Business Line Of Credit Rates

Establishing or re building business credit with wells fargo.

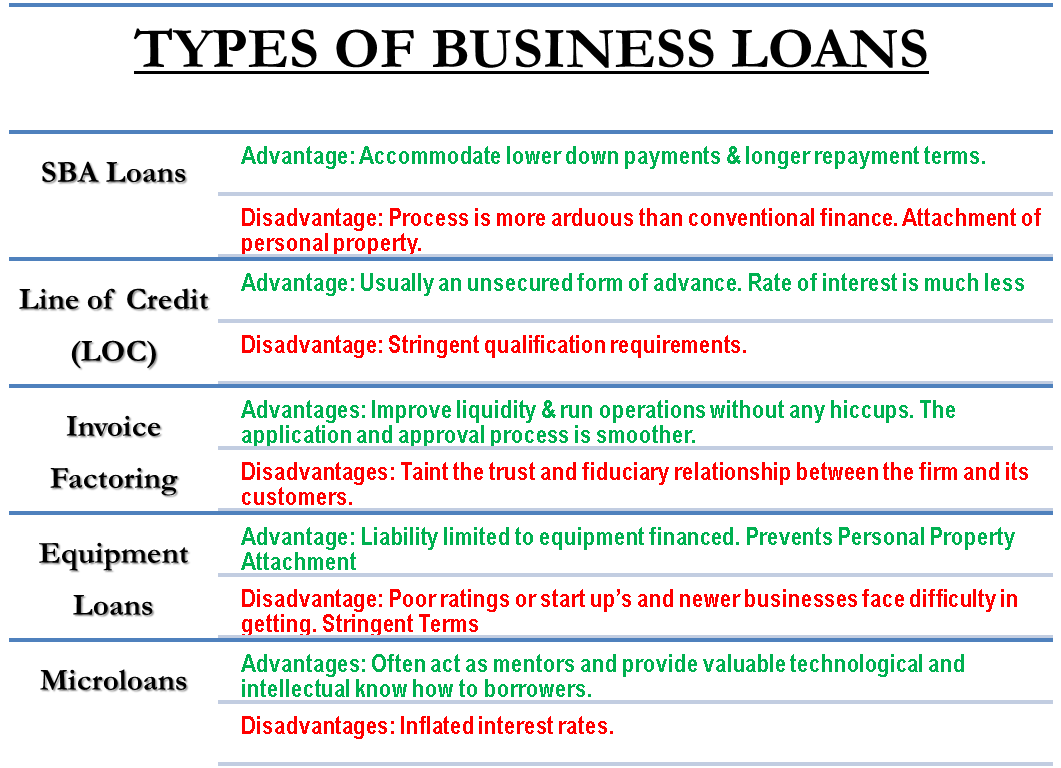

Business line of credit rates. Secured small business line of credit best for. Credit lines from 5 000 to 50 000. When considering a business line of credit u s. Businesses who have non real estate assets to collateralize a line of credit.

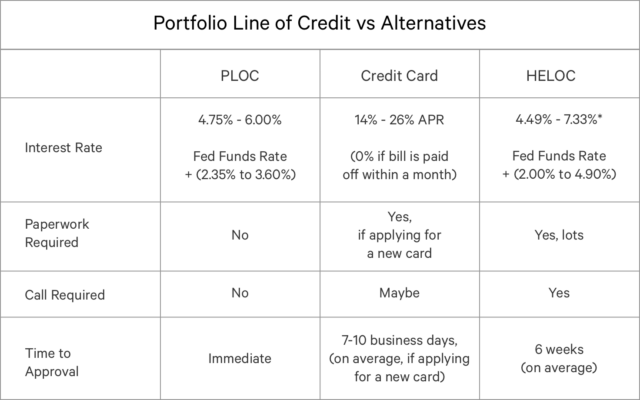

10 000 to 500 000line of credit annual fee is automatically waived when your average line utilization is 40 or more. Business line of credit. You credit limit will be between 10 000 and 100 000 and you can get unsecured business lines without having to use any property as collateral. Which line of credit may be right for your business.

