Days Purchases In Accounts Payable

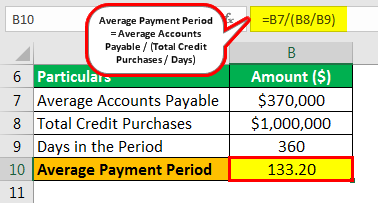

Average accounts payable x.

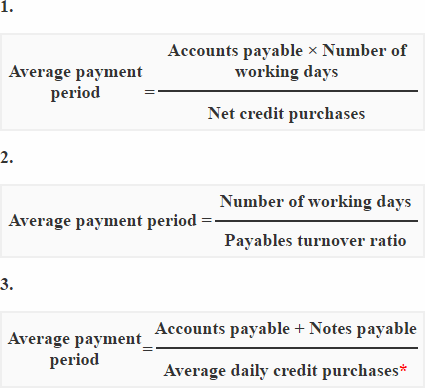

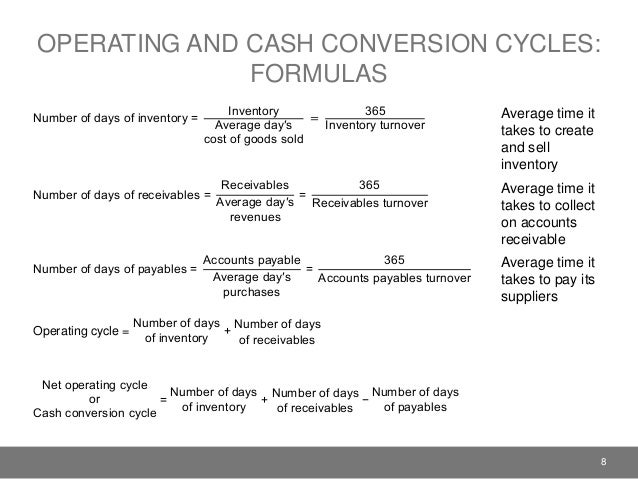

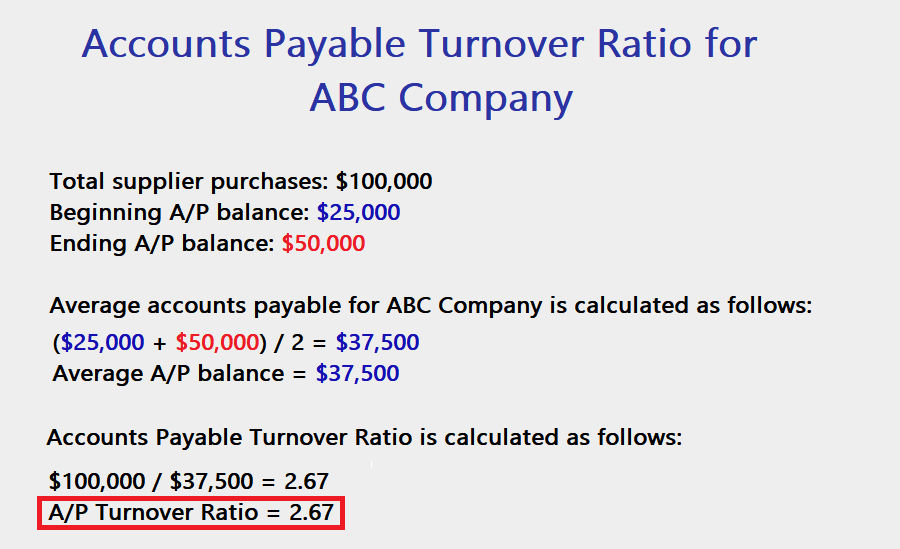

Days purchases in accounts payable. As a rule of thumb a well managed company s days accounts payable do not exceed 40 to 50 days. For the purpose of this calculation it is usually assumed that there are 360 days in the year 4 quarters of 90 days. To calculate accounts payable days summarize all purchases from suppliers during the measurement period and divide by the average amount of accounts payable during that period. Days payable outstanding accounts payable cost of sales number of days the dpo calculation consists of two three different terms.

