liability company llc you ll need to prepare and file various documents with the state. The first step to filing an llc in delaware is to decide if you are going to be a single entity llc or have multiple members.

Corporations public benefit corporations effective august 1 2013 limited liability companies llc limited partnerships lp statutory trusts and many general partnerships gp are required to file with the delaware division of corporations. Although limited partnerships limited liability companies and general partnerships formed in the state of delaware do not file an annual report they are required to pay an annual tax of 300 00. A single member llc can be either a corporation or a single member disregarded entity. What is a single member limited liability company llc.

Unlike most states delaware does not require llcs to file annual reports. The filing questionnaire for an llc is different than a corporation but we make it easy by having an online order form to help you meet delaware llc filing requirements. Mandatory delaware compliance requirements for existing companies delaware llc series llc. Some types of businesses have different requirements in delaware including related fees and costs.

A an individual who is the single member of a non electing limited liability company llc conducting business in this state shall be subject to the filing requirements of title 30 of the delaware code for all years in which the llc conducts business within this state. Sole proprietorships do not file with the delaware division of corporations. Delaware does not require an annual report. Delaware llc licenses fees and filing requirements.

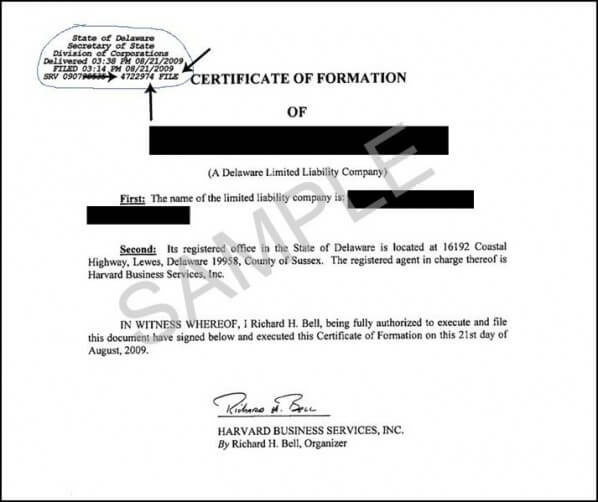

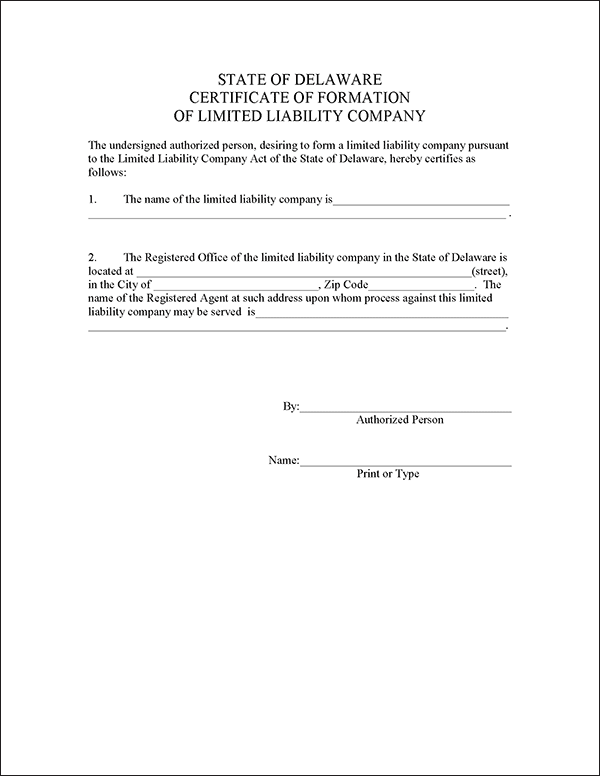

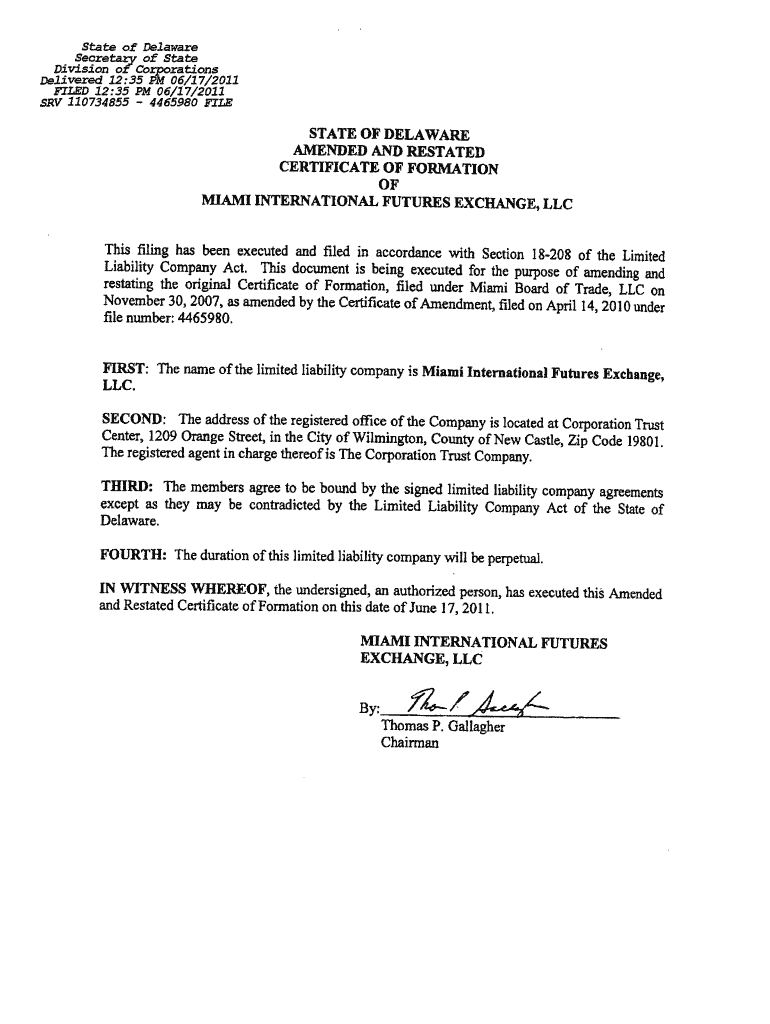

Limited liability companies classified as partnerships must file delaware form 300. The fee for filing the annual report is 125 00. A delaware llc is created by filing by mail or fax a certificate of formation of limited liability company with the delaware division of corporations. And texas because it s so darn large growing and business favorable.

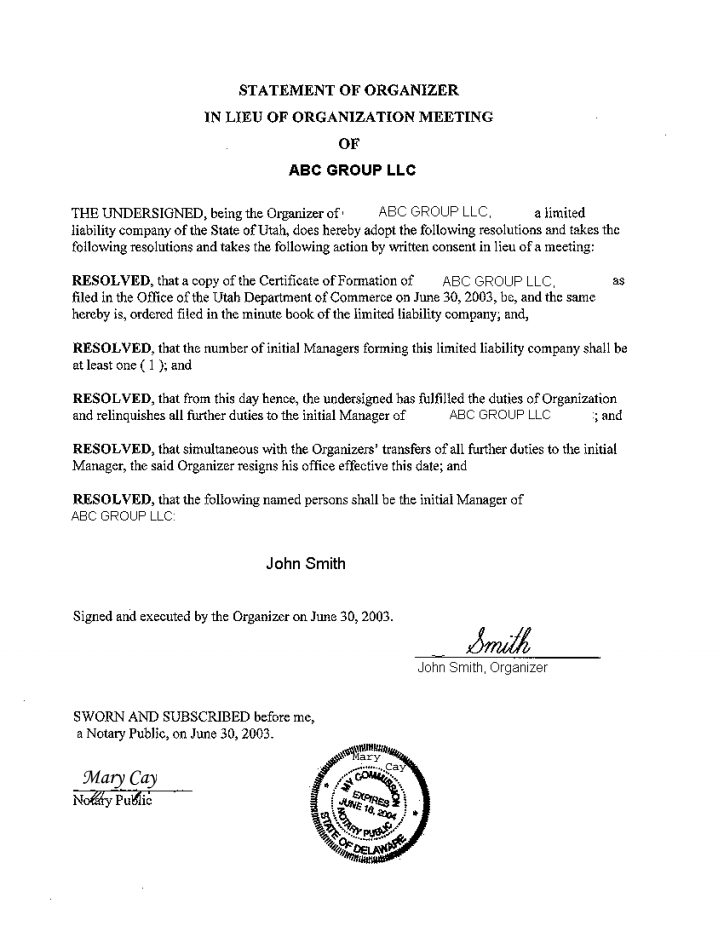

In this article we ll look at annual compliance and filing requirements for limited liability companies llcs and corporations in both texas and delaware two states where i m licensed as a business lawyer and two states where a lot of entities are formed delaware because it s the hub of corporate law in the u s. The certificate must include. The name and address of the llc s registered agent signature of an authorized person the organizer or person authorized by the organizer.