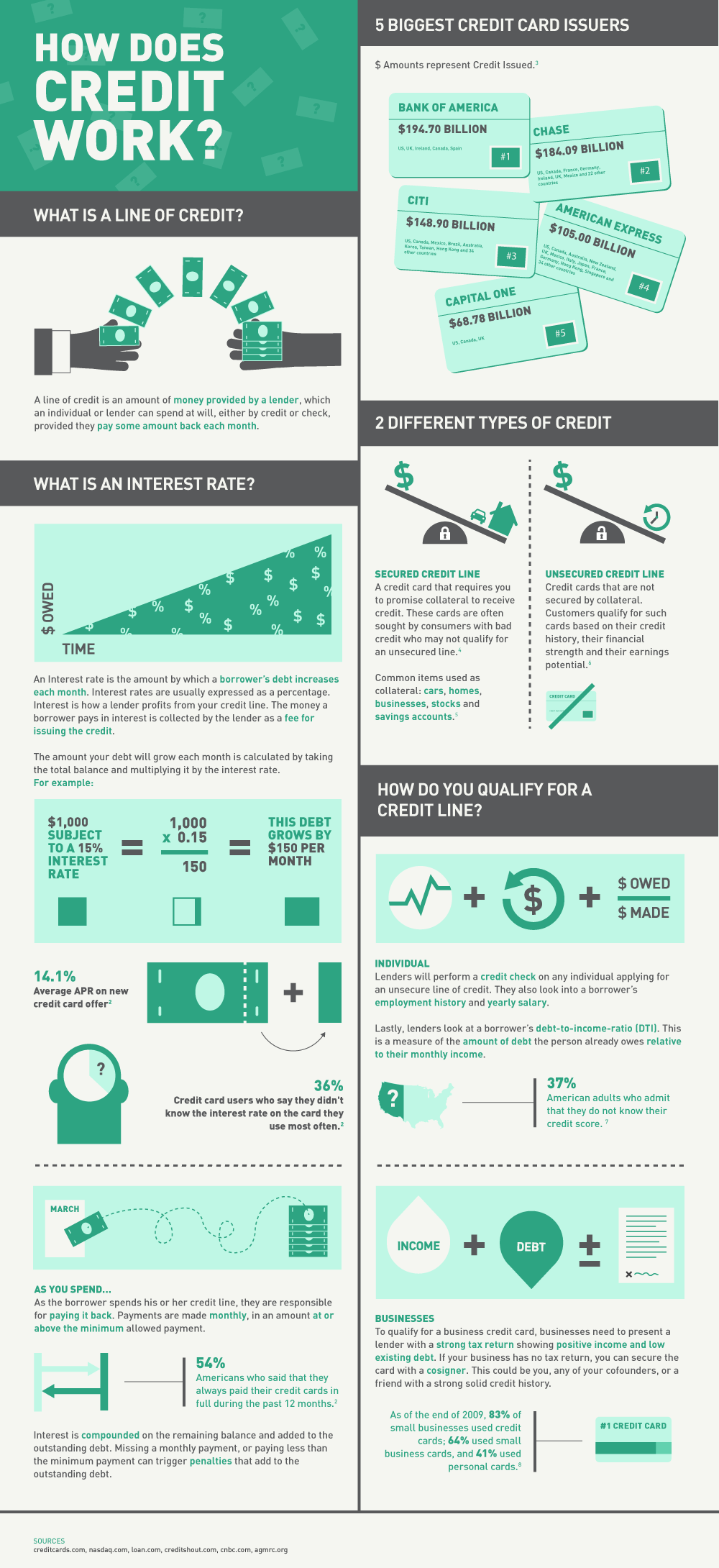

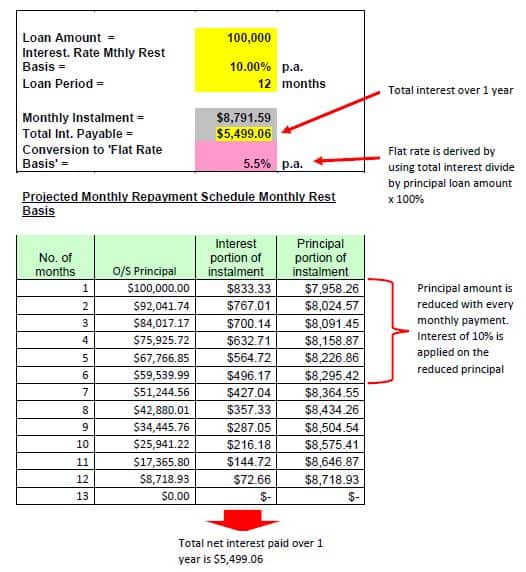

Business line of credit and term loan interest rate discounts are available to business applicants and co applicants who are enrolled in the program at the time of line of credit or term loan application for a new credit facility excludes specialty lending products that receive customized pricing. Interest rates for business lines of credit might run anywhere from 5 to more than 20. But on the other hand if you re late with a payment or go over your credit limit that interest rate could spike pretty high. For an loc with a six month term this equates to 1 500 to 2 500 per 10 000 borrowed.

5 year revolving line of credit no scheduled annual review. A cash flow manager line of credit a business equity line of credit or a business line of credit. Wells fargo small business advantage line of credit backed by u s. Bank of america with bank of america you could qualify for a business line of credit with an interest rate as low as 7 00.