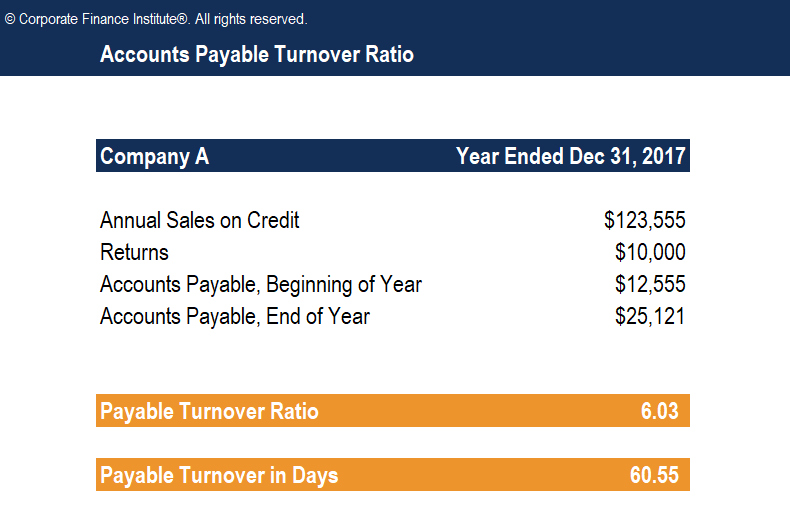

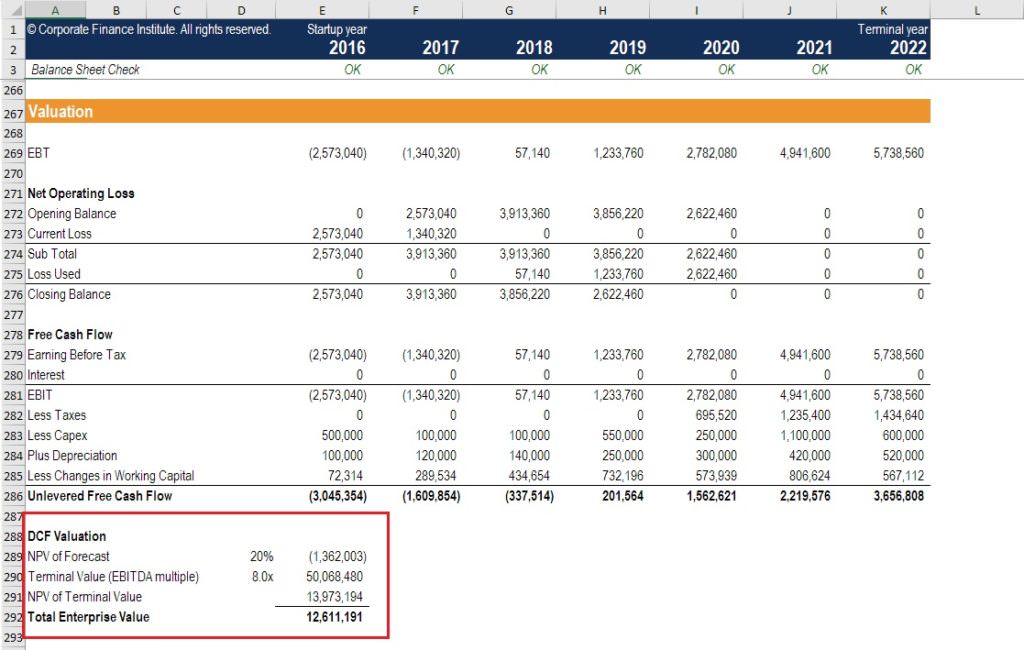

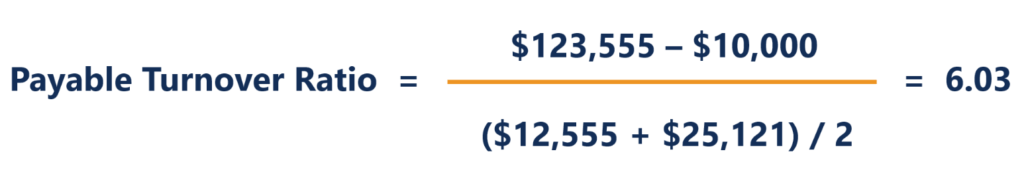

Therefore over the fiscal year the company s accounts payable turned over approximately 6 03 times during the year. Accounts payable cost of goods sold x number of days in year. Accounts payable this is the amount of money that a company owes a vendor or supplier for a purchase that was made on credit. Once you have your annual tapt divide it by 365 to find the average accounts payable days dpo.

Days payable outstanding dpo refers to the average number of days it takes a company to pay back its accounts payable. Therefore days payable outstanding measures how well a company is managing its accounts payable. Days accounts payable days a p. The turnover ratio would likely be rounded off and simply stated as six.

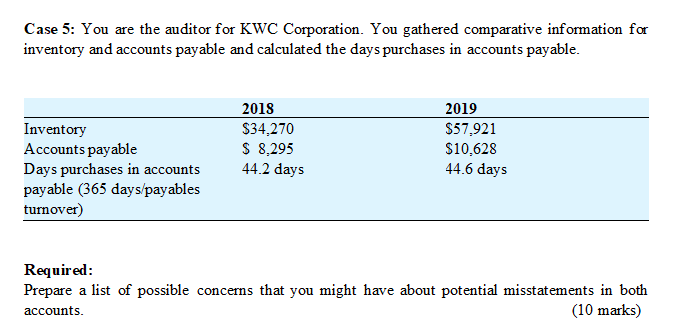

The average number of days a company takes to pay its bills used as a measure of how much it depends on trade credit for short term financing. Total supplier purchases beginning accounts payable ending accounts payable 2 this formula reveals the total accounts payable turnover. This ratio is used by financial managers to determine the extent to which accounts payable represents current liabilities rather than long overdue liabilities. The days purchases in accounts payable determines the average number of days it takes for the company to pay its short term suppliers creditors.

Accounts payable turnover in days. For example let s say your company had a beginning accounts payable balance of 700 000 at the start of the year. This process is usually handled by a separate department in large organizations. The average period that a company has between receiving goods and paying its suppliers for the goods utilizing after tax accounts payable and cost of sales values.

The formula for calculating accounts payable days is. Also called days sales in payables. A dpo of 20 means that on average it takes a company 20 days to pay back its suppliers. The accounts payable turnover in days shows the average number of days that a payable remains unpaid.

Accounts payable days formula. Accounts payable days is often found on a financial statement projection model. Accounts payable process is important since it includes almost all the payment beyond the payroll.

/calculate-cash-conversion-cycle-393115-v4-JS2-869f1dcda7b744abb1b815b2fd25c031.png)

/calculate-cash-conversion-cycle-393115-v4-JS2-869f1dcda7b744abb1b815b2fd25c031.png)