Credit Fraud Alert Number

The initial fraud alert expires after 90 days.

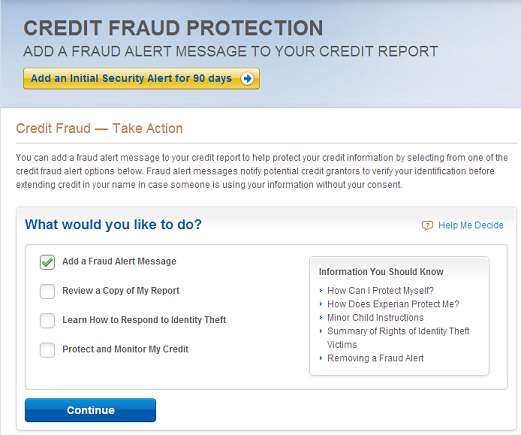

Credit fraud alert number. A fraud alert can make it harder for someone to open unauthorized accounts in your name. Adding or updating a phone number on your alert if you already have an extended alert on file and need to add or update the phone number you can call the number on your credit report to speak to someone in the fraud department. It has to put the alert on your credit report and tell the other two credit bureaus to do so. Initial fraud alerts and extended alerts.

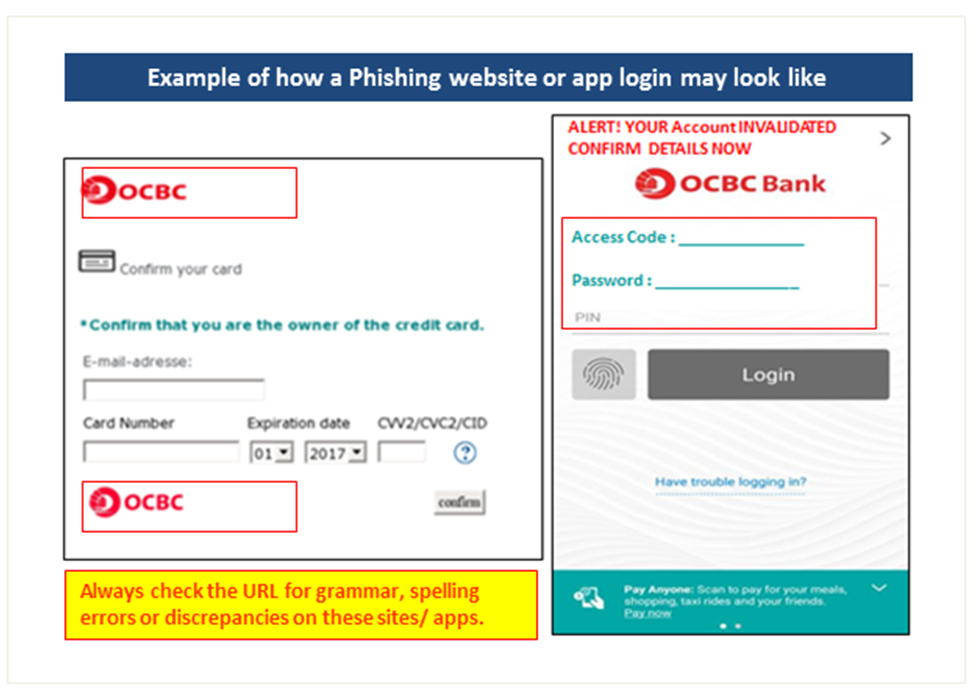

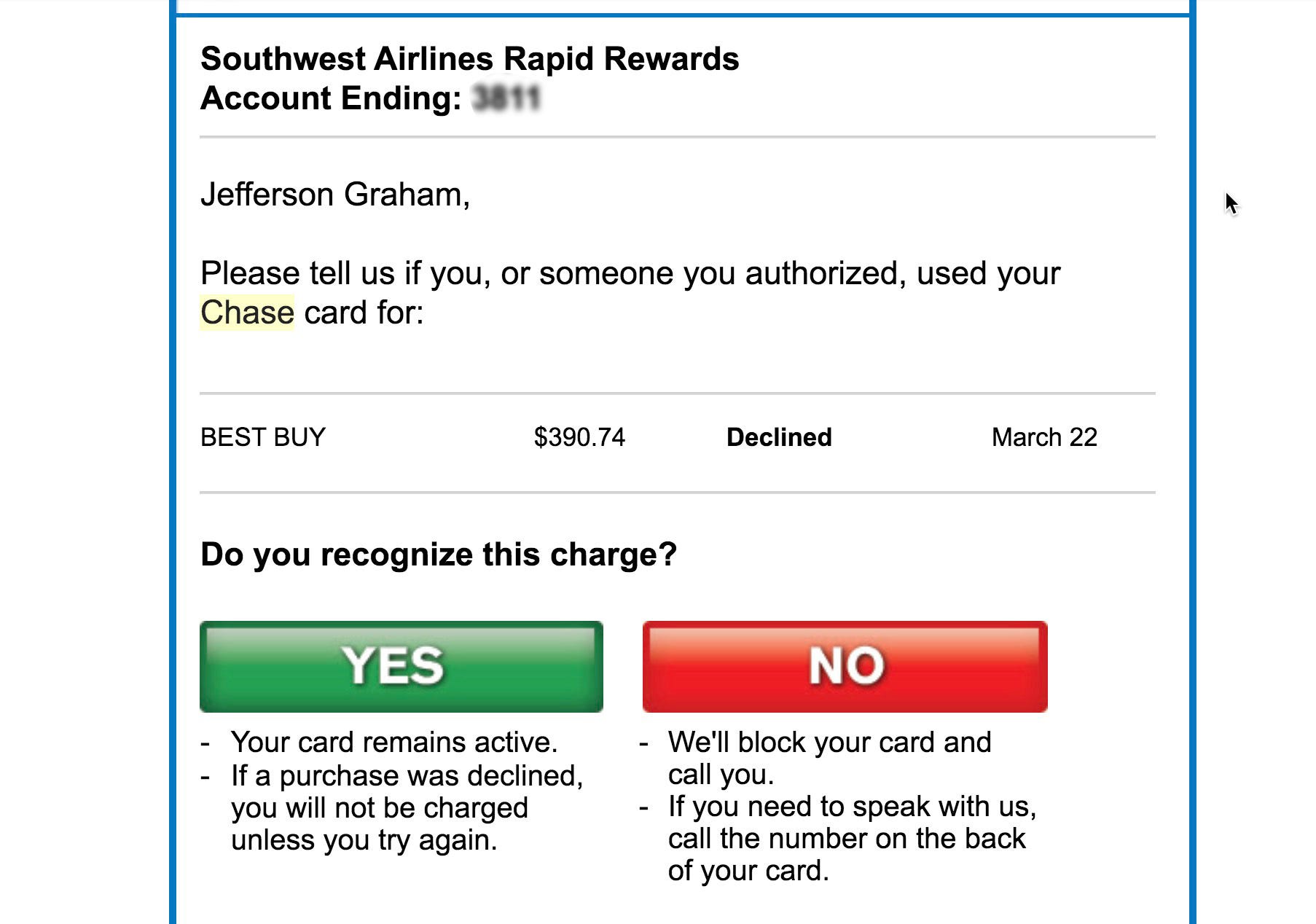

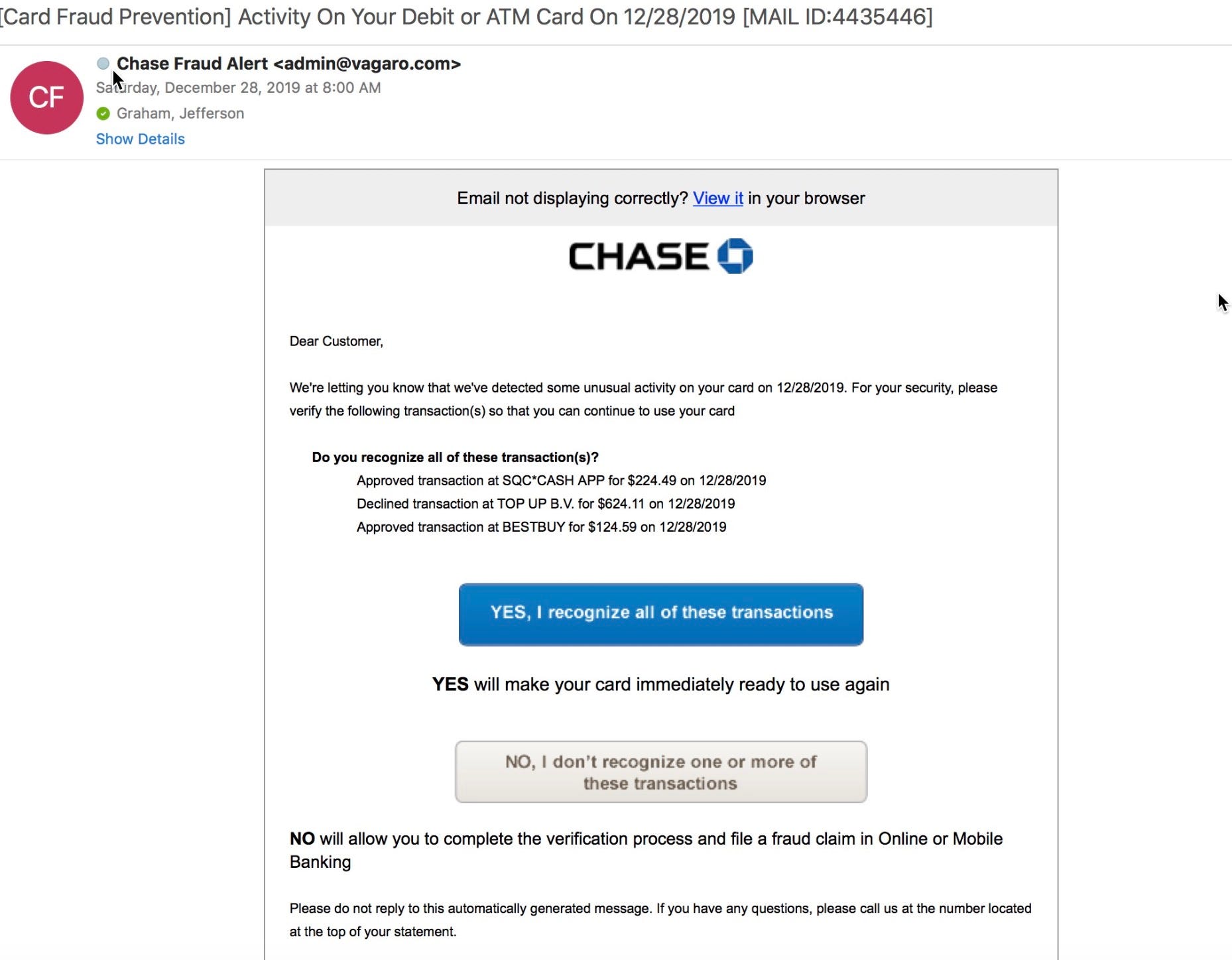

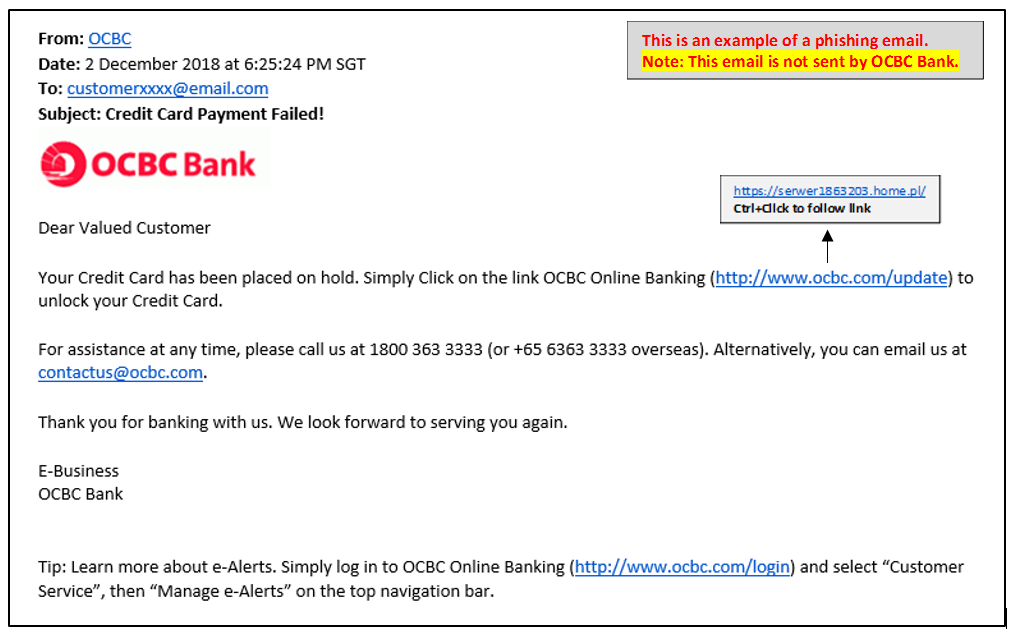

Types of fraud alerts. How it works if we have your current mobile phone number on file you ll now receive instant text messages notifying you if we detect suspicious activity on your td credit cards or td access cards. With fraud alerts in place lenders must confirm your identity before approving new credit which is attached to your social security number. There are two main types of fraud alerts you can place in your credit reports.