Small business administration ideal for businesses in operation for less than 2 years. Bank has three options you can consider. Advertised rates are always low but your business characteristics as well as the type of lender you use determine how much you ll really pay. Business line of credit a chase business line of credit is ideal if your business needs easy access to cash for short term capital inventory purchase supplier payment or an emergency fund.

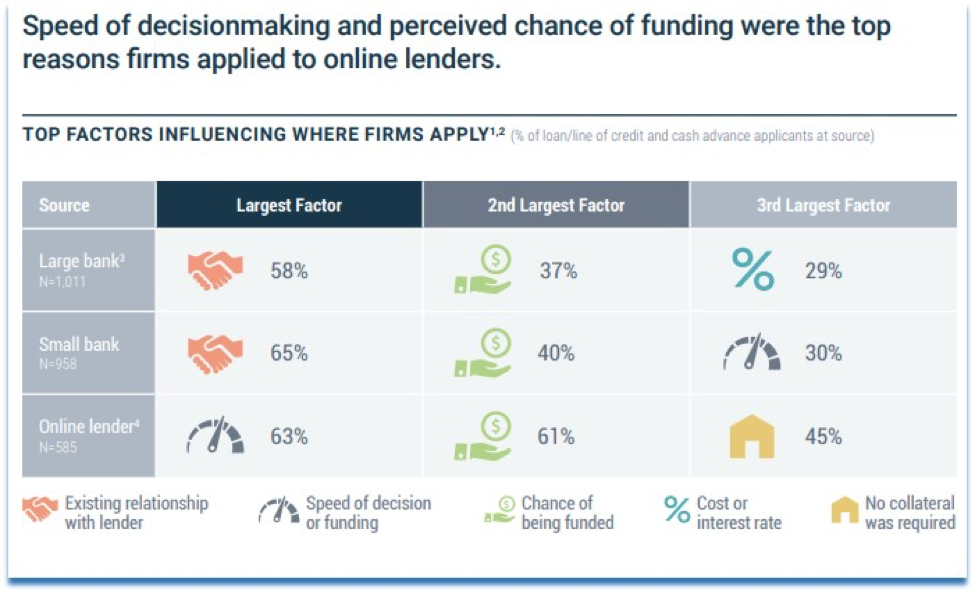

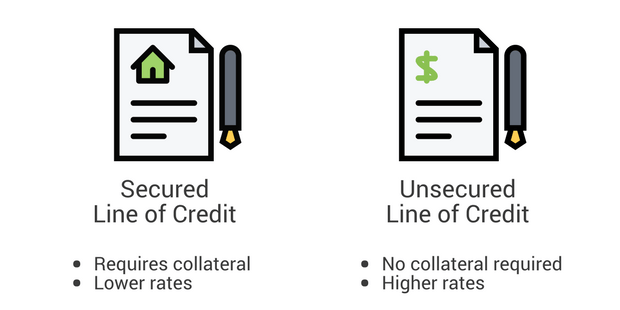

Line of credit amounts between 100 001 and 3 million increased credit flexibility collateralized lines of credit generally have lower interest rates and higher credit limits than unsecured lines of credit. Opening a business line of credit and.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

:max_bytes(150000):strip_icc()/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg)

:max_bytes(150000):strip_icc()/how-letters-of-credit-work-315201-final-5b51ed66c9e77c0037974e85.png)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)