With an extended fraud alert a lender or creditor is required to verify your identity in person or by phone at a number you provide before opening new accounts or making changes to existing accounts. If you believe you are a victim of fraud you may find the following suggestions helpful. An extended fraud alert is similar to an initial fraud alert but lasts for 7 years. Initial fraud alert 1 year extended fraud alert 7 years active duty military alert 1 year.

You can place a fraud alert by asking one of the three nationwide credit bureaus. If a thief were to apply for credit using your information he would hopefully be stopped whenever the lender reaches out to you often on the phone number you provide to verify that the application is legitimate and authorized. Our full service identity theft protection includes access to your experian credit report 3 bureau credit monitoring with email alerts and immediate access to our fraud resolution. Is it right for me.

It encourages or requires lenders and creditors to take extra steps to verify your identity such as contacting you by phone before opening a new credit account in your name. Td fraud alerts is available at no cost on all td credit cards and td access cards. You are concerned about becoming a victim of fraud or id theft. You have been a victim of fraud and have an identity theft report.

You can request removal of a fraud alert from transunion by sending a request to po box 2000 chester pa 19022 2000. The alert lasts one year. Once it expires the credit bureaus will automatically remove it from your reports. Protect yourself first make sure a security alert or victim statement is on file with all national credit bureaus.

Although equifax notifies transunion and experian when a fraud alert is placed on your credit report it does not notify them if you request that the fraud alert be removed before its expiration date. When an extended alert is added the fraud victim can provide up to two telephone numbers to include in with the alert.